Why might I be wrong about trend GDP?

In recent years, I’ve suggested that trend RGDP growth is around 1.8%, which implies a 3.8% NGDP figure in order to achieve the Fed’s inflation target. Recent strong GDP growth, combined with the Atlanta Fed’s current 4.2% RGDP estimate for Q1, suggests that trend growth might be stronger than I assumed. Why might that be?

In theory, faster than expected trend growth could be due to either productivity or labor force growth. But if I was wrong about GDP, it was probably related to a similarly over-pessimistic assumption about labor force growth.

In theory, the recent strong jobs numbers might reflect a variety of factors:

1. Falling unemployment.

2. Discouraged workers re-entering the labor force.

3. Immigration.

I lean toward the third explanation. The unemployment rate has not fallen over the past 20 months, so the first explanation won’t work. In theory, the correct explanation should be growing labor force participation, as the Census Bureau claims that recent population growth has been very slow (0.4% and 0.5% over the past two years.)

But I’m skeptical of the population growth figures. There’s a lot of anecdotal evidence of a surge in illegal immigration. We are seeing big increases in illegal migrant detentions, even from far-flung places like China, India and Russia, not just Latin America. While migrant detentions don’t tell us how many people slipped through the net, the two figures are widely assumed to be highly correlated.

I suppose this is good news for monetary policy, as this view suggests that the recent strong jobs figures don’t necessarily imply overheating. But in order for immigration to prevent overheating, we need it to prevent strong nominal wage growth. And on that score the 0.6% figure for January is worrisome:

Wages skyrocketed on the month and from the prior year, both above what economists expected to see. Average hourly earnings were up 0.6% from the prior month, double the average estimate, and rose 4.5% from the prior year. Part of the outsize gains could be attributed to reduced hours, which tend to distort pay. Hours worked fell to the lowest since March 2020.

The report clearly shows that demand and wage pressures are far from cooling. That is consequential for the Federal Reserve, which has been signaling that the strength in the labor market shows inflationary pressures are still in the system, and that’s something policymakers will keep in mind before pivoting to rate cuts. Wage growth in particular points to additional fuel for consumers.

The bond market also seemed a bit worried about the wage figures, as interest rate futures jumped on the news. Still, it’s just a single month, and the longer run trend still points to an increasing prospect of a soft landing.

This is one of those odd periods where both hawks and doves seem to have missed something important. Hawks warned that inflation would stay high if we avoided recession, and it’s come down quite a bit. Doves warned that the Fed was holding rates high for too long—but there is little sign of the recession they feared would result from that mistake.

I still say that monetary policy is not tight, just a bit less loose than back in 2021 and 2022. People have consistently put too much weight on interest rate increases, but as Larry Summers recently pointed out, the neutral rate is probably higher than we’ve been assuming:

Former Treasury Secretary Lawrence Summers said the economy’s enduring strength in the face of vigorous Federal Reserve tightening makes it increasingly likely that neutral interest rates have risen.

It’s also increasingly clear that the strong labor market of the late 2010s had relatively little to do with Trump. We have an equally strong labor market under Biden. And he also deserves zero credit.

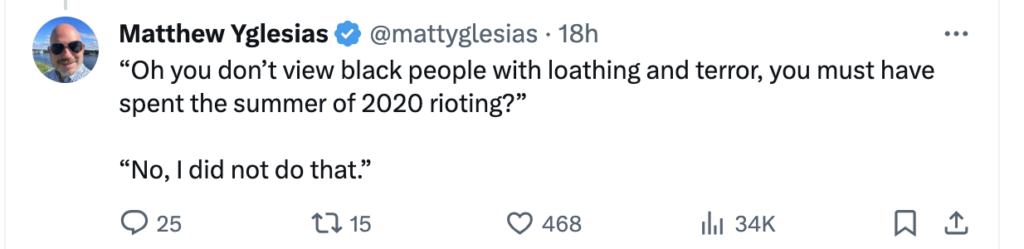

Speaking of politics, Matt Yglesias linked to a 5-minute clip of a Sam Harris interview. I cannot think of a single person who’s political views are closer to my own. Except Sam Harris is far more eloquent.

To give you an idea of how bizarre our politics has become, I have no idea whether that tweeter is attacking Harris from the left or the right.

And I feel a bit better knowing that Yglesias has exactly the same sort of nuts in his comment section that I have over here:

That’s what I find so funny about my trolls. They are not even aware of how others see their posts. And that “@harvard.edu” email address doesn’t fool anyone.

Tags:

3. February 2024 at 12:51

Have you seen this from Skanda Amarnath?

https://www.employamerica.org/blog/it-wasnt-ai-how-fiscal-supports-supply-chain-healing-full-employment-explain-exceptional-productivity-growth-in-2023/

I think one important reason to expect higher trend growth is that things like high quit rates, gains from job switching, lower cyclical risks to capital investment, etc all raise the trend real growth rate. In other words, NGDP growth targeting raises the trend growth rate. And the Fed (together with some fiscal policies) aggressively restrained a 5% NGDP growth rate.

Market monetarism creates a higher real growth trend!

3. February 2024 at 12:52

“Re-attained” not restrained

3. February 2024 at 13:24

Anyone who wants a secure border, according to Scott, is now a racist. According to this logic, the Japanese and Sudanese, with strict immigration policies, are crazy racists.

That’s a brilliant conclusion. You’re a real genius.

Instead of name calling, perhaps it would be more productive to end catch & release, and stop tearing down the wall.

And for those who say walls don’t work. Any person with an I.Q. above 90 understands that a wall isn’t just a wall. It comes with high-tech equipment: cameras, lights, motion sensors, all of which collect and transmit data. That data is then sent to a command control center, which helps border patrol track down drugs and crime, apprehend illegals and improve the safety of officers. These are all things that the border patrol union supports.

So instead of calling people trolls, trumpistas, or putin lovers, which only reveals your immaturity — a sad outlook for a man in his seventies — you might recognize that commenters you disagree with are concerned citizens.

For those who virtue signal their love for the black community, one must ask how housing illegals at logan airport, hotels, and inside black community centers in Boston, predominately in Dorchester, benefits the black community?

How does giving amnesty to tens of millions of illegal immigrants benefit the working class?

And why would anyone fill out an application at the U.S. embassy abroad, and patiently wait in line for a work visa, when all they have to do is simply walk across the border?

You’re not very bright. You write poorly, you’re ill-spoken, and your policy proposals make people’s lives worse off.

3. February 2024 at 13:29

Trump’s TCJA was pretty good though. Research is very positive on it

3. February 2024 at 13:30

Average wages going up while hours worked going down sounds more consistent with a recession than continued expansion. Are there seasonal adjustments involved in that data? You would expect hours to fall in January and average hourly wage to go up as low wage temp workers exit holiday employment in January. It is only one month of data. But it seems that if the trend continues, that would lead to slower NGDP growth, not higher growth.

3. February 2024 at 13:35

I wouldn’t go that far but I say that Scott tends to ascribe racism to any person or action that concerns the Chinese government or culture. China and Han are the equivalent of Israel/Jew for him, synonyms and perfectly interchangeable.

On the racism comment, well everyone is racist hence the term is meaningless today like rape. Casual racism didn’t use to mean racist but today you are a card carrying member of the KKK if you don’t find black men attractive or take offense at them mugging you.

3. February 2024 at 14:35

Matt is not getting ‘swarmed by racists.’He’s getting swarmed by Americans who know he’s bat shit crazy.

The left wing are always the bigots. From slavery to Jim crow, CRT, to Latinx, these people just don’t know when to quit.

Matt – believes in open borders, no school choice, big government regulation.

Scott – believes in a creepy one-world-NATO. He also supproted covid mandates, BLM marxists in 2020 as they were rampaging, and calls religious people ‘delusional’. He also believes that Trump is Adolf Hitler.

These two are literally insane. They create more division in this country, not less.

Sam Harris is not insane, but his view on free will is wrong. His view on religion is the typical athiest position; he’s added nothing substantial to that conversation. He borrowed all of his arguments from Dawkins.

3. February 2024 at 15:26

Surely, a prosperous economy with 3% inflation is better than a recession and 2% inflation (even if most orthodox macro economists disagree).

By the way, I think a large part of the problem is actually structural, in housing scarcity, and may not be entirely explained by fiscal or monetary policies.

3. February 2024 at 18:06

On the topic of immigration, I would support the position of open borders, but that isn’t a pragmatic attitude to hold unfortunately. If we consider sovereignty and what it means for a nation-state, the type of support needed for that would have to come out of convincing people that it is fundamentally in their self-interest in order for immigration be more relaxed. Public choice would likely explain how public sentiments configure into political incentives for propaganda to spur against immigration, especially when there are economic downturns as a scapegoat method. Fixing that should be a priority for those who support immigration. Anyhow, it’s good to see a post on here.

PS: Very random, but what’s your views on Fischer Black?

Very random by the way, but what’s your thoughts on Fischer Black?

3. February 2024 at 18:21

My comment is a correction to a comment that disappeared. The gist of it was that a 5% NGDP level targeting policy would raise real growth trends and that’s basically what happened after Covid. You won!

3. February 2024 at 18:51

I don’t disagree with your analysis, but is there any reason why you don’t think the reason for higher trend RGDP is likely to be higher productivity growth, say, due to AI? That seems to be the view that Lars Christensen is arguing for at the moment: https://marketmonetarist.com/2024/02/03/we-feared-it-would-be-a-return-to-the-70s-but-it-might-be-the-return-of-the-booming-90s/

3. February 2024 at 19:12

Yep, a great little monologue there, which reflects my own views as well. Rita Panahi is an Australian commentator, and I can tell you she would be attacking Harris from the Trumpist right. She used to be a vaguely respectable right wing commentator making some good points about the left a decade ago, but like many, has in more recent times jumped the shark into Trumpism.

3. February 2024 at 20:07

Bobster, Sure, if you ignore the fact that it’s not paid for.

Lizard, You have to squint pretty hard at the data to see signs of recession in this booming economy, which is churning out new jobs at a rapid pace.

Peter, That’s an unusually dumb comment, even by the standards of my dumbest right wing commenters. See if you can at least get up to Ricardo, Edward, Sara levels of stupidity.

Junio, Black did some interesting work, but I’m not really a fan of his macro approach.

Kevin, Monetary policy doesn’t affect trend RGDP growth. If the surge in immigration ends, I’d expect growth to return to 1.8%.

Rajat, AI might affect the economy at some point, but surely it’s too soon to show up in recent growth figures?

4. February 2024 at 03:19

Borrowing money doesn’t equate to ‘economic growth’. I can use my credit card to hire employees, but that doesn’t mean I’m in a better financial position than I was yesterday. The labor market is fueled by borrowing; it’s not real growth.

Almost half the workers in this economy are parasites living off the industrious.

Even those who claim to work in the private sector, mostly work for the government. University employees, for example, are paid their wages through government student loans. Many of these people have more administrators than students. People working for the military industrial complex, like Raytheon and Boeing, are dependent on subsidies and grants. Even new startups in energy receive tax payer subsidies.

And you can’t be serious about Sam Harris. He wears hoodies at 55.

I mean, c’mon. What serious intellectual has ever dressed like a teenager in their 50’s?

And as Ricardo said, what has he contributed to the intellectual debate that hasn’t already been said?

Hayek destroyed the determinists more than fifity years ago in his book constitution of liberty when he correctly recognized that they cannot even define the word free. They criticize something they cannot define. How silly is that.

The common law is also not compatible with determinism, because you cannot punish those incapable of making a choice. That would be like putting an automaton in prison. People who view others as self-operating machines, like Harris, are also extremely dangerous. There is nothing people like him won’t try to justify under the ‘common good.’

4. February 2024 at 07:27

There does seem to be a disconnect in the economy between perception and reality that can’t totally be attributed to political affiliation. I went to Chipotle the other day and paid $16 for a burrito and drink, and while filling my drink at the soda dispenser there’s a job flier right on the machine saying that you can earn over $100k within a few years working there. How long can this trend go on for? Is Chipotle the new white collar job? My other favorite personal economic indicator-stuff in people’s driveways-would make one believe that just in the last few years people (at least around me) have either become significantly richer or significantly more in debt. It’s not uncommon now to see entire driveways full of cars/boats/rv’s/atvs for relatively modest houses. Then there’s the gigantic trucks that people love to buy but never seem to use for their practicality. I don’t think immigration is the reason the economy is booming. Apparently nobody really knows how much bad debt there is in the new financial products, i.e. buy now pay later for consumers and the private credit for companies, not to mention commercial property. Oh, then there’s the 7% government budget deficit. We’ve pulled forward so much consumption in the last few years that when the next recession comes along, I doubt it’ll be the short and mild type. Then again, maybe AI is already rapidly improving productivity, but I’m not noticing it when I go to Chipotle.

4. February 2024 at 07:57

Edward, LOL, determinism doesn’t mean that people are unable to make choices. I’d suggest you avoid philosophy—it’s not your forte.

Alex, You said:

“Then again, maybe AI is already rapidly improving productivity, but I’m not noticing it when I go to Chipotle.”

I agree, which is why I see immigration as the only plausible explanation. What other explanation is there?

4. February 2024 at 11:50

Secular stagnation was according to Martin Wolf, chronically deficient AD. Secular stagnation was due to the impoundment of monetary savings in the payment’s system. I.e., banks don’t lend deposits. Deposits are the result of lending/investing. All bank-held savings are frozen.

C-19 changed the composition of the money stock. The proportion of transaction deposits to gated deposits has risen. This increases AD.

Our means-of-payment money supply has just reversed after 22 months of deceleration. This is probably due to the seasonal injection which should now have been washed out. However, short-term money flows, proxy for R-gDp, will climb during the first half of 2024 while long-term money flows become negative later this year. So, if the trend continues, N-gDp will decelerate.

4. February 2024 at 13:27

Matthew Yglesias got a lot of hate from the Left after the Hanania outing, he’s trying to avoid a similar controversy over the poorly kept secret that he reads Steve Sailer.

4. February 2024 at 17:15

Is the jobs illegal immigrants do tracked in the data?

I would have thought it would be in the informal sector

4. February 2024 at 17:27

Scott, do you have any posts that elaborate more your views on Black’s work? Thanks.

4. February 2024 at 21:32

Scott,

Do you have any thoughts on the Fed Funds futures curve, which has rates dropping down to just over 3% in 2026, but then beginning to rise to get to close to 4% by 2026? The CDS market suggests that it isn’t the beginning of a fiscal crisis that’s expected, and the 5-year inflation breakeven is below the Fed’s target, in core PCE terms.

It could represent a J-curve related to an AI productivity boom, but there are obviously other possible explanations.

4. February 2024 at 23:08

White, They hate him because he’s rational and intelligent.

Bobster, I should not have used the term “illegal”. They can legally work while waiting for their asylum hearing—which may be years in the future.

Junio, Not that I know of. I did briefly discuss him in an academic article I published back around 1990, but I forgot the context. Something about the “New Monetary Economics”.

Michael, I suspect the futures markets still see a soft landing as the most likely result.

5. February 2024 at 02:00

OT but what a headline:

“Housing glut leaves China with excess homes for 150m people”–Nikkei Asian Review

Oh, a few tens of millions of units here, and few tens of millions of units there, and pretty soon you are talking about a serious housing glut.

5. February 2024 at 04:06

What about the lagged impact of fiscal stimulus and monetary policy that was slow to respond to it?

5. February 2024 at 06:48

Scott, do you have any concern over the hours worked part of the jobs report?

“The average workweek was 34.1 hours in January, down from 34.3 hours in December. The average workweek is down half an hour over the last year. That is the lowest number since 2010 outside the pandemic recession”

5. February 2024 at 07:09

Solon, Well, I suppose that’s less silly than the 3 billion figure I see thrown around.

John, I don’t believe in long lags.

TMC, Not concerned, given how strong all the other data is.

5. February 2024 at 10:09

Scott,

So you see the process of the soft landing extending into 2026 then. The time frame for the beginning of an AI boom in 2026 would be roughly similar to that of the internet boom that began in the late 1990s. The internet boom began roughly a few years after the internet started to become popular. Likewise, 2026 will also be roughly a few years after the use of LLMs like ChatGPT became popular.

5. February 2024 at 11:03

Michael, I’d say I’m agnostic on the timing of any LLM boom. I wouldn’t rule out what you suggest, I just don’t have much confidence in any prediction of that sort.

5. February 2024 at 11:26

Scott I think it’s LLMs being adopted. They have easily doubled my productivity.

5. February 2024 at 12:43

A good example of independent journalism is this piece of work by Bret Weinstein, who traveled to the Darien Gap himself. This is what journalism ought to look like:

https://twitter.com/BretWeinstein/status/1753219510189125836

The sinister plot that Bret uncovered in the Darien Gap doesn’t surprise me. It’s what many of us have been saying from the beginning.

There are basically two types of academics. On the one hand, you have pseudojournalists and pseudointellectuals like Matt and Scott. These are the people who read headlines, skim articles, and repeat what they read or hear. And on the other hand, you have real intellectuals who actually read the congressional bills, dig deeper into the substance, investigate, and look for the truth themselves. They’re mostly skeptics. People Bret Weinstein, Jordan Peterson, Thomas Sowell, Glen Loury, Hayek, Mises, etc.

As you’ve probably noticed, the latter group does not spend their time calling people trolls and trumpistas. They’re not so tribal and closed-minded.

5. February 2024 at 19:59

Scott, Interesting. What industry are you in?

But I still don’t get why the answer isn’t employment—job growth has been extremely high. LLMs should save jobs.

6. February 2024 at 02:04

Scott,

Is it possible that wage inflation (which according to the Atlanta Fed has outpaced general inflation for lower paying jobs) has driven some acceleration in productivity growth.

6. February 2024 at 10:54

As part of my deeper investigation into Sumner, I stumbled upon an interesting fact.

He follows three people on Twitter. And naturally, since he only follows three people, you’d have to imagine those three people are very important to him.

Here they are:

1. Razib Khan, a bengali muslim writer based out of Austin, Texas, who rants and raves against homeopathy and holistic medicine.

2. A man named Semonyang (@semonyang). Semon Yang is a chinese artist who takes photos of nude women in bondage. Some of the naked photos look occultish: for example, women are staked around a circle fire and hanging from a rope. A few of the photos look like the women have been physically abused, and/or are dead. Cover photo of the artist has one of those occultist looking skulls. And some photos have lots of blood. Pretty creepy and sadistic stuff.

3. A man named Frank Fuhrig. This guy has a photo of himself pumping his fist menancingly at someone. Perhaps it’s to the populist movement or his hatred to the public at-large. Pretty weird. He also has one of those virtue signaling, warmonger, anti-russian posts pinned to his twitter profile.

I don’t believe in guilt by association, but just remember that Klaus Schwab and many of the so-called ‘elite’, who meet once a year in Switzerland to plan agendas and buy prostitutes, have the same taste in sadistic art as Sumner. Hitler was also very interested in genetics.

Of course there are always exceptions, but the general rule is that Birds of a feather flock together.

6. February 2024 at 18:10

Re: January wage numbers. The entire civilian federal workforce (“finally”) got a 5.2% raise. Surely that helped skew the numbers (?)

6. February 2024 at 18:41

Noah Smith refers to the immigrants showing up and claiming asylum in spite of the low odds that they have a valid claim “asylum spammers”. We need some sort of short phrase to describe the large number of people showing up at the border to exploit the loopholes in the US’ asylum system in some manner that indicates that while the immigrants are technically in the US legally, it still isn’t really lawful immigration insofar as the immigrants aren’t coming to the US to seek safety, but instead to seek jobs and their claims for asylum are not made in good faith.

7. February 2024 at 03:40

dtoh, Why would wages impact productivity?

Edward, Well, I do follow Razib Khan, so you got that right.

JT, Wouldn’t seasonal adjustment mostly handle that?

Lizard, Good point.

7. February 2024 at 11:35

Prof. Sumner,

Compared to most Americans, your foreign policy view is relatively dovish re: China.

So I’m curious what you make of this argument:

https://www.semafor.com/article/02/05/2024/xi-would-see-not-passing-supplemental-as-us-weakness-krishnamoorthi-says

“US failure to fund Ukraine and Israel could make war in Taiwan more likely”

7. February 2024 at 13:56

I’m not Scott (sorry!) but the relevance of whether war in Taiwan could be more likely due to US failure to fund Ukraine, less so Israel, has some merit I suppose. If China’s expectations changes, in that if there were to be political issues preventing Ukraine’s funding, in the long term it’s a possibility that could be the case for them; political backlash begins to occur against funding for Taiwan. You have to consider something however: Americans, including their politicians, seem far more anti-China than anti-Russia. Whether or not that position is justified, American seems keen on competition against China, with China being the same.

7. February 2024 at 15:52

Scott,

If real wage costs have risen relative to the cost of investment in labor saving equipment and processes, won’t firms accelerate their investment in those equipment and processes. And… depending on the form and amount of those investments, they may or may not show up in the national accounts.

7. February 2024 at 16:19

Travis, You said:

“US failure to fund Ukraine and Israel could make war in Taiwan more likely””

I agree, and I’d add that Ukraine is more important, as Israel is capable of taking care of itself.

Junio, You said:

“Americans, including their politicians, seem far more anti-China than anti-Russia. Whether or not that position is justified,”

That’s certainly true of the GOP, and it’s obviously not justified.

dtoh, I generally view causality in the opposite direction. Higher productivity leads to higher wages.

You’d want to consider why wages rose—was it due to productivity or government mandate?

7. February 2024 at 16:48

Why is it that so many pro-Russia, anti-China right-wingers fail to realize that Russia and China are allied, along with Iran and North Korea, against US interests in many respects? Weapons from Russia, Iran, and North Korea supply Hamas.

7. February 2024 at 17:26

“That’s certainly true of the GOP, and it’s obviously not justified.”

I’m not too confident on the last part. I’ve become more ambiguous, partly thanks to you. Perhaps as time passes, I’ll come to agree more with you on that.

I have a one primary question: what caused this ‘competition’ to occur in the first place in your view?

7. February 2024 at 19:11

Scott, that harvard.edu email address could at most fool you, because the email addresses are hidden from the public.

Btw, I wish you would go the way of the other Scott, Scott Alexander, and just ban people who are too disruptive or troll too much. (And he explicitly says that he reserves the right to be an arbitrary dictator in his little fiefdom.)

Btw, I am fairly sceptical of large language models having any measurable impact on productivity yet. I would be very happy to be proven wrong on this, but so far they are too unreliable for much useful work.

They are definitely entertaining, and can already be useful to replace a web search in many cases. And I guess they can confidently bullshit, and that kind of text is perhaps useful for lots of people to produce quickly?

8. February 2024 at 01:20

Another great post. You were one of my favorite professors at Bentley and I too have thought for years that Sam Harris is the only person who represents my political views. You saying the same makes me more confident that I’m thinking correctly

9. February 2024 at 19:22

Scott,

>You’d want to consider why wages rose—was it due to productivity or government mandate?

Maybe there was a lot of stickiness at the low end of the wage scale. And maybe Covid loosened it up.

10. February 2024 at 04:35

Off topic but it’d be great to get your thoughts on David Andolfatto’s recent blog post re: whether higher rates can be stimulative.

10. February 2024 at 05:30

Junio, I blame nationalism. But I suppose that just pushes the question back one step—what caused nationalism?

Matthias, I do ban some people. I agree there’s a good argument for Scott’s approach, but I have no problem with showing the stupidity of my opponents.

Thanks Ken.

dtoh, That’s a lot of maybes. I think wages have always been somewhat upward flexible when the job market is extremely strong (due to excess demand). But yes, Covid might have reduced supply somewhat.

Effem, As you know, that’s reasoning from a price change. Interest rates have no causal effect on GDP. It’s like asking how oil prices affect oil output–a meaningless question. You need to consider why interest rates change.

10. February 2024 at 16:00

Scott,

Isn’t the way to get to the truth is to consider a lot of maybes?