Stop reasoning from a price (or quantity) change

Larry Summers always has interesting things to say, and his new twitter thread on the current state of monetary policy is no exception. He begins with an argument made by many other economists, that low rates imply central banks have less ammunition. He goes on to argue that this casts doubt on the proposition that central banks can create inflation.

In my view, this gets things exactly backward, confusing cause and effect. The low rates are partly the result of contractionary monetary policies. Places with expansionary monetary policy have absolutely no difficulty keeping interest rates well above zero, and creating as much inflation as they wish.

Economists look at central banks that seem to have already done a lot, and have still fallen short, and then ask how much more they would have to do to get higher inflation. The actual answer is “much less”. Interest rates are not (primarily) a policy tool, they are an outcome. A more expansionary policy will lead to higher rates over time. A more expansionary policy will lead to a smaller central bank balance sheet as a share of GDP.

Because of this confusion, people are again calling for “helicopter drops” as if that will somehow “solve the problem”. But the Japanese tried that for many years, and the deflation ended only after they stopped doing a combined fiscal/monetary expansion. As David Beckworth points out, helicopter drops only work if the injections are expected to be permanent. But if helicopter drops were expected to be permanent, then monetary policy alone would work just fine.

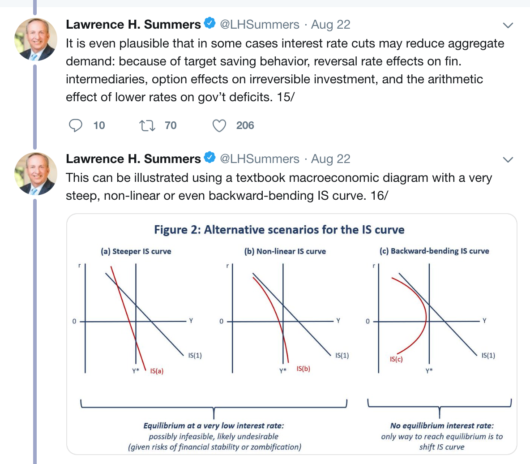

The profession is finally beginning to reach the point that monetarists like Friedman reached decades ago—low rates don’t mean easy money. But instead of ending the practice of reasoning from a price change, they either wildly swing over to NeoFisherian (another form of reasoning from a price change), or they start adding epicycles to the flawed Keynesian model:

Summers talks about “interest rate cuts” without explaining what causes the interest rates to fall. The liquidity effect? The income effect? The Fisher effect?

This is so frustrating. Instead of looking for ever more convoluted explanations for why low rates don’t “work” in Europe and Japan, how about we do what we teach out students to do in EC101, and stop reasoning from a price change.

And while we are at it, stop reasoning from a quantity change. Stop suggesting that low unemployment should cause high inflation.

Tags:

23. August 2019 at 17:24

Off-topic:

Proof that (old-school) monetarism was part of the zeitgeist of c. 1970.

A monetarist punchline in a joke in Rowan & Martin’s Laugh-in:

“Simple economics, darling. Either you’re a victim of tight money or over-inflation!”

https://www.youtube.com/watch?v=qwVFKEzT7rQ&t=190

23. August 2019 at 18:03

A couple of questions:

If helicopter money supposedly only works if it is expected to be permanent, why would QE ever work, when it’s supposed to be temporary? Also, how could helicopter money be temporary when it can’t be withdrawn (easily at least), unlike QE, and so represents a permanent increase in the money supply.

Also, what would you suggest as a policy prescription for the ECB for the short-term? Sure, a more expansionary policy pushes up the natural rate in the long-term, but implementing a significantly more expansionary policy than the market expects would be a serious challenge, giving that interest rates can’t go much further and QE is close to reaching its legal limits.

23. August 2019 at 18:09

Scott Sumner:

Okay, I am really just an econo-buff, and I sometimes wear a tin-foil hat.

But you can see the problem any member of the lay public has: Summers says

“A,” and Sumner says “Z.”

This paragraph is bewildering, to me.

“Because of this confusion, people are again calling for “helicopter drops” as if that will somehow “solve the problem”. But the Japanese tried that for many years, and the deflation ended only after they stopped doing a combined fiscal/monetary expansion. As David Beckworth points out, helicopter drops only work if the injections are expected to be permanent. But if helicopter drops were expected to be permanent, then monetary policy alone would work just fine.”—Scott Sumner.

Huh?

1. Japan is still running fiscal deficits.

2. If helicopters drops are expected to be permanent, they will work, you say. Good, let’s make them permanent. If this works, why not?

3. Do you mean QE in combination with fiscal deficits will work, the same as a helicopter drop, if the balance sheet expansion is expected to be permanent?

4. Or, do you mean a national government should run balanced fiscal budgets, but central banks should be aggressively and overtly expansionary, when needed?

5. In this latter case, should a central bank clearly indicate, without hesitation, that its QE program is permanent?

6. Should the Fed, during its recent QE programsm have publicly stated, “We are buying these bonds off the market for good. Get over it.”

23. August 2019 at 18:30

Ricardo, Cute. Watching that whole segment is a trip down memory row. What would “woke” people say?

Ben, The Japanese withdrew helicopter money in 2006.

Ben#2, The Japanese deficit is much smaller since 2013, and debt as a share of GDP has leveled off, after rising fast during the helicopter era.

23. August 2019 at 18:55

Scott Sumner:

Add on (sorry):

I think your “QE and lower interest rates only” approach (no helicopter drops, no fiscal deficits) is regarded as weak as you are trying to stimulate growth by pouring money into already flooded capital markets.

But it may be the right approach—but would be perhaps be more effective and more salable, if married to sensible tax reforms.

That is, large tax cuts on people who will spend the money. So, cut payroll taxes and income taxes towards the lower end of the scale, and raise taxes on property, luxury consumption, pollution, fuels, tariffs, and highest income brackets. (and yes, cut overall federal spending).

The world is flooded with capital. The shortage is in demand.

And you did not answer the question: During its rounds of QE, should have the Fed stated clearly, without equivocation, the balance sheet additions would be permanent?

23. August 2019 at 19:48

For an economics naif, would you explain this?

“The low rates are partly the result of contractionary monetary policies. Places with expansionary monetary policy have absolutely no difficulty keeping interest rates well above zero, and creating as much inflation as they wish.”

What should central banks do to implement an expansionary monetary policy if not low interest rates and helicopter drops? What specifically would an expansionary monetary policy entail that a central bank do?

Thanks.

24. August 2019 at 00:01

Ben, You said:

I think your “QE and lower interest rates only” approach”

That’s not my approach.

Russ, They should set a NGDP level target at a high enough rate to raise nominal interest rates above zero. Then peg the price of NGDP futures contracts.

24. August 2019 at 03:23

Scott, is Powell misleading himself to factor into his thinking ‘long and variable lags’?

24. August 2019 at 05:01

Seeing so many developed economies at negative nominal rates, with others trending there, as the global economy slows down, with those economies never having enjoyed even the nominal growth rates of the past, it is tempting to think there’s something very wrong with standard economic theory. And, perhaps there is. By standard economic theory, I mean Mishkin’s pre-Great Recession treatment of the subject. I bought an old copy of his textbook, after reading this blog.

But,there was a similar situation in the 70s, but opposite. Nominal growth was too high in most developed economies, and Volker and others apparently showed that it was an easy problem to deal with, intellectually.

So, until central banks try something like NGDP level targeting, more deeply negative rates, with some changes suggested by Miles Kimball, etc., there’s no reason to go heterodox.

24. August 2019 at 05:04

German government bonds are yielding below zero across the entire yield curve.

Talk about central bank mismanagement!

The Rothschilds are psychopaths.

24. August 2019 at 05:15

Because of fake news, and in a small way this blog author’s TDS, more people identify as Republican and fewer identify as Democrat today than when Trump was elected.

https://news.gallup.com/poll/15370/party-affiliation.aspx

24. August 2019 at 06:55

China just imposed tariffs on $75 BILLION of US imports.

I GUARANTEE THE BLOG AUTHOR WILL NOT BE SUBMITTING CRAP ARTICLES TO THE FAKE NEWS CLAIMING “CHINA ENGAGING IN UNNECESSARY TRADE WAR WITH US”.

😂

24. August 2019 at 08:12

“Larry Summers always has interesting things to say”??? Er – yes – one of the “interesting” ideas he promoted was to relax bank regulations just before the 2008 bank crisis.

Second, and about ten years late, he seems to have caught up with MMT, i.e. the idea that when monetary policy doesn’t work, fiscal stimulus is the best alternative.

24. August 2019 at 08:15

The idea that helicopter drops only work if they are expected to be permanent is straight out of cloud cuckoo land: i.e. the idea that the average household or small or medium size firm devotes any thought at all to whether helidrops are temporary or permanent is plain unrealistic.

24. August 2019 at 12:02

Dear Blog Author,

Thank you for agreeing to put up with me posting high volumes of anon whatever it is, I never meant true offense. I found an open line and see free networking as knowing at least what is happening and admit to making mistakes.

I am ending comms effective now. Awakening has its challenges and just something saved and not deleted.

Its happening everywhere.

24. August 2019 at 12:20

Scott said: “Russ, They should set a NGDP level target at a high enough rate to raise nominal interest rates above zero. Then peg the price of NGDP futures contracts.”

Russ, I did not understand this response to your question so I did a search on Scott’s site and found the comment below that I think explains what “peg the price of NGDP means”

December 25th, 2018 Blog Post by Scott.

“….Looking further ahead, my preference would be to have the Fed entirely cease its targeting of interest rates and let the market determine the appropriate rates. Instead, the Fed would give the New York open market desk the following instructions:

1. A range for one year NGDP growth–say 3.5% to 4.5%.

2. Instructions for the New York Fed to take unlimited short positions on NGDP futures contracts at 4.5% and unlimited long positions at 3.5%.

3. Instructions to do open market purchases and sales (with Treasury securities) in such a way as to avoid losses in their trading of NGDP futures contracts.

That’s all. Let the market set interest rates; they are much better able to determine the appropriate fed funds rate.”

24. August 2019 at 14:42

wlb, Yes.

Michael, Great comment. Check out Econlog, where I quoted you.

Ralph, You said:

“he seems to have caught up with MMT, i.e. the idea that when monetary policy doesn’t work, fiscal stimulus is the best alternative.”

So that’s how MMT now defines itself? They change the definition every single day. At one time that was considered Keynesian economics.

24. August 2019 at 14:50

[…] Michael Sandifer had this to […]

24. August 2019 at 15:57

I can definitely see what Ralph means. The quantity theory in general is based on the assumption that people care about the money stock (narrow or broad) when making their spending decisions. The pure version of the theory is quite silly in this regard.

24. August 2019 at 17:12

“or they start adding epicycles to the flawed Keynesian model”

It is almost like economists add in random tastes for altruism to keep the homo economics model going …

The article Zoon Politikon does a nice job of discussing the scientific evidence.

https://pdfs.semanticscholar.org/88bf/63588a76f615c5fef6151bbdbbf1b6b642bb.pdf

24. August 2019 at 17:46

Do people think that if the Fed announced tomorrow that they were going to target NGDP levels, or NGDP growth, that the markets would believe them? I feel like the Fed has earned a great deal of skepticism that it has the will to re-inflate the economy by treating the 2% inflation as a ceiling, and that the performance of other central banks around the world have also added to general skepticism that central banks want to or are even able to re-inflate an economy.

25. August 2019 at 04:32

Scottt, You claim that the idea that fiscal stimulus is important was “at one time considered Keynsian economics”. That IS Keynsian economics! At least in the early 1930s Keynes said (e.g. in a letter to Roosevelt) that the way out of the recession was to print or borrow money and spend it. In fact MMT is sometimes criticised for being little more than Keynes write large, a criticism which I, as an MMT supporter, accept.

25. August 2019 at 06:11

Chaos at the DNC convention in San Francisco

https://w3.cdn.anvato.net/player/prod/v3/anvload.html?key=eyJhdXRvcGxheSI6dHJ1ZSwicGx1Z2lucyI6eyJjb21zY29yZSI6eyJjbGllbnRJZCI6IjYwMzY0MzkiLCJjMyI6Imh0dHBzOlwvXC93d3cua3JvbjQuY29tIiwic2NyaXB0IjoiXC9cL3czLmNkbi5hbnZhdG8ubmV0XC9wbGF5ZXJcL3Byb2RcL3YzXC9wbHVnaW5zXC9jb21zY29yZVwvY29tc2NvcmVwbHVnaW4ubWluLmpzIiwidXNlRGVyaXZlZE1ldGFkYXRhIjp0cnVlLCJtYXBwaW5nIjp7InZpZGVvIjp7ImMzIjoia3JvbiIsIm5zX3N0X3N0Ijoia3JvbiIsIm5zX3N0X3B1IjoiTmV4c3RhciIsIm5zX3N0X2dlIjoiS1JPTiBPTixCYXkgQXJlYSJ9LCJhZCI6eyJjMyI6Imtyb24iLCJuc19zdF9zdCI6Imtyb24iLCJuc19zdF9wdSI6Ik5leHN0YXIiLCJuc19zdF9nZSI6IktST04gT04sQmF5IEFyZWEifX19LCJkZnAiOnsiYWRUYWdVcmwiOiJodHRwczpcL1wvcHViYWRzLmcuZG91YmxlY2xpY2submV0XC9nYW1wYWRcL2Fkcz9zej0xeDEwMDAmaXU9JTJGNTY3OCUyRm1nLmtyb24lMkZuZXdzJmltcGw9cyZnZGZwX3JlcT0xJmVudj12cCZvdXRwdXQ9dm1hcCZ1bnZpZXdlZF9wb3NpdGlvbl9zdGFydD0xJnZpZD1zaG9ydF9vbmVjdWUmY21zaWQ9MTIzNCZ1cmw9aHR0cHMlM0ElMkYlMkZ3d3cua3JvbjQuY29tJTJGbmV3cyUyRnZpZGVvLWNoYW9zLWF0LWRlbW9jcmF0aWMtbmF0aW9uYWwtY29udmVudGlvbi1tZWV0aW5nLWluLXNhbi1mcmFuY2lzY28lMkZhbXAlMkYmY2l1X3N6cz03Mjh4OTAlMkMzMDB4MjUwJmFkX3J1bGU9MSZjdXN0X3BhcmFtcz12aWQlM0QzODc0OTI1JTI2Y21zaWQlM0QxODk5NDMlMjZ2aWRjYXQlM0RcL25ld3MlMjZib2JfY2slM0RbYm9iX2NrX3ZhbF0lMjZkZXNjcmlwdGlvbl91cmwlM0RodHRwczpcL1wvd3d3Lmtyb240LmNvbVwvbmV3c1wvdmlkZW8tY2hhb3MtYXQtZGVtb2NyYXRpYy1uYXRpb25hbC1jb252ZW50aW9uLW1lZXRpbmctaW4tc2FuLWZyYW5jaXNjb1wvYW1wXC8lMjZjb3JyZWxhdG9yJTNEW3RpbWVzdGFtcF0lMjZkX2NvZGUlM0QxNzYlMkM4OSUyQzE2NSUyQzU1JTJDMjElMkMxMTclMkMxMDklMkMxODUlMkMxODMlMkM3NyUyQzMzJTJDMTA1JTJDMjAxJTJDMTkwJTJDNSUyQzEzMSUyQzM3JTJDMTUwJTJDNjMlMkMxODkifX0sInRpdGxlVmlzaWJsZSI6dHJ1ZSwibnNWaWRlb0Fzc2V0VXJsIjoiaHR0cHM6XC9cL254c2dsb2JhbC5zdG9yYWdlLmdvb2dsZWFwaXMuY29tXC9rcm9uXC92aWRlb1wvdmlkZW9fc3R1ZGlvXC8xMTMzXC8xOVwvMDhcLzIyXC8zODc0OTI1XC8zODc0OTI1XzQ4QkMwODE3RkYwOTRGMzA4NzU3Q0U0QkZGOTFDM0E2XzE5MDgyMl8zODc0OTI1X0NoYW9zX2F0X0RlbW9jcmF0aWNfTmF0aW9uYWxfQ29udmVudGlvbl9tZWV0aW5nX18xMjAwLm1wNCIsImRpc2FibGVNdXRlZEF1dG9wbGF5IjpmYWxzZSwicmVjb21tZW5kYXRpb25zIjpmYWxzZSwiZXhwZWN0UHJlcm9sbCI6ZmFsc2UsInAiOiJkZWZhdWx0IiwiaHRtbDUiOnRydWUsIm0iOiJMSU4iLCJ2IjoiMzg3NDkyNSIsIndpZHRoIjo2NDAsImhlaWdodCI6MzYwfQ==#amp=1

25. August 2019 at 06:49

Scott,

Thanks. I thought I was just extending your remarks a bit.

25. August 2019 at 07:59

The NYT is dead.

https://nypost.com/2019/08/24/bias-has-killed-the-gray-lady-and-dean-baquet-fired-the-fatal-shot/

25. August 2019 at 09:59

With long-term interest rates too low, shouldn’t the Fed quickly unwind QE? That is, if demand for debt is high, and the Fed has extra debt, they should sell it. That is good for the Fed balance sheet and satisfies a market demand.

25. August 2019 at 13:04

Dr. Sumner:

How is the Fed supposed to implement this more-expansionary monetary policy if the transmission mechanisms stop working like they used to under certain market conditions?

This is the crux of the paper Summers links to. For example, they could buy up assets, suppressing rates, but at some point the private sector might not be willing to get the money flowing instead of suffering low returns- they might just live with the low returns. What is the Fed to do then?

It would be really helpful if you could discuss policy vs. implementation vs. the stability of parameters for those mechanisms. You make it sound very easy for the Fed to just achieve expansionary monetary policy, while at the same time you make it sound like the Fed is just pursuing a contractionary monetary policy. It’s one thing for policy to switch to contractionary as market conditions change and the Fed lags, but it seems quite another for them to just being pursuing the wrong economic conditions. Could you explain what’s missing here?

25. August 2019 at 16:33

Paul, No, that’s not what the QT is based on. Perhaps you should study the theory before dismissing it.

Ralph, So you are saying that MMTers don’t even know how to explain their own theory? Or is it possible that you don’t understand MMT?

Don, Sounds good to me.

Daniel, The transmission mechanism always works fine, it’s the policy that sometimes goes off course.

26. August 2019 at 03:45

Sanders, Warren, and Harris are LIARS.

Facts that prove Trump’s policies are pro-wage earner.

https://twitter.com/realDonaldTrump/status/1165869638779060224

https://twitter.com/realDonaldTrump/status/1165869755967909889

26. August 2019 at 04:10

Scott, I have studied the QT, but there are so many different versions of it I’m confused as to which to accept. And I was taught by Fisher and Friedman that only unexpected inflation matters, but then I have Sumner and the MMs telling me that only expected inflation matters. This latter version is circular, as it says an increase in the money stock raises expected inflation, which causes inflation. But the inflation needs to be historically precedented before a rational people will accept its validity.

26. August 2019 at 04:22

Just China counterfeiting USD.

https://twitter.com/Sangeysabmey/status/1165659644640935937

Do we now know why “China is a currency manipulator” is in the narrative?

26. August 2019 at 05:44

I think this is somewhat further to Daniel’s question, but as someone who has found your blog almost entirely persuasive, I also found the point about negative interest rates becoming increasingly ineffective at stimulating activity to be fairly persuasive (as in a paper cited by Summers and in the recent Blackrock paper that has made the rounds). Intuitively, this makes a great deal of sense: once interest rates go negative, basically all investors will switch to cash or equities, so what other investment activity will MORE negative interest rates stimulate?

It seems like I am missing the mechanism by which a certain NGDP level is achieved. Ultimately, even the hypothetical futures market feeds into the real economy via interest rates, right? Or am I missing some identity that makes hitting the NGDP target automatic if policy is correct?

26. August 2019 at 06:06

derek, for Scott, the transmission mechanism is the hot potato effect. Essentially, if you inject more cash into the economy than people want to hold, it creates a disequilibrium, and they try to get rid of it by spending it, but because all spending is someone else’s income, they can’t get rid of the money on their own, so the whole process continues until the price level and NGDP rise to their intended level.

However, money demand is not independent of money supply, interest rates or NGDP, even at a point in time, so Scott mainly focuses on expected NGDP. This runs into the problem outlined above (expectations can only change if current variables change, but current variables can only change if expectations change).

26. August 2019 at 08:28

That time when Fake News pushed a ‘sky is falling’ recession narrative, and their brainwashed sheep tried to portray themselves as independent thinkers by saying “50%/50% probability of a recession.”

https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

Losers.

26. August 2019 at 08:30

China asked Trump to “restart” negotiations right after Trump struck a deal with Japan to buy American corn. Why?

China lost its leverage.

Meanwhile, the fake news media tells you that Trump is having “second thoughts” about the trade war. Really?

Trump is winning on our behalf.

26. August 2019 at 08:52

Dr. Sumner,

Thank you for your reply. Like Derek, I often find your posts persuasive, but there is just something missing.

Derek gets to my point here- the way the Fed will pursue NGDPLT is basically the same way the Fed pursues interest rate level targeting. It just so happens that in one case the Fed targets the outcome it wants (or as you suggest, ideally a forecast of it), and in the other, the Fed targets an intermediary outcome, which is antecedent to the outcome it wants. (Maybe it’s the simultaneity and/or recursion I’m struggling with here? Thanks Paul)

The Fed would increase the money supply to a point where policy is positioned in an expansionary way. Based on your answer to my question, you believe that is all that is required to get an expansion. But it’s also tautological. How about instead, we call that Point P, which Dr. Sumner believes is the true expansionary Point E. Summers/Palley suggest that Point P might not be as expansionary as expected because some parameter values in the transmission mechanisms change (i.e., the hot potato is just a lukewarm potato, or people have less arm strength, etc.), so really Point P remains tight.

Is it fair to assume these parameters (such as ‘own liquidity return’) are constant (“the transmission mechanism always works fine”)? Or am I misunderstanding at the more fundamental level- interest rates aren’t intermediate outcomes (I agree they are an outcome!), but terminal outcomes (in which case the whole modeling approach of Summers/Palley is suspect)?

Trying to learn! Thanks for helping.

26. August 2019 at 09:34

Scott

As much as it annoys me to have the same/similar question as Derek :-)—-(although perhaps it should annoy him)—kidding of course—–however, as I used to say quite often in the early days of reading you, I have often perceived your ultimate reasoning behind NGDP targeting to be circular in nature.

As much as my intuition screams in support of your perspective—particularly your analysis of Summers’ remarks (although I wish you had not led off with “In my view”) I still do not understand the mechanism of making NGDP function.

I think you say it functions through the buying and selling of NGDP futures to keep the target price where desired—-which I accept must be part of any program of NGDP targeting—so far so good.

But what keeps the market from believing the Fed has no bullets to back up its futures’ buying and selling? In other words, besides taking the other side of the NGDP futures bet—what other mechanism does the Fed have to actually target NGDP? If it has that mechanism, it could do it without futures—–if it does not have that mechanism, the bet (buying and selling NGDP futures) seems like a poker bluff.

In other words, to avoid circular reasoning you need to explain either: 1) what the mechanism is behind the buying and selling of NGDP futures which makes the bet credible; or 2)explain why just the buying and selling of futures is enough in itself to make the bet credible

26. August 2019 at 12:10

https://twitter.com/SayWhenLA/status/1166070896597045248

26. August 2019 at 12:48

Paul, but once the interest rate goes negative, isn’t the potato about as hot as it’s going to get? I understand that people are holding negative-interest bonds in Germany, but surely the amount of money that people stop holding as the interest rate falls from -1% to -2% is less than they stopped holding when the interest rate went from 0% to -1%. How does market monetarism deal with money elasticity?

26. August 2019 at 13:34

It seems to me that if we can’t get big names to agree that inflation is *easy* to cause, that we really can’t have a reasonable conversation about monetary policy. Not that they are listening to us to have a conversation in the first place.

It’s like talking to a young earth creationist about the extinction of the woolly mammoth. There’s basic agreement needed before the conversation can start. I really wonder if they aren’t intentionally not understanding MV=PY.

26. August 2019 at 15:49

MV=PY does not suffice as proof that inflation is ‘easy to cause’.

It’s not even a necessary factor.

It’s just a numerical truism based on non-existent and thus incoherent concepts such as ‘price level’.

26. August 2019 at 15:56

Must read news site:

https://x22report.com/

https://twitter.com/X22Report

26. August 2019 at 20:06

Paul, Monetarists argue that only unexpected inflation matters for real variables. Expected inflation is important for nominal variables.

Derek, The purpose of negative IOR is to reduce the demand for bank reserves. Less demand for bank reserves is inflationary.

Monetary policy is not about moving interest rates to a level where people want to invest, it’s about adjusting the supply and demand for base money.

Daniel, Perhaps the Bretton Woods analogy would help. Countries with fixed exchange rates move the supply of base money to a position where the equilibrium exchange rate equals the target rate. I want central banks to adjust the supply of money until the price of NGDP futures equals the target.

26. August 2019 at 20:07

Michael, See my reply to Daniel.

27. August 2019 at 04:55

Scott—-thanks—got it

27. August 2019 at 05:44

Dr. Sumner,

Thank you! That helps, and I hope to become further converted to the NGDPLT side as I continue to read your blog.

27. August 2019 at 08:32

https://www.armstrongeconomics.com/world-news/climate/global-warming-is-about-destroying-capitalism/

United Nations official Christiana Figueres admits global warming conspiracy was never about saving the planet but to destroy capitalism.

Imagine the horrors that would have been unleashed had the witch won.

27. August 2019 at 08:34

Why aren’t investors buying and selling “NGDP futures” in the open market?

27. August 2019 at 08:42

Is Daniel the blog owner?

What rational person would WANT to be convinced something is true, before the truth evinces it so?

Dear lord is this character a cringefest.

27. August 2019 at 10:24

This explains the drivel pouring out of Bentley.

https://i.imgur.com/pWrOjnx.jpg

27. August 2019 at 12:49

What does the real mbka say to what’s going on in this thread? I think it’s outrageous. This other guy, this spam guy, with no fixed name, was allowed to change his name for at least the third time, and this time he was even allowed to take over the name of another commentator.

From now on, how can we even know for sure what is coming from an original commentator and what comes from this madman? Not to mention all this spam.

Scott, do you want the comments section to be completely destroyed? It almost looks that way. Rejoice, you are on a really good path.

27. August 2019 at 13:33

spammer did nothing wrong; actually better than old mbka