Not impressed

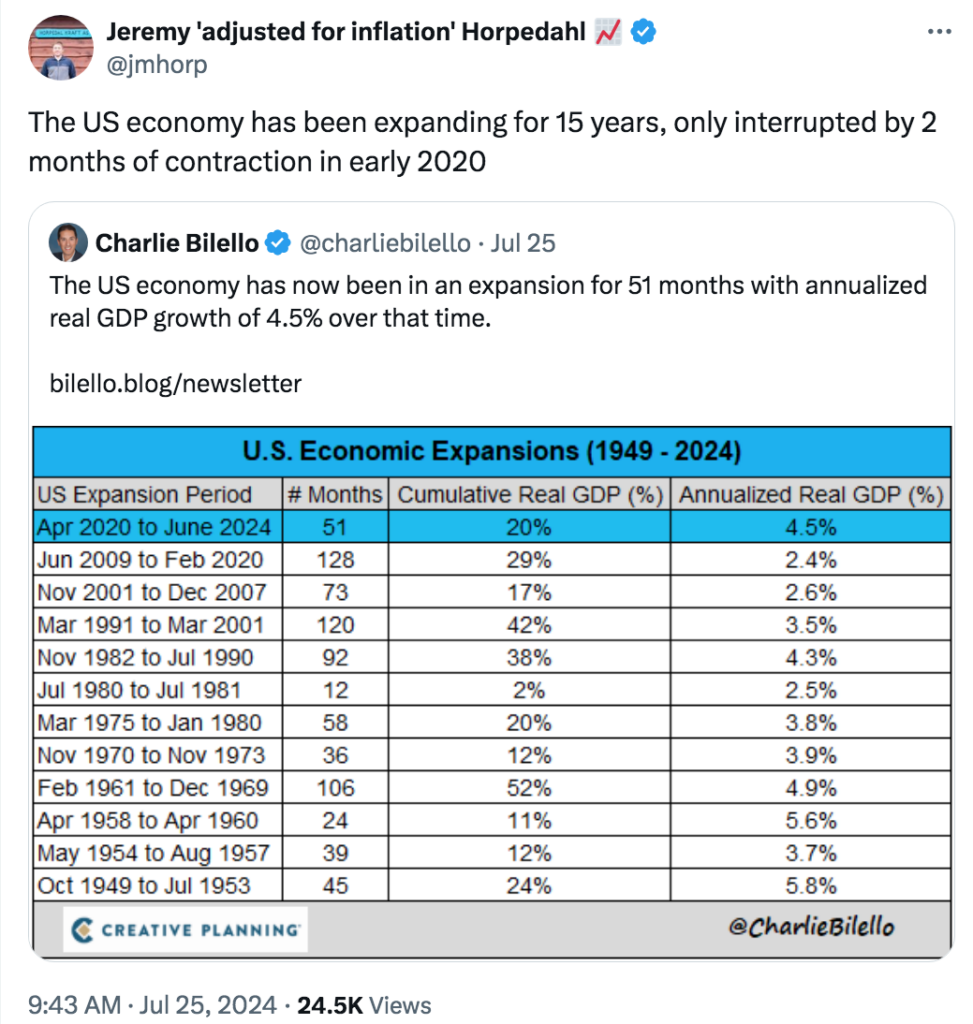

Tyler Cowen linked to an interesting set of tweets:

Neither observation impresses me. The fast growth over the past 51 months comes from a rebound from Covid (plus strong immigration.) The expansion after March 2009 was way too slow, featuring very high unemployment for a number of years.

I am impressed by the low unemployment rates since March 2022, and (in fairness to Trumpistas) the low unemployment of 2018-19. So I do see some things to be impressed with, just not those two data points.

If we get to a soft landing in 2025, then I’ll be really impressed.

PS. The subsequent tweet is also misleading:

Look at 1929. Are we to believe that during WWI and the Roaring 20s the economy spent more time in recession than during any postwar 15 year period? Even more than 1970-85? NBER recession dating is not reliable prior to WWII.

Tags:

27. July 2024 at 09:36

I feel like a better start for the GDP analysis would be the beginning of the GFC, not the ending? Base effects matter… 35.5% RGDP growth since then or 1.86% CAGR; 21.9% RGDP per capita or 1.21% CAGR. Not incredible.

Regarding pre-WWII data, this seems like a good post on which to also note that the S&P 500 did not exist before 1957 (and was not in its current methodological form until 2005). Be extremely sceptical of any stock analysis that goes before 1957!

27. July 2024 at 11:53

The Tweet/post isn’t even accurate. True there was no official recession in 2022 (and I agree with NBER’s call on that), but RGDP went down in both 1Q22 and 2Q22 on a Q/Q basis. 2009-present has been an unusual period of mostly steady expansion ex-COVID, with RGDP averaging 2.3% annual growth inclusive of everything over that time, but not quite a straight or monotonic line.

27. July 2024 at 17:07

I wonder about these figures. US real GDP up 49% since 2009? Granted, some population growth in that period. But still…who feels richer?

Is US GDP being consumed by items that do not make people feel richer?

For example, let’s say due to crime waves, every store has a security guard. Real GDP could go up, while living standards go down.

27. July 2024 at 18:50

Tacticus (and Robert), I agree that it would be better to start from the pre-GFC period, say 2007.

28. July 2024 at 03:29

1. Increasing immigration doesn’t increase growth. That’s an economically illiterate remark. And even if our fictious dream world allowed for such a scenerio, it doesn’t mean that increased growth will increase happiness (harmony). Nobody voted for shariah law to be imported, or for importing flag burning, religious zealots who chant death to America. There is more to life than “growth”.

2. Growth doesn’t say anything about standard of living. If at the start of year 1, there are 10 apples on a tree, and at the end of year 1 the number of apples increases to 12, that doesn’t mean joe the plumber is better off.

Over 50 years, we’ve seen a centralization of industry and government that now threatens western freedoms.

1) The Trusted News Inititative (TNI), recently sued by the great Robert F. Kennedy jr, is the best example of how centralized actors can collude to bring you propaganda.

2) You talk about Vance’s concern about Soros. It’s not just right wing republicans who are concerned about that evil monster. Moderate liberals, like Alan Dershowitz, are also concerned because he’s a gangster who uses his money to install radical prosecutors, and who establishes NGO’s to recruit, feed, clothe, and give brand new cell phones to any migrant willing to trek from the darian gap. His goal is to overthrow the American republic.

Even Hillary Clinton has private concerns about Soros. No morderate supports that fat, wrinkled, lard.

28. July 2024 at 09:38

Huh? My comment was mainly about factual inaccuracies, and not at all about whether 2009 was a good starting point (whether or not it is depends on what you’re trying to see).

28. July 2024 at 10:30

Robert, You said:

“2009-present has been an unusual period of mostly steady expansion ex-COVID, with RGDP averaging 2.3% annual growth inclusive of everything over that time, but not quite a straight or monotonic line.”

That’s what I was responding to.

I don’t agree about the “factual inaccuracy” claim. Economists define the term “expansion” more broadly than RGDP growth. It’s defined as a phase of the business cycle between recessions, for better or worse. You may not like that definition, but his claim was not inaccurate under this definition.

(There’s little doubt that those 2 negative quarters were mis-measured.)

28. July 2024 at 11:42

How is the soft landing looking?

Inflation seems stubborn at 2.5-3%

28. July 2024 at 12:58

Except that:

I never mentioned 2007. I was noting that the period he looked at was stable but not -that- stable.

They are using RGDP as the metric, so that’s what to use here to engage them on their own terms.

28. July 2024 at 17:38

Bobster, I agree, they still have a ways to go.

Robert, You said:

“I never mentioned 2007.”

Yes, I know that. My point is that growth rates are misleading when they go from trough (2009) to peak (today).

In any case, we are not arguing over anything important, as we both see the tweets as problematic

29. July 2024 at 05:40

I guess I took your comment (that you agree with me that it’s better to start at 2007) to mean that you think that: I think it’s better to start at 2007. My mistake.

To be clear, I think for some purposes it is better, for some purposes it is not.

Moving on

30. July 2024 at 09:10

–“I wonder about these figures. US real GDP up 49% since 2009? Granted, some population growth in that period. But still…who feels richer?”–

Roughly 55% since 20% and 29% compound. Population growth seems just under 12% higher, so about 38% per capita growth.

The only three things that are really noticeably different are (1) most technology is way better for the price (some software has gotten worse), TVs, cellphones and laptops are obvious examples (2) housing is hideously more expensive and (3) unemployment is much lower.

Getting more people to work at the same wage would give a boost, but probably something closer to 5% than 38%.

If I had to say how much wealthier things ‘feel’ today, I’d probably say more like 10-15%, mostly due to tech.

30. July 2024 at 12:21

“Roughly 55% since 20% and 29% compound.”

No, because RGDP fell sharply from February to April 2020.

30. July 2024 at 14:35

Solon: “I wonder about these figures. US real GDP up 49% since 2009? Granted, some population growth in that period. But still…who feels richer?”

Back in 2009, my own local area economy of about 40,000 people had just shed thousands of industrial jobs and unemployment was 20%+. A 49% improvement from that very deep pit of despair feels entirely reasonable to me.

30. July 2024 at 14:53

Again, Solon misread the numbers—stop saying 49%.

30. July 2024 at 20:27

Ignoring the 2020 drop came to mind about an hour after the comment. Elementsry error there!