Magical thinking

Paul Krugman has a couple of posts criticizing MMT. He tries to be polite, pointing out that at the zero bound their policy recommendations are less bad than those of advocates of austerity. But deep down he must know that this model is sheer madness.

Stephanie Kelton responds, and continues the long MMTer tradition of being unable to provide a clear explanation of the ideas. Here she responds to Krugman’s concern that massive deficits might eventually push the public debt so high that interest rates rise to a level that puts a big burden on taxpayers.

First, “there is a devil in the interest rate assumption,” as economist James K. Galbraith has explained. Preventing a doomsday scenario is not difficult. As Galbraith explains, “the prudent policy conclusion is: keep the projected interest rate down.” Or, putting it more crudely, “It’s the Interest Rate, Stupid!”

And just how is the government supposed to “keep the projected interest rate down”? By magic?

Yes, by magic:

Since interest rates are a policy variable, all the Fed has to do is keep the interest rate below the growth rate (i<g) to prevent the ratio from rising indefinitely. As Galbraith says, “there is no need for radical reductions in future spending plans, or for cuts in Social Security or Medicare benefits to achieve this.”

Rather than presenting this as a problem for functional finance, Krugman should be wondering why the Fed would ever maintain an interest rate that would put the debt on an unsustainable trajectory. I don’t believe it would. If i>g, then debt service grows faster than GDP, which Krugman argues would be inflationary.

So his hypothetical scenario begs the question: Why would an inflation-targeting Fed permit i>g with a debt-to-GDP ratio at 300 percent?

Notice that she doesn’t tell us how the Fed is supposed to keep the market interest rate down. It doesn’t just happen by magic. Market interest rates are not a “policy variable”; they are impacted by various policies. While the Fed directly controls the discount rate and the interest rate on reserves, the rates that really matter are market interest rates on public debt. How does the Fed keep them down?

In the short run, the Fed can lower market interest rates (to below the natural rate) via the liquidity effect of an easy money policy. To hold rates down in the long run, you need a very tight money policy, which reduces NGDP growth and thus lowers the natural rate of interest. I kept reading, waiting for an explanation of how the Fed is supposed to keep interest rates down. Easy money in the short run or persistent contractionary demand-side policies? And the answer came in the very next paragraph:

Japan serves as a pretty good example here, with a debt ratio that might well rise to 300 percent one day. Meanwhile, rates sit right where the Bank of Japan sets them, and the government easily sustains its primary deficits.

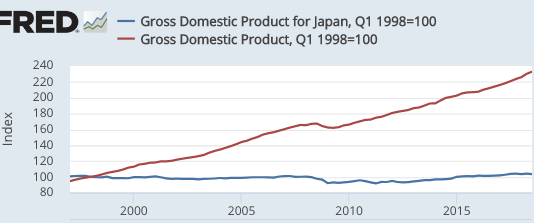

As you may know, over the past 20 years Japan’s had the most contractionary demand side policy in modern human history, with almost no growth in NGDP since 1998. So the example cited by MMTers as the way to keep rates down is the paradigmatic example of where the action is accomplished through severely depressed spending.

Yes, that will “work”, but don’t MMTers favor boosting demand? I thought they believed that even the US had deficient demand, despite having NGDP growth (red line) far higher than in Japan, even adjusting for population growth.

MMTers seem to believe that policymakers have one more degree of freedom than they actually have. If you want strong growth in spending, you must accept higher nominal interest rates. Otherwise the economy will spiral into hyperinflation.

Second, if we’re so obsessed with debt sustainability, why are we still borrowing? Remember, Lerner didn’t think of borrowing as a financing operation. He saw it as a way to conduct monetary policy – that is, to drain reserves and keep interest rates at some desired rate — as I explained here.

But the Fed no longer relies on bonds (open-market operations) to hit its interest rate target. It just pays interest on reserve balances at the target rate. Why not phase out Treasuries altogether? We could pay off the debt“tomorrow.”

Yes, you can replace all Treasuries with interest bearing reserves, which are simply another form of debt. And that insures that the interest rate you pay is no higher than the “target rate”. But again, if you set the target rate below the natural rate for an extended period you’ll end up with hyperinflation. And no, tax increases don’t prevent high inflation, as we learned in 1968.

What about Japan? Well, Japan pushed their natural interest rate to zero with the most contractionary policy for NGDP growth in all of modern history. Is that their solution? Is that their evidence that there is no natural rate of interest?

HT: Dilip

Tags:

21. February 2019 at 13:00

Scott in his 2nd para onwards doesn’t seem to understand how it is possible to increase the deficit without increasing interest rates given that more deficit means more government debt. The answer is easy: don’t incur more government debt. I.e. just print money and spend it (and/or cut taxes), as suggested by Keynes in the early 1930s. And if overt money creation is now allowed, do it the indirect way: have the central bank do $X of QE for every $X of deficit (funded by government borrowing).

I’m not suggesting that overt money creation (or the latter “indirect / QE” equivalent) wouldn’t NECESSARILY raise market rates: my guess is that rates would rise initially to fund more capital investment, and then fall back again. But who cares what the market rate is? In the UK in the 1990s, mortgagors were paying THREE TIMES the rate of interest they pay nowadays. The sky didn’t fall in.

21. February 2019 at 13:22

“The answer is easy: don’t incur more government debt. I.e. just print money”

Outside the zero-bound, financing deficits with money will raise prices. More money chases the same number of goods.

If *market* interest rates remain the same, the investors will have a lower *real* interest rate. As real interest rates decrease, some investors decide to consume rather than invest. Market interest rates then go up from lower demand from investors.

The Fed can itself print money to buy bonds. The bond purchase reduces supply of investments to offset lower demand of investment. However, even MORE money exists. The new money increases prices further, required the Fed to buy yet more bonds. Hyperinflation results.

21. February 2019 at 13:25

Last sentences should read: “However, now even MORE money exists. The new money increases prices further, requiring the Fed to buy yet more bonds. Hyperinflation results.”

21. February 2019 at 14:44

Ralph, Printing money increases rates far, far more than borrowing money, because it causes high inflation. Try paying for government spending by printing money.

Matthew, Exactly.

21. February 2019 at 15:55

This explains how the gov can keep rates at any level they want

https://www.businessinsider.com/why-treasury-prices-are-so-high-despite-record-supply-2012-6

This explains it too although a bit muddled

https://player.fm/series/macro-musings-with-david-beckworth-166390/ep-144-peter-stella-on-debt-safe-assets-and-central-bank-operations

There is also Japan which showed bond vigilantes their place

https://twitter.com/mauerback/status/1002657561382879232?s=21

Also look to WW2: the gov sinply pegged the10 yr rrate as easily as it now get the short rate where it wants

I know that you are impervious to evidence but arguments from incredulity don’t cut it at this point.

21. February 2019 at 16:14

It seems to suggest that the Fed can buy up to 100% of the Treasury Action, so the auction can never fail. And the rate that the Treasury has to pay can never exceed the rate the Fed establishes as the “reserve price” on the auction.

That is the Treasury says we need to borrow 1 trillion dollars this month. The fed says we will buy up to 1 trillion dollars at a rate of 6%. Anyone who wants to match or beat 6% can step in front of the Fed and participate in the auction.

So much for Fed independence.

I also seem to gather that MMT suggests that the government use tax policy instead of monetary policy to drain off any excess currency creation to hold off inflation. That requires a much more nimble congress than I have ever seen.

And what is never mentioned is the FX market. It seems to me, that before a country experiences a fiscal crisis, the currency comes under attack. The currency crisis precipitates the fiscal crisis.

With the average maturity of US Treasuries at 8 years, Rates rise today, debt service stays the same. It takes years of high interest rates, before the added interest expense becomes a problem.

It won’t be rising debt service that triggers an attack. It will be out of control spending, with no political will to reign it in that will trigger the attack. MMT going mainstream, might just be enough.

21. February 2019 at 16:24

As if macroeconomics was not already in a discredited shambles, then comes along MMT.

It is unfortunate that MMT has seized centerstage as the macroeconomic controversy of the day.

Perhaps now it is a better time for discussion of money financed fiscal programs.

21. February 2019 at 16:49

OT but thought-provoking:

Germany in 2018 was the world’s most successful exporter. It net exported $294 billion, on a population of 82 million, or about $3500 for every resident.

About 45% of Germany’s GDP is in the public sector.

In general, free traders insist that Germany does not subsidize exports.

Then, how on earth does a nation with such high tax rates and 45% of its GDP in the public sector also become the world’s preeminent exporter?

Side note that means nothing but is really interesting: German wheat farmers obtain yields per acre double those of the United States.

21. February 2019 at 17:07

What is the election strategy of the Democrats for 2020 again? Making so many extreme suggestions so that Trump’s policy looks better in comparison? Good news first: It works out brilliantly so far.

21. February 2019 at 17:39

Dear Prof. Sumner,

Not to play devil’s advocate, but is the different between your position and their simply one of means (and not ends)?

In essence, it seems to me they propose to increase net gov’t spending (through debt) until inflation sits comfortably above the fed’s target.

I gather their favorite policy tool is a different. That said, isn’t their stated objective close to your prescription?

21. February 2019 at 17:48

@Ben

I’m pretty sure it’s mainly the other way round: Germany became so rich through trade and their competitive industry. Germany has an endless list of so-called “hidden champions”.

There’s an endless list of subsidies as well but they don’t have much to do with Germany’s success. It’s just an endless list of failures and wasted money.

21. February 2019 at 18:55

Christian, re Germany:

It gets worse. The average German works 1,350 hours a year, vs. 1,750 in the US. The average German worker has 10 weeks off every year that the typical American does not!

As a Westerner, free-market kind of guy, I am looking for bias conformation in Germany. Looking really hard.

No doubt Germans are efficient—just look at their wheat farmers, who produce double that of Americans per acre.

Is it free markets that have made Germans so efficient?

21. February 2019 at 20:00

Would spending on wasteful ineffective public projects keep GDP growth and interest rates low?

21. February 2019 at 20:56

Unfortunately you will find that due to mood affiliation, thanks to very old views of ecology, I find MMT proponents that really would we happy if a flat, relatively equal, yet not growing Japan became the new norm.

@BenjaminCole, there are many reasons for higher wheat yields in Europe. The main one is that high inputs, high outputs kind of farmers are typically not planting wheat in the US, but alternating corn and soybeans. Specifically, the amount of pesticides that German farmers use are outrageous by US standards.

21. February 2019 at 21:09

“Would spending on wasteful ineffective public projects keep GDP growth and interest rates low?”

Well, it did in Japan.

21. February 2019 at 21:40

I wonder everyone can eat “magical banana” or not

21. February 2019 at 21:47

PeterP,

In the 40’s, the Fed had an interest rate peg of US Treasuries. Essentially spending was monetized. After price and wage controls were ended, the CPI went to 17% in 1946. By the Korean war, the peg was untenable as CPI in early 1951 reached a 21% annualized rate. The Fed stopped buying Treasuries at a fixed rate.

https://www.federalreservehistory.org/essays/treasury_fed_accord

A tight-money, low NGDP growth government can indeed issue a lot of debt and print a lot of money. Monetary policy hurts returns from private investments. Given no alternative, the market accepts public currency and bonds with terrible returns. So Japan and Europe can issue negative rate bonds and charge negative interest on reserves.

Once NGDP truly picks up, the market no longer accepts the terrible returns. So the US Treasury had an easier time issuing bonds for World War II than it did for the Korean War.

22. February 2019 at 01:49

Matthew Waters and Scott Sumner:

The “print and spend” policy advocated by Keynes and MMTers is only intended to be implemented to the extent that it brings full employment plus the target rate of inflation: i.e. Keynes and MMTers have never advocated printing and spending so much that an excessive amount of inflation ensues. MMTers have said over and over again that inflation is the constraint when it comes to stimulus.

Plus Bernanke and more recently the deputy governor of Japan’s central bank gave an approving nod in the direction of print and spend. See respectively para starting “A possible arrangement…” halfway down here:

http://fortune.com/2016/04/12/bernanke-helicopter-money/

And: http://fortune.com/2016/04/12/bernanke-helicopter-money/

22. February 2019 at 04:00

Benjamin, Germans also earn less than Americans. Eg in terms of GDP per capita. Even per hour worked.

If you think German wheat yields are impressive:

Antarctica probably has the best yield of wheat per area.

(Assuming that there’s probably one weird experiment where some scientist has a square metre of wheat in their lab in Antarctica.)

They also have the highest proportion of PhDs per capita of every continent.

Some parts of Germany do indeed have some awesome soil for growing wheat and potatoes. I grew up around one: https://en.wikipedia.org/wiki/Magdeburg_B%C3%B6rde

22. February 2019 at 04:51

It’s tough to be a macroeconomist.

Scott Sumner just defined the MMT’ers as believing in magic.

And David Andolfatto just suggested that the Neo-Fisherians are “nuts.”

And that is what the nice guys are saying about other macroeconomists.

Right-wing economists discharge Niagaras of foul calumny on Paul Krugman.

The Federal Reserve is daily accused of “blowing asset bubbles.”

Curiously, there is no right-wing economist presently with the stature of Krugman, and so there is no rueful figure for intellectual effigy-hanging. This may be because no one believes right-wing economists anymore.

Why do people watch WWE? Macroeconomics features much better in-fighting.

22. February 2019 at 06:05

“MMT is the contention that giving Bernie Sanders a blank and unlimited checkbook will work out well.”

Discuss.

22. February 2019 at 07:03

Scott,

So years ago before I even got the company founded, funded, and built #Uber4Weflare (first patent(s) just approved…

Warren Mosler dug into my plan and this was his response:

http://www.twitlonger.com/show/n_1rk0ugd

I’ll post my response back next, but the important point here is that MMT isn’t “really” about Monetary Theory…

It’s about their Job Guarantee

Notice here that Mosler admits flat out #U4W will end labor slack forever. Anytime you mention this to MMT guys they go dead silent.

None will respond.

But it raises this riddle I have for you, I’ll tell you Nick Rowe’s answer next.

Question: If #U4W (weekly wage subsidies liquidating all labor supply at whatever employer payments are required in the private sector) ends labor slack forever…

WHAT DOES THE DO ALL DAY?

Scott I ask, bc the Fed is always focused on unemployment, they don’t want to little of it…

But built into that is the idea that prices will rise.

But what if the state adopts an EVERYONE WORKS EVERY WEEK fiscal policy?

How does the Fed determine the state of things?

I asked because I really didn’t know, Nick’s answer knocked some things loose…

Can you please take a shot at it Scott? ASSUME all labor slack is liquated weekly. Whats the Fed do – what is their purpose then?

22. February 2019 at 07:04

My response to Mosler:

http://www.morganwarstler.com/post/49828770506/sultans-and-their-fanners

22. February 2019 at 07:38

Unfortunately, even though MMTers are engaged in “magical thinking”, what really works to their political advantage presently, is the fact Republicans have chosen to ignore their own decades long advice (and common sense), re fiscal restraint. For a long time, they had Democrats willing to follow that logic, in the form of political compromise!

22. February 2019 at 09:11

[…] 3. Scott Sumner on MMT. […]

22. February 2019 at 09:16

Inflation is the pivot around which mmt discussions become circular.

1) “Conduct expansive monetary policy to pay for social programs.” 2) “It will result in inflation.” 3)”No, when inflation emerges, you can respond by contracting.” 4) “But if you’re contracting monetary policy to stop inflation then you’re not expanding monetary policy to pay for social programs.” 5) “Then, [go back to 1 and repeat].”

mmt advocates tend to be too polite to replace 3 with “Yes, raise the inflation target to 20%” because that would be socialism.

22. February 2019 at 09:46

Peter, No one disputes that the government can hold rates near zero for long periods, the Japanese have done that, as Kelton says. What’s your point?

As for the post WWII experience, check out 1951, when people caught on to the fact that the US wasn’t going to have the normal postwar deflation.

kav, There’s a difference in means, and also a difference in how the economy works. I believe their means would have bad effects, and I’d point to Japan, which has had the worst performance of AD in modern history. Japan’s doing OK, but its demand policies (the focus of MMT) are a complete disaster.

Ralph, you said:

“MMTers have said over and over again that inflation is the constraint when it comes to stimulus.”

These arguments are just incredibly annoying. We show that you can only raise a trivial amount of revenue via seignorage, the rest requires current and futures taxes. They respond that they’d only do seignorage until we get inflation. But that means very little as, in practice, almost all spending must be financed with taxes. But then they deny that. Sorry, but Krugman’s right, and new huge spending programs will effective require much more taxes, even though you can dream up implausible scenarios where it’s done by printing money. Good luck with that!

As far as Bernanke, lots of mainstream economists favor more expansionary fiscal and monetary policy; MMT hardly has a monopoly on those preferences. Heck, even I thought we should print far more money during the Great Recession and recovery period.

Kevin, Real GDP might be low, but nominal is another story (see Zimbabwe.)

Becky, Yes, the GOP seems to favor the MMT agenda; spend without taxing as long as inflation is low.

Rick. Excellent.

22. February 2019 at 10:06

Ralph,

Once MMT is defined down enough, it starts looking like regular Keynesianism. Keynesians do imply that some chunk of stimulus at zero-bound will be monetized.

From 2008 to today, US debt held by public went up $10 trillion. Currency in circulation has gone up $900 billion. So 10% of the spending was monetized. Like Japan, the US has large foreign demand for the currency. Most countries do not have the same luxury.

I do not consider reserves paying interest to be monetized. Reserves now are overnight T-bills.

22. February 2019 at 10:58

There are two flaws (at least two) with MMT:

1. The government (the central bank – the FED) cannot really control interest rates. The government can control the rate at which it lends money to banks, but it has no real control over at what rate people are willing to lend money to the government. IF the market ever perceives that there is either a risk of default, or a risk of inflation, the market will bid up interest rates accordingly.

2. Even at the current level of interest rates, if you double the size of the Federal debt (as would be required by the Green New Deal), the resulting interest bill would make interest payments the number one expenditure in the Federal budget. This would lead to either inflation as money is created by the Fed to pay the bills, or to even more debt as debt is issued to pay the interest bills.

In short what the MMT advocates propose is sheer lunacy. No government has ever borrowed and spent its way to prosperity for its economy and its citizens.

22. February 2019 at 12:08

@Benjamin Cole as far as wheat yields there are many reasons that might be true and it seems to have been that way at least since the late 1800’s. http://ageconsearch.umn.edu/bitstream/142651/2/wheat-1937-11-14-03.pdf

People often forget that people agriculture do not target maximum yields but maximum earnings per unit of effort (with some land constraint), which is one reason that the 1970’s population doomsters were so wrong.

(BTW an agronomist friend told me that there is a part of Chile that is known for huge wheat yields without huge inputs.)

22. February 2019 at 12:19

Sorry, but the government printing money to finance government spending is begging the question. Why not just skip a step and make government workers provide government services for free? This would also prevent further debt incursion and inflation. Seems like the silver bullet to me.

22. February 2019 at 12:30

@Matthew Walters…

The debt is always monetized. You can only buy initial auction US Treasury’s with FED reserve account balances. Absent QE the banking system does not keep excess reserves floating around…

https://fred.stlouisfed.org/series/EXCSRESNS

Where did the reserves come from to buy Treasuries prior to QE? The only place reserves can come from… the FED.

Former FED Chair Marriner Eccles explains it quite clearly on page 8 of his congressional testimony (“Mr. ECCLES. Well, as I remember the discussion…)

https://fraser.stlouisfed.org/files/docs/historical/house/1947hr_directpurchgov.pdf

22. February 2019 at 14:06

The central premise of MMT is that in the face of high inflation, the federal government could always institute austerity to shrink the budget deficit and thus reduce demand in the economy.

But the political incentives don’t work like that. In the face of stagflation, Congress is more likely to cut taxes than raise them. Indeed, any tax hikes on the middle class are politically toxic to implement. If we’re relying on politicians to take things away from voters just as the economy begins to overheat, we are bound to be behind the curve on fighting inflation especially during election years.

22. February 2019 at 18:21

Although I found Kelton’s op-ed confusing, at least she has committed something to paper. I am trying to get my head around a few points in her piece:

1. The notion of ‘crowding in’. My understanding is that she is initially referring to money-financed deficits, which would result in excessive investment and potentially inflation. In this context, she sees the sale of government bonds as a way to ‘mop up’ the extra liquidity “to the point that the short-term interest rate rose enough to prevent excessive investment”. But prior to and in the absence of those govt bond sales, presumably the interest rate on private loans/bonds would be very high, reflecting the high expected inflation. She suggests that the sale of govt bonds would push interest rates *up* and reduce investment, but I would have thought that relative to a state of the world with no govt bond sales, the sale of govt bonds would help push interest rates *down* by reducing expected inflation. Am I making sense?

2. Re the Japan example, Scott, you’ve always said that if Japan embarked on a more expansionary monetary policy, the Japanese treasury would likely gain more from higher tax revenue than the BoJ would lose from lower bond prices. If so, then why would i>g create problems? Or is your view contingent on govt debt not rising too high?

3. Kelton’s comment that policy makers could always clamp down on (private) credit through macroprudential-type controls as an alternative to higher interest rates confirms my understanding that MMT at full employment is fundamentally concerned with effecting a politically desired reallocation of resources from the current allocation to the one preferred by MMT advocates.

22. February 2019 at 21:10

Ben,

50 days sounds like a lot, I guess. But you are right in so far that 30 work days of vacation is pretty much standard in Germany plus 10-12 days of public holidays. I heard only 10 work days is the standard in the US plus 10 public holidays.

From my experience Americans are at work too often. They don’t work “more”, they just stay in their company longer, a bit like in Japan.

My experience is that my work performance drops sharply after a few hours. I’m also much more efficiant in the beginning of the week. I bet I could just work 3-4 days a week for 6 hours per day (instead of 9-12 hours as of now) and I would still achieve the same results, maybe even better ones.

I’m not sure if agriculture is a good example for anything. Its share of the economy is so small and its so extremely subsidzied in nearly every country. Spontaneously, I would say German farmers are making better use of agricultural land because agricultural land in Germany is much more limited.

What else? It wasn’t the notorious German bureacracy, that’s for sure.

23. February 2019 at 02:08

Dear Prof. Sumner,

I’ve recently read a very thoughtful analysis of the BOJ policy in the three decades since 1989. The analysis was focused on explaning *why* this policy was so contractionary (the motivations). But not so much on the *how*. It could be great if you could point to an explanation (ideally by yourself or maybe provide one in one post one day) as to *how* exactly is the BOJ policy too contractionary (what is it that they should not do).

Thanks in advance,

23. February 2019 at 04:10

My understanding of MMT is that debt is nothing, spending is everything, and all spending is political.

While it’s easy to ridicule,look at the evidence.

We have extremely high debt, zero statutory debt limit, low interest rates, and extremely low velocity of money.

The federal reserve creates the money to buy the treasury bonds, then holds the bonds until maturity. By never selling the collected treasury bonds, they never expose the marketplace to the bad money of the federal spending deficit. The very slow unwinding of the fed’s balance sheet with $50B monthly sales of those bonds is a very mild influence used to create inflation. The federal reserve has all the time in the world to await the inexorable effect of inflation to make the federal debt disappear.

Interest rates happen, but there is very little influence from sequestered U.S. debt on interest rates.

23. February 2019 at 15:39

Rajat, Your first point sounds right.

On the second point, we don’t know a lot about the conditions where r > g. Right now Japan’s debt problem seems manageable, but what if interest rates rose sharply?

You are right that I’m not too concerned about the BOJ printing money, but that’s a different issue from Japan borrowing more. Even extra borrowing is not a short term problem, but might be a long term problem if rates rose.

kav, They are not printing enough money to hit their inflation target.

23. February 2019 at 18:24

Serious question for MMTers: Do they believe that it would be feasible to cut taxes to zero and fund the government entirely through borrowing?

24. February 2019 at 03:19

Cooper,

You are quite right to say that if the deficit / surplus is the sole weapon used to implement stimulus (or “anti-stimulus”) we cannot rely on politicians to implement anti-stimulus when needed. Indeed, the very idea that politicians are qualified to determine the right amount of stimulus is laughable.

For that reason, if stimulus is to be determined just via fiscal means, which is what many MMTers want, then determining the size of the deficit must be put into the hands of some sort of committee of economists, maybe the central bank, while strictly POLITICAL decisions, like what % of GDP goes to public spending stays with politicians.

Positive Money (which like MMT backs overt money creation) has thought that through much more thoroughly than MMTers.

E.g. see here (p.10 in particular).

http://b.3cdn.net/nefoundation/3a4f0c195967cb202b_p2m6beqpy.pdf

24. February 2019 at 06:51

The point is if “the government can hold rates near zero for long periods” it is a policy variable. Otherwise, bond vigilantes can dictate the terms by which they lend to government which the evidence says they patently cannot do as Peter shows. The monopolist calls the shots not the customers.

24. February 2019 at 12:08

Bob, No, persistently low rates are the outcome of highly contractionary monetary policies. MMTers don’t know this, and that’s a problem.

24. February 2019 at 16:05

Scott, is there any evidence that deficits financed by money creation are significantly more inflationary than deficits financed by bonds?

24. February 2019 at 17:19

Here’s a good criticism of your post from J.W. Mason…

https://twitter.com/JWMason1/status/1098970350610571264

24. February 2019 at 17:54

Arilando,

Outside the zero-lower-bound, monetized new spending is not inflationary at all if the Central Bank has a rigid policy target. The CB sells bonds to destroy money and offset the spending.

If the CB runs completely out of bonds to sell, the CB can still increase interest on reserves. If the CB refuses to increase IOR to incredible levels, then only fiscal policy affects inflation.

At the zero-lower-bound, the answer is complex. If the CB has truly exhausted all monetary tools to increase NGDP, then both monetized and debt-financed spending increase NGDP. Monetized spending may have slightly more inflationary effect.

In practice, CBs only run into artificial political limits to expansionary policy. The Fed in 2008 had trillions of dollars of Treasuries it could have bought but did not. At an artificial political boundary, deficits of both types could also increase inflation. However, running deficits is second-best to more expansionary policy.

24. February 2019 at 19:16

Ilya, I don’t get his point. Is he saying per capita growth in NGDP in the US is not far higher than in Japan? If he is, he’s wrong. It’s over 3%/year in the US and close to zero in Japan. Maybe he’s confusing real and nominal GDP.

Arilando, Yes, I’d say you could fill a room with such evidence. Look at all the studies of hyperinflation. What they mostly have in common is money financed deficits. In contrast, debt financed deficits are generally much less inflationary.

In addition, the market responds differently to the two types of financing. Indeed open market purchases would not even be expansionary if it were not for the fact that high powered money is more stimulative than government debt.

25. February 2019 at 05:48

Scott, MMTers typically advocate parking the interest rate of reserves (federal funds rate in the US) at zero. In such an environment it’s not clear to me that there would be a significant difference between debt financed deficits and money creation financed deficits.

26. February 2019 at 08:24

Scott, J.W. Mason’s point is that the graph you used isn’t per capita, so is seriously misleading.

Real per capita GDP growth in the US since 1998 has averaged 1.4%, see:

https://fred.stlouisfed.org/graph/?g=n68G

26. February 2019 at 08:47

Arilando, If base money pays zero (as was true before 2008) and bonds have positive yields, then printing lots of money leads to hyperinflation. There’s no free lunch here!

Taj, If he’s talking about RGDP then he doesn’t have a clue as to what he’s talking about. This post was about NGDP. In the US, per capita NGDP growth exceeds 3%/year. It’s been near zero in Japan since 1997.

You measure demand with NGDP. RGDP shows changes in aggregate supply.

I didn’t both to construct a graph with per capita because it wouldn’t have made a meaningful difference in my basic point. Why waste time?

26. February 2019 at 09:13

Ah, I see – thanks for the reply! I don’t know if he understands that, but I certainly didn’t.

Might be worth amending the post not to imply that the graph adjusts for population growth. I overestimated how significant a factor it was.

Graph of that for anyone interested:

https://fred.stlouisfed.org/graph/?g=n6ba