It’s services, i.e., it’s NGDP, i.e., it’s monetary policy

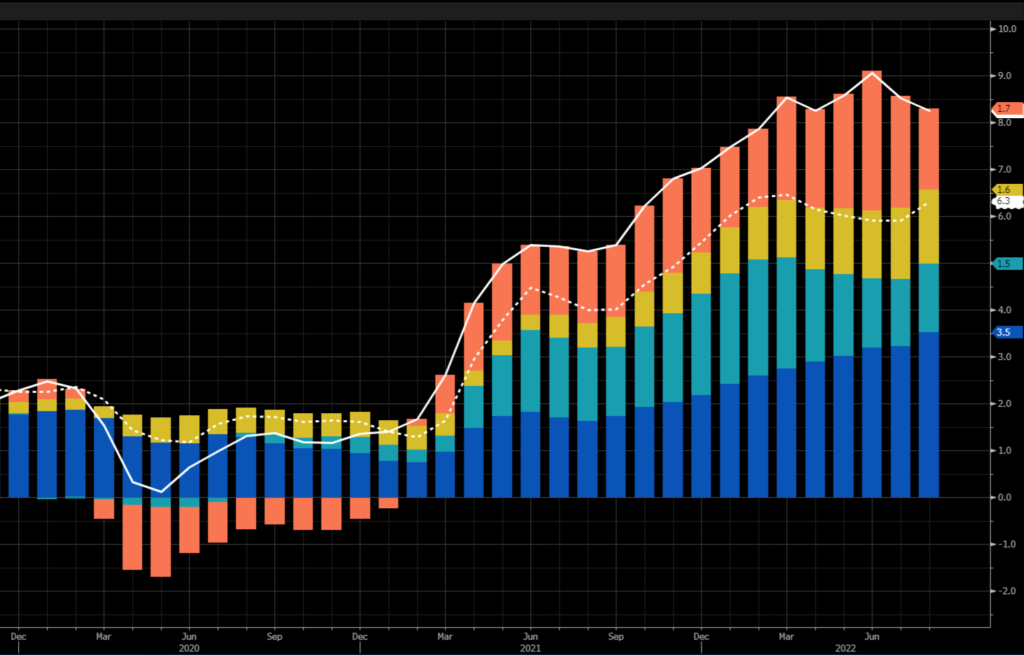

So what’s the problem with inflation? John Authers and David Beckworth directed me to the following graph, which shows that the most recent upswing is in services:

I apologize if the graph’s hard to read, you can look at the original here.

If you decompose the 8.3% annual inflation, 1.7% is energy (orange), 1.6% is food (yellow), 1.5% is other goods (teal) and 3.5% is services (blue.) Be careful interpreting these components; they are not annual inflation rates, they are contributions to inflation. Each component is rising much faster than its contribution to the total. Thus services and other goods are rising at 6.3%, which is the core inflation rate, even though they contribute only 5% to headline inflation. And food and energy prices are rising at double digit rates over the past 12 months, despite contributing just 3.3% to a headline inflation rate of 8.3%.

But I’m more interested in recent trends. Stocks plunged today because core inflation is worse than expected, and that’s mostly services. Why is service inflation getting worse? Because it responds with a lag to increases in nominal GDP. It’s almost always thus way. Much of services inflation is wages and implicit rents. Wages are sticky and rents are even stickier, often on one year contracts. The average “spot” rent on new contracts has already peaked and is heading downward, but the measured average rent will get worse for a while.

There are a few lessons here:

1. During periods when NGDP is rising too fast, ignore so-called experts who try to tell you that inflation is caused by this or that supply problem. It’s the NGDP, stupid.

2. Don’t assume that rising interest rates mean that monetary policy is getting tighter. That may be true in some cases, but until we get a slowing in NGDP growth (which is expected to remain quite high in Q3), we don’t actually have a tight money policy. At most, a bit less loose than earlier in the year.

3. Heavily discount any sort of Phillips Curve analysis of inflation, which focuses on tight labor markets. The problem is NGDP growth.

4. Back in January, I criticized the Fed’s pivot to asymmetric average inflation targeting. With every new data point, it becomes more and more obvious that the abandonment of average inflation targeting was a huge mistake. “Keep It Symmetrical, Stupid.”

We’ll be paying the price for this mistake for years.

Tags:

13. September 2022 at 15:35

Doesn’t this graph also prove that monetary policy is in fact ‘political’, contrary to the narrative (sourced by the Rothschild cult who control central banks worldwide) that there must be an informational and control firewall dividing central bank operations from the public that is allegedly ‘too stupid’?

Inflation took off as soon as fake President Biden took office. Coincidence?

13. September 2022 at 16:02

The Phillips curve arguments are also going to be tremendously unpopular, left or right: Dear workers, if you want less inflation, we must get more unemployment! Is not going to sell well.

13. September 2022 at 16:49

George, you clearly don’t deserve a response, but I’ll give you one, if for no other reason than to practice my own skills of communication. Inflation (and NGDP growth) did not immediately take off on January 20th, the minute president Biden was sworn in. Inflation took off after the passage of the American Rescue Plan, which you’ll remember put $1.9 trillion into the economy. If the Fed had been pursuing a nominal GDP target, or if they were actually pursuing a flexible average inflation rate target, they would have reacted to this massive increase in the deficit by decreasing the supply of money and creating a more balanced equilibrium. They did not, feeling that getting the unemployment rate lower and achieving full employment was the more important consideration.

You may say that is political. Sure. I don’t really know who you think is out there saying this (saying this, not financing it, you antisemitic dingbat). But it was also political of Jerome Powell to allow inflation to run above 2% in 2018 and 2019 to allow for the best labor market in my lifetime. Had it not been for covid, democrats would have had an enormously bad time trying to convince the American public that the economy was bad. The Fed, insulated from democracy by one or two orders, is not as political as, say, tax policy. But to claim it is apolitical would be, obviously, wrong.

13. September 2022 at 17:16

“George, you clearly don’t deserve a response”

Ah yes, the response of an arrogant fool, sitting behind a desk, who believes he’s better, smarter, greater than everyone else. He doesn’t need to “respond” to you, because you are unworthy of his response. He’s only doing it to “practice his writing skills” not for any other reason, and he wants you to know that.

This is the type of person who uses pre-enlighntment dogma such as “settled science” to describe his work, and then tells dissenters to “shut up or be canceled” because the whole world should bend a knee to his sumpreme logic. This is the type of person who believes that if only he could manage everything — if only he was in charge — the n we would all live in a grand utopia. All of those “losers”, those ungrateful perfidious pricks, those farmers, those academics who disagree with him, those who dare question his “settled science” would be “put in their place”.

Folks, the psuedointellectuals are on the march.

13. September 2022 at 17:25

Why is NGDP growth still so high? It seems like the Fed is communicating that it wants inflation, and hence NGDP, to fall. From what I have read, professional forecasters have been revising their estimates of the possibility of a recession.

13. September 2022 at 17:35

George’s “Rothschild cult” dog whistle is loud enough to be deafening; the rest is MAGA nonsense.

And Sara, even non-pseudo-intellectuals should consider using a spell-checker when crafting a straw man argument.

13. September 2022 at 17:39

lizard man shames economist manque sumner to come down off the grassy knoll and give the answer begging to be answered in every psuedo-economic post by sumner.

13. September 2022 at 17:48

Andrew C:

In the graph, there is a distinct inflection point Jan 2021 after which inflation skyrocketed. You can tell me any specific implementation you want, this act or that act, this funding or that funding, my point is the TIMING. As soon as fake President Biden entered office, inflation made a significant turn upwards.

If you ask site owner or any other ‘monetarist’, they’ll tell you it’s the central bank that is ultimately responsible for inflation.

I trust my eyes more than your cringe “I am just practising my communication” conceit.

By the way, you just proved you’re anti-Semitic. If you see criticism of a name, and you immediately think criticism of 17 million people, INCLUDING MYSELF (50%) THANK YOU, you are not ‘seeing’ anti-Semitism outside you, you’re PROJECTING your own.

The iron law of woke projection never misses.

Also, I don’t regard the Rothschild cult as Jewish. They don’t worship God, they worship Satan.

https://www.mansionglobal.com/articles/rothschild-family-sells-large-austrian-hunting-estate-87753

https://money.cnn.com/2018/02/02/investing/stock-market-today-dow/index.html

Feb 2, 2018 news. Black Forest Estate sold and stock market dives 666 points. Coincidence?

Guess what was really ‘hunted’ at that Estate. I’ll give you a hint: “a most dangerous game”.

13. September 2022 at 18:03

https://truthsocial.com/@TheStormHasArrived17/posts/108994131718286452

https://truthsocial.com/@TheStormHasArrived17/posts/108993904273265347

There is ZERO reason to trust the FBI’s targeting of Trump today.

The ‘raid’ is yet another hoax to cover up THEIR corruption.

13. September 2022 at 18:04

I’m sure glad that copernicus didn’t think the earth centered universe was “settled science”.

13. September 2022 at 18:18

Lots of interesting spellings of pseudo-intellectual.

13. September 2022 at 18:30

And Danton ALSO projects his own antisemitism, labeling it a ‘dog whistle’.

Lots of anti-semites in this thread, wow.

13. September 2022 at 18:38

Scott, for playing any role in this thread, my bad. Sorry

13. September 2022 at 18:43

Ricardo,

Indeed, any ‘science’ asserting itself as NOT TO BE QUESTIONED, is not a science at all.

Just happened: The FBI just raided the my pillow guy.

here’s why:

https://truthsocial.com/users/realLizUSA/statuses/108994441881872472

We are living in a weaponized police state, with rigged elections, woke psychos preying on children, corrupt msm which is really nothing but the propaganda arm of the Democrat party, inflation out of control, open borders with drug and human trafficking, a fake President, puppet of China and Ukraine, billions taken from taxpayers struggling to make ends meet to send to most corrupt country in Europe, Ukraine, no oversight/audit, and the entire time, we still have TDS victims asleep at the wheel.

If the Republicans don’t crush the Democrats this election, we may no longer have a country.

13. September 2022 at 19:20

Scott,

Let’s assume (correct or not) that the price of one input has increased permanently for structural reasons, i.e. a shift in a supply curve.

Doesn’t that mathematically (assuming sticky wages/prices) leave you with just two choices.

Make a one time upward shift the NGDGLT line up to accommodate

OR

Give up some real growth.

13. September 2022 at 19:45

Man, I thought you said you were going to remove the blatant cranks from the comments section :\

13. September 2022 at 19:48

Inflation expectations have eased considerably since March. Isn’t that what we should really be focused on?

13. September 2022 at 20:10

I’m not sure what your banning policy is, but if you do ever ban folks, I think George deserves it. Holy cow.

14. September 2022 at 03:23

Boom!

https://justthenews.com/government/congress/capitol-police-whistleblower-memo-lays-out-jan-6-intelligence-failures-pelosi

Booooom!

https://justthenews.com/accountability/russia-and-ukraine-scandals/new-durham-bombshell-fbi-paid-russian-accused-lying

14. September 2022 at 03:53

Over the past 6 years, anything that countered the radical Democrat / MSM propaganda arm narrative was deemed ‘Russian disinformation.’

Pizzagate? Russian disinfo

Election fraud? Russian disinfo

Covid truth? Russian disinfo

Hunter’s laptop? Russian disinfo

Now we’ve learned that THEY were literally paying for Russian disinformation (Danchenko) and using it to push their lies to the world.

Define PROJECTION.

14. September 2022 at 04:03

Hillary Clinton paid a literal Russian spy (Danchenko), to fabricate evidence about Trump, which was then presented by corrupt agents within the FBI, to the FISA court, to justify spying on Donald Trump both as a candidate AND while he was in office.

And then when Trump and America First GOP members like Devin Nunes started looking where the bodies were buried, the FBI hired Danchenko as an informant in an attempt to cover up their activity from congressional oversight and public exposure.

TREASON!

This information was disclosed within the last 24 hours, through court filings, and msm is almost silent, why?, because they’re implicated.

The SOURCE of the fake Russian Dossier was sitting right in DC getting paid by the FBI during all those months when the MSM pretended to take it seriously and never asked the guy any questions.

How many times did the media scum “bump into” Danchenko around town, or go to the same “get Trump” parties?

No way they didn’t know the Steele Dossier source was sitting in DC getting paid that whole time.

The MSM truly is The Enemy Of The People.

And how many people across the country, and world, TRUSTED the false narrative pushed 24/7 by MSM? Site owner, multiple posters here are definitely included.

“The control of information is something the elite always does, particularly in a despotic form of government. Information, knowledge, is power. If you can control information, you can control people.” – Tom Clancy

14. September 2022 at 04:34

Most of the comments (mine included I am sure) demonstrate my hypothesis that few understand economics——-and in particular monetary policy.

One of the premises I have believed since reading this sight is the Fed has the power to alter inflation and NGDP—-and when it does not, it either is choosing not to, or does not fully understand (or understand at all perhaps) what needs to be done. Also, the Phillips curve “worked” for 5 years by accident and then stopped. It is irrelevant.

Rents are sampled monthly —I think_—and the rolling 6 months become the rent input. As Scott says, these have peaked. (well my daughters rent in August held constant!)

Wages?—-I read they rose .3% month over month (4.2%annualized)—-but since they lag—I assume that will drop.

MoM inflation for the last 2 months is very low——of course that is not excluding food and energy——which is just a smoothing mechanism——unless the Fed targets it—-which it says it does. But it is not persuasive on how it deals with know lags.

So inflation is likely falling—-but not fast enough for markets to feel like it will continue fast enough.

And it is entirely Powell’s fault ( or too much of it). The market speaks——they really don’t trust Powell——and why would it?

14. September 2022 at 04:49

I am a bit confused on 1. Are you saying that you can’t have supply side inflationary pressure because NGDP is rising to fast? Cant both happen simultaneously? If auto workers all go on strike during a period where NGDP is rising to fast… it would seems like both things could occur at the same time.

14. September 2022 at 05:03

dtoh, I’m not sure what you are asking. With NGDPLT the point is to allow a bit higher inflation during supply shocks, along with lower real growth.

But no, you don’t want to change your policy because one relative price changed. In that case, it was never the right policy in the first place.

Will and Nicolas, I suppose I’ll eventually have to remove George. But dtoh says he has some good points, so I wouldn’t want to miss any of those. He has FASCINATING theories about a family called the “Rothchilds”

Student, Sure, you can have both at once. But ignore those who say it’s all supply side.

14. September 2022 at 05:10

Scott, excellent post; I really love the graphic. Where you you find these kind of things? I’d love to see an update to it each month as time goes on, but I fear it may never be updated.

As for the stock market plunge yesterday, I saw all of the pundits saying it was because inflation was “higher than expected at 8.3%”. So I did a quick search to see what the “expected” rate was. Sure enough, the consensus expected rate was 8.1%. So 0.2% of inflation above expectations causes a 4% drop in the market? It seems like investors are just a wee bit jumpy to me.

And yes, it’s NGDP, of course. Why is it so hard for the professionals (like Powell) to realize this? I’m just an engineer with no financial training, and it makes perfect sense to me.

14. September 2022 at 05:53

Will and Nicholas have weak, fragile egos, assuming they’re different people that is, lol. Censorship is the recourse of those who can’t tolerate ‘dissent’ from their own ideas and wish to remain in an echo chamber bubble.

Yes indeed I do have some good ideas, as does everyone here. It’s funny, there is zero thought in my mind to censor/ban anyone here. It’s not in my consciousness. I am not afraid of seeing ideas that dissent from my own. That is perhaps one of the biggest differences between people right now, those who seek to destroy other people’s speech for the sake of their own power, and those who seek to defend everyone’s speech to eliminate power for its own sake even if it means to see speech we don’t like.

Perhaps what I am writing is ‘triggering’ some part of the pro-censors who lack confidence in their own minds in not being able to maintain self control over managing what is ultimately information? That there is some recognized absence of mental fortitude that only avoidance and escape are the solutions?

Here’s another good idea: The reason that is thought of is the same dialectic faith logic that also induces epistemic demoralization. That each of us as individuals are too stupid, too cut off from reality, to form mental concepts of truth as it is, that we are to cower and defer like worms to some ‘authority’ driven by what I would call worship of Scientistic Gnosticism, that truth with a capital T is ONLY existent in a historical process of the universe ‘becoming’, with real truth ‘revealing’ itself within the mundane, an alchemy process akin to the belief that gold can spring out of lead, using up human beings and then discarding them along the way.

Lenin invoked a Hegelian logic of ‘accelerating the contradictions’. 100 million killed under communist logic is not ‘wrong’ in the dialectic faith, it’s just history trying to understand itself, using up people and revealing more contradictions that reshape ontological reality, where the faith is that at some point, when death and destruction reach their acme, that the dialectic will do its thing forcing all the ‘contradictions’, all the ‘conflicts’, to melt away, paving the way to Utopia where human beings no longer are ‘imprisoned’ in their bodies nor imprisoned in the world.

If this triggers a reaction of another ‘crazy conspiracy theory’, look closely at this Executive Order Biden just signed:

https://www.whitehouse.gov/briefing-room/presidential-actions/2022/09/12/executive-order-on-advancing-biotechnology-and-biomanufacturing-innovation-for-a-sustainable-safe-and-secure-american-bioeconomy/

They want to literally ‘recode’ human beings. “Socialist man” whose sole purpose is to feed ‘The Eye’ (NWO) is what they want.

14. September 2022 at 06:02

If monetary policy is transmitted with a lag, say, one year (as you just said, services/rent), doesn’t that mean the NGDP growth we see today was largely put in place by monetary policy last year? Likewise, the monetary policy of this year won’t show up until next year, so the current stance of monetary policy cannot really be known until next year, right? It would seem looking at NGDP right now doesn’t actually tell us about the stance of current monetary policy, just that of past monetary policy.

14. September 2022 at 06:10

Scott – when you say inflation is caused by NGDP growth, what do you say to people that argue the causal arrow is the opposite? NGDP growth is caused by inflation (plus real growth)? I’m trying to come up with an easy way to explain this to people.

14. September 2022 at 06:15

Powell thinks N-gDp level targeting is too difficult to communicate to the public. And other market monetarists think a futures market best projects N-gDp targets.

Martin validated the great inflation, the “monetization of time deposits”. So, did Burns and Miller. Volcker never tried monetarism. And then the definition of money was supposed to have changed.

Nothing’s changed in>100 years. “Money” is the measure of liquidity; the yardstick by which the liquidity of all other assets is measured.

Dr. Leland Pritchard (Ph.D. Economics, Chicago 1933); “If the “store of purchasing power” attribute of money, when applied to a given asset, is to have significant meaning, it ought to be defined in terms which are applicable to the whole economy. That is, no asset really has a “monetary store of purchasing power” quality unless there can be a net conversion of that asset into money, ceteris paribus.” – March 1954

It is obvious that the FED doesn’t understand money flows, the volume and velocity of money, or AD. Rates-of-change Δ, in M*Vt = RoC’s Δ in AD, aggregate monetary purchasing power.

Nobel Laureate Dr. Milton Friedman argued that “there is a continuum of assets possessing in various degrees the qualities we attribute to the ideal construct of ‘money’ and hence there is no unique way to draw a line separating ‘money’ from ‘near-moneys’” (1960, p. 90). (or money products from savings’ products).

“Economics calls for the study of abstract constructions at the same time that it requires the observation and analysis of facts” – MAURICE ALLAIS

Rates-of-change in money flows, volume times transactions’ velocity = RoC’s in P*T (where N-gDp is a subset and proxy) – as in American Yale Professor Irving Fisher’s truistic: “The Purchasing Power of Money” (1911)

Fisher also pioneered the *distributed lag* effect of money flows, or “the cumulative effect of earlier actions”. The FED’s Ph.Ds. obviously don’t understand money flows as the FRED database does not encompass a rate-of-change for the distributed lag effects of money, and money flows.

14. September 2022 at 06:41

The transactions concept of money velocity, Vt, has its roots in Irving Fisher’s truistic “equation of exchange”: P*T = M*Vt, where (1) M equals the volume of means-of-payment money; (2) Vt, the transactions’ rate of turnover of this money; (3) T, the volume of transactions units; and (4) P, the average price of all transactions units.

The “econometric” people don’t like the equation because it is impossible to calculate P and T. Presumably therefore the equation lacks validity. Actually, the equation is a truism – to sell 100 bushels of wheat “T”, at $4 a bushel “P” requires the exchange of $400 “M” once, or $200 “Vt” twice, etc.

The real impact of monetary demand on the prices of goods and services requires the analysis of “monetary flows”, and the only valid velocity figure in calculating monetary flows is Vt. Milton Friedman’s income velocity, Vi, is a contrived figure (Vi = Nominal GDP/M). It is a “residual calculation – not a real physical observable and measurable statistic.” The product of M*Vi is obviously N-gDp.

So where does that leave us? in an economic sea without a rudder or an anchor. A rise in N-gDp can be the result of (1) an increased rate of monetary flows M*Vt (which by definition the Keynesians have excluded from their analysis), (2) an increase in R-gDp, (3) an increasing number of housewives selling their labor in the marketplace, etc. The income velocity approach obviously provides no tool by which we can dissect and explain the inflation process.

To the Keynesians, aggregate monetary demand is nominal-GDP, the demand for services (human) and final goods. This concept excludes the commonsense conclusion that the inflation process begins at the beginning (with raw material prices and processing costs at all stages of production) and continues through to the end.

Admittedly the data for Vt are flawed. So are nearly all economic statistics, but that does not preclude us from using them. An educated estimate is better than no estimate at all. For example, we know that the international balance of payments balances – debits equal credits, payments equal receipts, etc. The Department of Commerce statistics do not prove this, so in order to make their statistics balance, they put in an “errors and omission “balance figure. This is the triumph of good theory over inadequate facts.

The Fed first calculated deposit turnover in 1919. It reported weekly until 1941 (like M3, the series was also discontinued, in Sept. 1996). The figure “other banks’’ was used until 1996. Prior to this revision Vt included all banks located in 232 SMSA’s excluding N.Y. City (the national series on velocity rates in the 337 “other” centers, which since 1943 excludes Chicago, Boston, Philadelphia, Detroit, San Francisco, and Los Angeles in addition to New York City). This was the best that could be done to eliminate the influence on prices of purely financial and speculative transactions. Obviously, funds used for short selling do not contribute to a rise in prices. The Fed calculates these velocity figures by dividing the aggregate volume of debits of these banks against their demand deposits.

In calculating the flow of funds (MVt), I am assuming that the Vt figure calculated by the Fed is not only representative all commercial banks in the United States, but that the velocity of currency is the same as for demand deposits. Is this valid? Probably not. But nobody knows.

But we do know that to ignore the aggregate effect of money flows on prices is to ignore the inflation process. And to dismiss the concept of Vt by saying it is meaningless (that people can only spend their income once) is to ignore the fact that Vt is a function of three factors: (1) the number of transactions; (2) the prices of goods and services; (3) the volume of M.

Inflation analysis cannot be limited to the volume of wages and salaries spent. To do so is to overlook the principal “engine” of inflation – which is of course, the volume of credit (new money) created by the Reserve and the commercial banks, plus the expenditure rate (velocity) of these funds. Also overlooked is the effect of the expenditure of the savings of the non-bank public on prices. The M*Vt figure encompasses the total effect of all these monetary flows M*Vt.

In the Federal Register: The usefulness of the FR 2573 data in understanding the behavior of the monetary aggregates has diminished in recent years as the distinction between transaction accounts and savings accounts has become increasingly blurred. Further, the emphasis on monetary aggregates as policy targets has decreased. In addition, respondent participation has declined over the last several years. For these reasons, the Federal Reserve proposes to discontinue the survey and the related statistical release.”

That of course, was complete nonsense. I.e., all the DEMAND DRAFTS drawn on these institutions CLEARED THROUGH DDs, except those drawn on MSBs, interbank, and the U.S. government. (G.6 release, debit & deposit turnover, discontinued Sept. 1996). I.e., financial transactions are not random.

Note that the ROC in bank debits turned negative for the first time during the S&L crisis.

14. September 2022 at 06:47

Remember that in 1978 (when VI rose, but Vt fell) all economist’s forecasts for inflation were drastically wrong. Put into perspective: There were 27 price forecasts by individuals & 9 by econometric models for the year 1978 (Business Week). The lowest (Gary Schilling, White Weld), the highest, (Freund, NY, Stock Exch) & (Sprinkel, Harris Trust & Sav.).

The range CPI, 4.9 – 6.5 percent. For the Econometric models, low (Wharton, U. of Penn) 5.7%; high, 6.6% U. of Ga.). For 1978 inflation based upon the CPI figure was 9.018% [and Leland Prichard, in his Money and Banking class, predicted 9%].

See: G.6 Debits and Deposit Turnover at Commercial Banks

http://bit.ly/2pjr81u

14. September 2022 at 07:36

George the problem is that you are a conspiracy nut. You might be intelligent, but like quit being a troll. Cut out the blame the globalist and pedophile crap. Use your brain man.

14. September 2022 at 07:39

BIG supply chain problems appear to be coming.

Nationwide rail strike:

https://www.dailywire.com/news/railroad-freight-companies-cutting-service-ahead-of-potential-nationwide-strike

https://i.imgur.com/tw7pLSJ.jpg

Significant damage to Panama Canal power system:

https://i.imgur.com/iDFW5LF.jpg

This is what happens when elections are rigged and ‘Regime’ Presidents loyal to globalist communists are in charge.

14. September 2022 at 07:48

I like Daniel’s questions. Without NGDP future contracts, how can the Fed know if their current policy is going raise future NGDP or lower it? Are spreads between TIPS and other bonds good enough of an indicator with an inflation targeting regime?

14. September 2022 at 08:01

Student, the problem is that you are projecting your own conspiracy nuttiness onto those who do not accept MSM conspiracy theories. Did you really believe that following more or less in line with MSM doesn’t make you a ‘conspiracy nut’? The MSM combined with allies in Twitter and Facebook is the largest conspiracy theory pushing propaganda machine in the world, they are intentionally ‘name calling’ everyone who disagrees with them precisely in order to shut people up and assert themselves as authorities over truth.

Cut out the blame on globalists and pedophiles? Why? The proof is already open source! Epstein, Maxwell, Weinstein, … Search DOJ database to see arrests of pedophile rings across the country. It’s GLOBAL. This is REAL.

https://newspunch.com/report-un-pedophiles-rapes/

Just because MSM smears the truth as conspiracy theory and elevates conspiracy theories as truth, it doesn’t make it so. Repeating a false statement many times ‘from all directions’ is precisely how the communists infiltrate nations to destroy them. Same exact pattern happened during Mao’s ‘cultural revolution’.

I know it’s a difficult pill to swallow. We’re all ‘waking up’ from the biggest psychological warfare ever perpetrated on humanity, and those seeking to maintain the ‘Old Guard’ power structure are lashing out at those uncovering THEIR corruption, they’re breaking the law, as we can now see from sources that bypass msm to expose criminal treasonous elements in the FBI and DOJ.

Election System databases were DELETED, against federal law. Rather than go after those who DELETED election evidence the FBI is going after those who PRESERVED election records (Mike Lindell’s phone stolen by FBI yesterday).

I will not bow down to your ‘authority’ over speech, Student, you can try all you want to control what I say and how I say it through childish insults and name calling, or potential lies of ‘I am saying this to help you’, but it’s all just you communicating who you want to be.

I do me. You do you, that should be enough.

14. September 2022 at 08:09

George I control nothing. I am a nobody. Its just that everything you are talking about is bullshit. You are a slave to the nut jobs. Keep reading this blog and blogs like it and you will come to your senses some day.

14. September 2022 at 08:10

George look at all of your links. They are crazy people.

14. September 2022 at 08:17

George there are just as many right wing pedophiles as left wing pedophiles. The problem really is that people have no morals anymore. It’s the thing I love about Christianity… you might argue it and many of us (including me are terrible)… but without morals and justice… everything goes to shit. Look at what’s happening in the Russian attack right now. Their problem is everyone is in it for themselves. They are corrupt and being selfish… that never goes well in the end.

14. September 2022 at 10:49

https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1205&context=masters-theses

Analysis of bank debits as a business cycle indicator 7-1-1963

We knew this already: In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7-year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45-year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Spindt and Barnett were clueless. It should be obvious that the extent of money’s impact on prices and the economy is measured by money flows not the stock of money. If the transactions velocity of money was a constant it would not matter, but money turnover has varied from an annual rate of 13 in 1945 to over 525 in September 1996 (last figure from the G.6 Debit and Demand Deposit Turnover release, then the Fed’s longest standing reported banking statistic).

The G.6 release fell to President Bill Clinton’s “Paperwork Reduction Act of 1995”: From the Federal Register: “The usefulness of the FR 2573 data in understanding the behavior of the monetary aggregates has diminished in recent years as the distinction between transaction accounts and savings accounts has become increasingly blurred”.

The G.6 was discontinued at the same time it was needed (to reflect asset inflation). Bank debits reflect both new & existing residential & commercial real-estate sales/purchases. As such the housing boom/bust would have stuck out like a sore thumb.

The “time bomb”, (which Dr. Leland Prichard foretold), the widespread introduction of ATS, NOW, and MMMF accounts at 1980 year-end — vastly accelerated the transactions velocity of money.

This propelled N-gNp to 19.2% in the 1st qtr 1981, the FFR to 22%, and AAA Corporates to 15.49%. My prediction for AAA corporate yields for 1981 was 15.48%. You can ask James Sinclair, whose father started the OTC stock market.

14. September 2022 at 11:17

If the goal is to “keep it symmetrical” should the Fed go back to treating FAIT as symmetric and eventually put us back on the 2% price level path? If not, is the symmetry goal only forward looking?

14. September 2022 at 11:26

Student,

According to my research, there are more ‘left’ pedos than ‘right’ pedos, because it just so happens that the evil cult had chosen the Democrat Party as the main party to infiltrate. Why? Because the Republican Party STARTED in 1870s as an anti-slavery party, and has always been ‘maga’ in its core logic, before it too was infiltrated with ‘RINOs’, so the R’s were inconsistent with what the foreign adversaries intended and the D’s were consistent.

History could have been the other way had the NAMES been different. But it is what it is.

The Democrat Party formed the KKK. The party formed the confederate states to fight against the ending of slavery. The party voted against giving freed slaves citizenship. These are historical facts which were smothered with so much dialectic projection from the same msm propaganda arm of the D party that millions still falsely believe the Republican Party did all those things, and that R’s are ‘racist’ while D’s are ‘anti-racist’. The truth is the reverse of the ‘regime’ narrative.

I want to emphasize that the global evil the world is fighting back against goes beyond race, religion, and political party affiliation. I don’t judge anyone by race, sex, class, or party affiliation. The ‘left’ vs ‘right’ as ‘opposites’ dynamic is itself a manufactured division from the same dialectic of opposites logic that has directed implementations from the ‘left’ since Hegel.

Infiltration not Invasion.

I look at the world now as Unity vs. Division. Many analogues to this:

Good vs. Evil.

Children of light vs. Children of dark.

Patriots vs. Wokecoms.

Those who view the world and all of humanity as from the SAME SOURCE where our lives are a gift from that same source vs. Those who view the world and all of humanity as a place of exile, division and ontological slavery where our lives are a prison by virtue of us not experiencing life AS an eternal one source of it all.

To your point about Christianity, I think the teachings of Jesus are not only still relevant today, but perhaps one of the best sources of information on what is happening in the world today and a path forward to freedom from the same ideological demonic cult that Jesus revolted against.

The ‘ancient’ cult that worshiped Moloch still exists today, and one form it is taking today is the mass murder of babies (Planned Parenthood), primarily black babies (population control/eugenics). This cult is global, and they actually believe that they are Gods (Hegel saw his mind as the mind of God, the left has been trying to become Gods ever since), that the orthodox God in Judaism, Christianity and Islam, is to be defeated, and they actually believe they can defeat God by harming and destroying everything ‘close to God’, such as children.

That’s why there is a global pedophile cult.

The ‘elite’, including Bill Clinton, and many on the Epstein flight logs WHO FLEW TO EPSTEIN ISLAND, engaged in Satanic ritual rapes and murders of kidnapped children from vulnerable countries like Haiti and Dominican Republic, of which Hillary Clinton and her cabal KIDNAPPED AND PROVIDED as the objects to harm to ‘punish the God that exiled them to the Earth prison’.

There have been Satanic bloodlines working in the shadows for at least 2000 years. The ‘Synagogue of Satan’. I wrote that I do not view the Rothschild cult as Jews, but as Satanists. Revelation 2:9. Nobody who rejects God and worships Satan can honestly call themselves a Jew, a Christian or a Muslim.

Call me any name, smear me with any insult, I don’t care. The patterns are noticeable and overt.

https://i.imgur.com/Ld1Hga6.jpg

https://i.imgur.com/m2GlOhx.jpg

https://i.imgur.com/lkw0Ltp.jpg

14. September 2022 at 11:29

Student,

“George look at all of your links. They are crazy people”

Look at your response, attacking the messenger not the message.

“George I control nothing. I am a nobody. Its just that everything you are talking about is bullshit. You are a slave to the nut jobs. Keep reading this blog and blogs like it and you will come to your senses some day.”

You haven’t SHOWN how anything you’re asserting here is correct, you’re just repeating the same triggered reaction of ‘reeeeeee’ as a substitute to that which you can’t refute.

YOU are a ‘slave’ projecting your own self induced slavery onto me.

14. September 2022 at 11:30

Velocity: Money’s Second Dimension – By. Bryon Higgins

“Money has a ‘second dimension’’, namely, velocity . . .. ” Arthur F. Burns in Congressional Testimony.

“Quantity leads and velocity follows” Cit. Dying of Money -By Jens O. Parsson

14. September 2022 at 11:31

Lizard, TIPS spreads are better than nothing, but they need additional indicators.

Effem, Unfortunately, it’s now too late–the damage has been done. They needed to commit to symmetric FAIT back in 2021. Doing so now would cause a depression.

14. September 2022 at 11:37

Vi is a “residual calculation – not a real physical observable and measurable statistic.” Income velocity may be a “fudge factor,” but the transactions velocity of circulation is a tangible figure.

I.e., income velocity, Vi, is endogenously derived and therefore contrived (N-gDp divided by M) whereas Vt, the transactions’ velocity of circulation, is an “independent” exogenous force acting on prices.

Money demand is viewed as a function of its opportunity cost-the foregone interest income of holding lower-yielding money balances (a liquidity preference curve). As this cost of holding money falls, the demand for money rises (and velocity decreases).

As Dr. Philip George says: “The velocity of money is a function of interest rates”

As Dr. Philip George puts it: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits.”

14. September 2022 at 11:45

You measure N-gDp using money flows. The money stock used to be measured with a one-week lag. And Powell removed deposit classifications.

I used monetarism to predict the 4th qtr. 2008 crash. I predicted the bottom in March 2009. I predicted the bottom in Oct 2002. I denigrated Nassim Nicholas Taleb’s “Black Swan” theory (unforeseeaable event), 6 months in advance and within one day.

I predicted both the flash crash in stocks on May 6, 2010 and the flash crash in bonds on October 15, 2015.

The Stock Market Was Rocked by a Mysterious ‘Flash Crash’ Five Years Ago. What You Need to Know. | Barron’s

“Diminishing market depth and a surge in volatility were both on display Oct. 15, when Treasuries experienced the biggest yield fluctuations in a quarter century in the absence of any concrete news. The swings were so unusual that officials from the New York Fed met the next day to try and figure out what actually happened”

Link: “Diminished Liquidity in Treasury Market” or:

https://acrossthecurve.com/?p=19499

“(Bloomberg) — Trading Treasuries keeps getting tougher and tougher.

For decades, the $12.5 trillion market for U.S. government debt was renowned for its “depth,” Wall Street’s way of talking about a market’s ability to handle large trades without big moves in prices. But lately, that resiliency has practically vanished — and that’s a big worry.”

14. September 2022 at 17:44

https://thefederalist.com/2022/09/14/the-fbi-paid-for-russian-disinformation-to-frame-trump-and-7-other-takeaways-from-durhams-latest-court-filing/

15. September 2022 at 05:32

Inflation is broad based. Demand is outstripping supply. The surge in the money stock is unparalleled in U.S. history. AD is incalculable. Not only is the roc in money flows historic, but at the same time, so is money demand. So, stagflation will be with us for a long time.

Larry Summers doesn’t know what secular stagnation is. It is not an imbalance between savings and investments. The increase in the supply of loanable funds was driven by the FED – in response to the impoundment of savings in the payment’s system.

I.e., an increase in bank-held savings shrinks gDp. It’s stock vs. flow (as predicted by Dr. Leland J. Pritchard, Ph.D. Economics Chicago 1933). See: “Should Commercial banks accept savings deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43.

15. September 2022 at 06:12

https://www.nbcnews.com/tech/internet/satanic-panic-making-comeback-fueled-qanon-believers-gop-influencers-rcna38795

Panicking Satanists PROJECTING their own panic, dialectically adding a ‘negating’ narrative that exposure of THEIR panic is somehow itself an unjust conspiratorial ‘panic’.

Winning!

15. September 2022 at 07:32

Question. If there is “asymmetric price transmission”, where the supply of inelastic prices is suppressed by artificially by administered prices (oil prices), then do the price of other goods and services demanded, rise?

15. September 2022 at 07:59

Great post Scott.

There has been a lot of supply shocks in the last year. It’s very helpful to see evidence that nominal demand still matters, even when it’s hard to see through all the supply side noise.

I was so happy when JP announced FAIT. I really thought it would reduce the damage done to so many people by the business cycle. Now it’s clear that he has actually done lasting harm by declaring a regime that he didn’t really believe. Very disappointing and sad.

BTW: George is nuts. It’s almost funny, but mostly disturbing.

15. September 2022 at 08:19

The GFC was the result of a contractive monetary policy blunder, a deflation. This cycle is different. As Nobel Laureate Dr. Milton Friedman said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it cannot occur without a more rapid increase in the quantity of money than in OUTPUT.” The surge in the money stock, yet another monetary policy blunder, was unparalleled.

The economy is on artificial life support. The suppression of inelastic oil prices, the administered prices, boosts N-gDp. Is that what the FED wants?

15. September 2022 at 13:51

Scott, I understand your point that symmetry needs to be a goal up-front. But doesn’t this create a very odd construct? Let me explain…

In a perfect world we don’t deviate much from our target (be it inflation or NGDP). But in the real world I’m pretty sure we will. I think what you’re saying is we should apply a symmetry rule to small deviations but not to large ones (as we have now). So doesn’t that mean that in practice even a symmetric framework is actually asymmetric? It just becomes a question of how often large deviations come around.

Also, would you apply the same rule in reverse? Meaning, apply a symmetry rule to small undershoots, but not large ones?

For as long as we’ve all talked about what’s optimal it still seems hard to pin down the actual framework.

15. September 2022 at 14:06

https://www.thegatewaypundit.com/2022/09/2000mules-texas-style-newly-discovered-police-body-cam-footage-implicates-tarrant-co-texas-democrat-officials-ballot-harvesting/

bUt ElEcTiOn fRaUd iS a cOnSpiRAcY tHeOrY

15. September 2022 at 20:06

bb, Perhaps I’m behind the George comments, faking them to make Trumpistas look bad?

Effem, You said:

“I think what you’re saying is we should apply a symmetry rule to small deviations but not to large ones (as we have now).”

No, no, 1000 times no. It needs to apply to ALL deviations. I was making a different point. The Fed should not announce seemingly symmetrical policy, then say it’s asymmetrical, and then say it’s symmetrical. Once they announced it was asymmetrical it became too late to go back to symmetrical. It’s the policy that needs fixing, not the tactics. Get the policy right and be consistent and then the tactics will be easy.

15. September 2022 at 21:37

You said committing to FAIT now would cause a depression. Can you explain why? I’m trying to learn and understand your material better. What should the fed do at this point if they’re not going to come out next meeting to announce ngdp targeting? I assume something like 100 bps increase and stronger language to bring inflation down?

As you pointed out, the data lags, sometimes by awhile, so prices could have already peaked.

16. September 2022 at 02:22

“Under this process, the Fed enters the market to buy securities, typically mortgage-backed securities (MBS) and Treasuries, injecting both capital and liquidity into the market. …

As of August 3, the Fed’s assets stood at $8.9 trillion.

from “Tracker: The Federal Reserve’s Balance Sheet Assets” (www. americanactionforum. org/ insight/ tracker-the-federal-reserves-balance-sheet/#ixzz7cUz9cqCE)

Just prior to the onset of the Financial Crisis of 2008-2009, the balance sheet of the FRB stood at $995B. In the last 14 years, the FRB increased M1 by $8T, in particular by buying MBS. Further, the FOMC kept interest rates at historically low levels for more than a decade. Between excessive injections of cash and low interest rates, the wealth gap that so many bemoan was enabled by the FRB and its complicit supporters in the political class. It is worthy of note the FRB purchased MBS, the securities that caused the FC ’08/’09 (with others), thereby juicing a housing market already benefitting from extraordinarily low rates. Washington, D.C., was busily laying the foundation for the inflation that afflicts the USA, and the world today.

All it took were the excesses of the COVID-19 pandemic and the Biden administration to tip it all over the edge.

“As a result of the stock market crash and global economic collapse caused by the covid pandemic in early 2020, the Fed aggressively increased the money supply by nearly 40%, more than double the money supply increases in prior recessions…”

from “What Causes The Recurring Boom And Bust Business Cycle?” (seekingalpha. com/ article/ 4519904-investors-can-profit-from-the-coming-recession)

Since quantitative easing stopped earlier this year, the FRB is now engaged in quantitative tightening, or reducing the money supply by selling securities from its balance sheet. Among other problems, the FRB is not pursuing QT with the same vigor it pursued QE.

A major, and rarely discussed, cause of the steadily growing “wealth gap” is the unrelenting decline in the velocity of money (“Velocity Of Money – Charts Updated Through April 28, 2022” at www. economicgreenfield. com/ 2022/04/28/ velocity-of-money-charts-updated-through-april-28-2022/; “Velocity of Money” at www. thebalance. com/ velocity-of-money-3306130, “Velocity of Money Chart”).

When money circulates it improves circumstances for everyone who (temporarily) holds it, enabling spending, investment, and saving. When the circulation of money slows, more are left out and suffer

more.

The steadily declining rate in the velocity of money means a new dollar goes through the economy ever faster, eventually ending up in the wealth hoards of the very rich. With quantitative easing and extraordinarily low interest rates for far too long (over a decade), the FOMC and the Federal Reserve Bank claimed to be “providing liquidity” for markets that benefitted the wealthy (bond investments…) at the expense of the middle class and the poor. If there was a bona fide liquidity problem, it was because the very people the FOMC helped were hoarding the latest tranche of new (further devalued) money.

If there ever was a “liquidity crisis” requiring FRB intervention, these charts of the precipitous decline in the velocity of M1 and M2 explain it quite well – over the past 14 years, a “new dollar” almost ceased to circulate. Therein lies the explanation… we have experienced considerable business consolidation with fewer and fewer suppliers even as we hugely increased the number of dollars. That is the classic explanation for inflation, too many dollars chasing too few goods and services. We are in a supply-caused and government-caused inflationary environment as all that has been done since the FC ’08/’09 has reduced the number of suppliers, ballooned the money supply, and boosted some segments of economy (housing…) while completing neglecting others (semiconductors, energy, infrastructure…).

The 21st century is a hot mess and did not have to be this way. Between the low quality of our elected leaders, and the incompetence of bureaucrats, the many problems we face were caused because all those people made campaign promises they, and their voters did not understand; and they pursued grand goals of “fixing” things that cannot be fixed and are best left to their own devices to sort themselves out.

16. September 2022 at 04:21

If you want to know how to stop inflation, look no further than Bernanke. Bankrupt-u-Bernanke drained required reserves for 29 contiguous months.

The 2-year rate-of-change, RoC in M*Vt (which the FED can control – i.e., the RoC in N-gDp), peaked in the 2nd qtr. of 2006 @ 12%. Bernanke let it fall to 8% by the 4th qtr. of 2007 (or by 33%). N-gDp fell to 6% in the 3rd qtr. of 2008 (another 25%). N-gDp then plummeted to a -2% in the 2nd qtr. of 2009 (another – 133%). That’s what created the cry, epitomized by Scott Sumner, for targeting N-gDp.

16. September 2022 at 04:44

https://i.imgur.com/WSTrw3C.jpg

bb: “George is nuts”

When you can’t attack the message, attack the messenger.

16. September 2022 at 04:59

https://justthenews.com/government/congress/multiple-whistleblowers-come-forward-about-jan-6-intel-failures-capitol

The FBI and Democrat Party WANTED there to be ‘events’ on Jan 6, to use as the material means to persecute MAGA.

16. September 2022 at 05:12

Lending by the banks is inflationary. Lending by the nonbanks is noninflationary, other things equal.

The correct response to stagflation is the 1966 Interest Rate Adjustment Act. “while the aggregate of time and demand deposits continued to increase after July, the proportion of time to demand deposits diminished. Whereas time deposits were 105 percent of demand deposits in July, by the end of the year, the proportion had fallen to 98 percent. These were all desirable developments.” – L.J.P.

I.e., you drain the money stock, while increasing the transaction’s velocity of funds.

16. September 2022 at 05:22

https://i.imgur.com/4dZMB0m.jpg

DeSantis is a genius. With just 50 illegals, he exposed the ENTIRE ‘Wokecom’ ideology as one gigantic hypocrisy.

And after decades of using immigrants as political pawns in a game of power, by ‘importing votes’ (Radical Democrats also pushing to permit illegal immigrants to be allowed to VOTE, gee wonder why), they and Fake News MSM are psychologically projecting their own ideology towards immigrants as political pawns onto DeSantis.

16. September 2022 at 05:24

Spencer: “Lending by banks is inflationary”

Not if the loan is 100% backed by prior DEPOSIT of money. Only if the loan is ‘ex nihilo’ (fractional reserve) would such a loan exert ‘inflationary’ pressure on prices.

16. September 2022 at 05:47

The U.S. dollar is in a self-reinforcing upward spiral. Export countries are selling Treasuries to defend their exchange rates, adding to supply, and the E-$ is contracting, removing demand.

George: Open market operations should be divided into 2 separate classes:

(#1) purchases from, and sales to: member commercial banks;

(#2) purchases from, and sales to: “other non-bank entities”:

(#1) OMO transactions of the buying type between the FRB-NY’s “trading desk” (the Central bank) and the member commercial banks directly affect the interbank demand deposit volumes in one of the 12 District Reserve banks without bringing about any change in the money stock.

The “trading desk” credits the master account of the clearing bank used by the primary dealer from whom the security is purchased. This alteration in the assets of the commercial banks (the banks’ IBDDs), increases – by exactly the amount the PD’s portfolios (or acting as dealer agents, NB’s portfolios), of Treasury and coupon securities was decreased.

(#2) Purchases and sales between the Reserve banks and non-bank investors directly affect both bank reserves (inside money) and the money stock (outside money).

16. September 2022 at 06:02

Ok good clarification Scott. Symmetric NGDPLT with no exceptions. Makes sense.

16. September 2022 at 06:49

Spencer,

The dichotomy between ‘inside money’ and ‘outside money’ can risk obscuring the fact that every ‘purchase’ made by the central bank, wherever the money goes to ANY entity outside its own central bank self, is an introduction of new money into the world.

This new money isn’t meant to be held in perpetuity, it’s designed to ‘back’ fractional reserve type of inflation from FRB banks. Since a continuous increase in FRB would eventually bankrupt any bank as it could not fund its own expenses or meet withdrawal requests, it’s the central bank ‘crediting’ entities outside itself that drives the whole inflationary process.

As it stands now, the central bank only gifts ‘member banks’ (harkens to the concept of ‘made’ men in the mafia) with new money created ex nihilo. Since prices and wages rise with a lag, the central banking plus member bank system continually extracts purchasing power from the public who are prohibited legally from producing their own money to pay taxes or buy food or pay rent/mortgage.

Fun fact: The Federal Reserve (and the IRS) is a private entity that sits on its own patch of land immune from US laws, with an information firewall dividing itself from the public (& congress). The Rothschild cult owns and controls all central banks worldwide, including the Fed.

https://i.imgur.com/awElGic.jpg

——————————-

Gavin Newsom is begging the DOJ to ‘explore kidnapping charges’ against DeSantis for flying 50 illegal immigrants to Martha’s Vineyard. There has been more media coverage of this over the last 24 hours than during the entire Trump and Biden admins where MILLIONS flooded the country illegally at the southern border.

I wonder if Newsom asked the DOJ to ‘explore kidnapping charges’ against the Biden regime?

https://nypost.com/2021/10/18/biden-secretly-flying-underage-migrants-into-ny-in-dead-of-night/

16. September 2022 at 07:27

[…] América EconomíaThe International Monetary Fund. What Is That Again? – Brian DomitrovicWe’ll Be Paying For This Fed Mistake For Years – Scott SumnerFive Questions for Fed Chair Jerome Powell – Thomas L. Hogan The Planet […]

16. September 2022 at 11:19

re: “it’s the central bank ‘crediting’ entities outside itself that drives the whole inflationary process.”

Powell monetized the fiscal helicopter drops. And “base” velocity (clearing balance velocity) is higher than ever. In the month June 2022, 17,387,933 million Fedwire transfers totaling $90.662,186 trillion[ii] were processed.

Likewise, from a system’s perspective, commercial banks (DFIs), as contrasted to financial intermediaries (non-banks, NBFIs): never loan out, & can’t loan out, existing deposits (saved or otherwise) including existing transaction deposits, or time “savings” deposits, or the owner’s equity, or any liability item.

When DFIs grant loans to, or purchase securities from, the non-bank public, they acquire title to earning assets by initially, the simultaneous creation of an equal volume of new money (demand deposits) – somewhere in the payment’s system. I.e., commercial bank deposits are the result of lending, not the other way around.

The non-bank public includes every institution (including shadow-banks), the U.S. Treasury, the U.S. Government, State, & other Governmental Jurisdictions, & every person, etc., except the commercial & the Reserve banks.

I prefer Trumps immigration policies to Biden’s. There is a persistent short-fall in residential housing driving up rent inflation.

16. September 2022 at 11:36

Stephen, Doing 100 basis points might be a good idea.

17. September 2022 at 07:07

Interest is the price of credit. The price of money is the reciprocal of the price level. The money stock can never be properly managed by any attempt to control the cost of credit.

We should have learned the falsity of that assumption in the Dec. 1941-Mar. 1951 period. That was what the Treas. – Fed. Res. Accord of Mar. 1951 was all about.

17. September 2022 at 07:12

Unlike what George Santayana said: “Those who fail to learn from history are doomed to repeat it”. In the area of economics, it is more accurate to say that those who believe economic history reveals eternal truths are doomed to error.

Volcker’s period and Powell’s period are entirely different. Today’s banks are thought of as intermediary financial institutions.

17. September 2022 at 07:19

Obama’s ‘personality cult’:

https://www.westernjournal.com/floyd-brown-obamas-enemies-list-general-michael-flynn/

FBI broke security laws:

https://www.washingtontimes.com/news/2022/sep/12/fbi-probing-allegations-top-officials-broke-securi/

FBI was literally paying and protecting (“sources and methods” information firewall) a Russian Spy who LIED to the FBI to ‘get Trump’:

https://justthenews.com/accountability/russia-and-ukraine-scandals/new-durham-bombshell-fbi-paid-russian-accused-lying

17. September 2022 at 07:20

“In late May, the Congressional Budget Office (CBO) projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion and summing to $8.1 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.”

https://www.pgpf.org/analysis/2022/07/higher-interest-rates-will-raise-interest-costs-on-the-national-debt

Houston, we have a problem. Is CBDC the solution?

17. September 2022 at 07:23

FBI/DOJ SUBMITTED A FORGED DOCUMENT IN COURT to ‘get Trump’:

https://apnews.com/article/florida-donald-trump-mar-a-lago-government-and-politics-66882a678d6f7d3b1d9abe019575092d

AFL sues National Archives for illegally concealing Biden’s documents from the public, the archive’s pathetically dishonest excuse “there is no widespread and exceptional media interest in these matters”:

https://www.aflegal.org/news/america-first-legal-sues-national-archives-for-illegally-concealing-federal-records-related-to-the-biden-family-corruption-scandal

17. September 2022 at 07:25

FAKE POLLS (“Suppression polls” designed to discourage voters who do not vote Democrat)

https://www.breitbart.com/midterm-election/2022/09/12/persistent-unaddressed-biases-nyt-data-shows-pollsters-overestimating-democrat-candidates/

18. September 2022 at 03:41

Can’t wait for October’s Diary of Consumer Payment Choice (DCPC)

18. September 2022 at 04:40

Monetarism is about the money stock, not interest rates. Banks aren’t intermediaries. If the commercial bankers are given the sovereign right to create legal tender, then the DFIs must be severely circumscribed in the management of both their assets and their liabilities – or made quasi-gov’t institutions.

Hiking administered rates reduces R-gDp more so than inflation. And this time is different from Volcker’s period. “In 1982, however, this long-run upswing (in v) was abruptly reversed; over the six quarters from the last quarter of 1981 to the first quarter of 1983 velocity declined at an average annual rate of 4.8 percent, a phenomenon unprecedented since the Great Depression.”

https://www.frbsf.org/economic-research/wp-content/uploads/sites/4/el85-23.pdf

If the FED pivots, it will accelerate inflation more than R-gDp. We are stuck with stagflation.

18. September 2022 at 07:08

https://www.mercatus.org/publications/monetary-policy/central-banks-are-inflation-creators-not-inflation-fighters

“Milton Friedman mockingly retorted that “whatever may be true about the economy, the propensity of economists to appeal to a change in our economic structure whenever they are puzzled works quite the way that it used to.” He similarly noted that medicine that had been given to treat this illness worked exactly the way that an economist would expect. The problem was not that the illness was new, but rather than the patient had been given the wrong medicine.”

“A prime example of the importance of counterfactuals is the concept of a monetary policy offset. This idea has been made popular in recent years by economist Scott Sumner.”

It’s stock vs. flow. Money matters. Velocity matters more.

https://fraser.stlouisfed.org/files/docs/meltzer/gardep1959.pdf

Professor emeritus Leland James Pritchard (Ph.D., Chicago Economics 1933, M.S. Statistics) never minced his words, and in May 1980 pontificated that:

“The Depository Institutions Monetary Control Act will have a pronounced effect in reducing money velocity”.

18. September 2022 at 07:22

So, one of the things impacting velocity is the growth of large time deposits:

https://www.richmondfed.org/-/media/richmondfedorg/publications/research/economic_review/1978/pdf/er640202.pdf

See the 1yr trend in large time deposits:

https://fred.stlouisfed.org/series/LTDACBM027NBOG

18. September 2022 at 12:22

It’s the Spencer and George show!

19. September 2022 at 02:11

In equilibrium {and assuming no involuntary unemployment}:

W/P = [1 – aΠ – {(pm.M) / P.Y}].Y/L

Where: W/P = real product wage: pm = price of raw materials: M = amount of raw materials.

An increase in pm will lead to a fall in the demand for labour and the equilibrium real product wage. This will shift the AS schedule to the left. With unchanged AD there will be an excess demand for Y. This will stimulate an inflationary process. Hence, the Fed, is using monetary policy to try eliminate the excess demand. ?

The equation is from: P. 300: Sargent, J.R. 2004. To Full Employment: The Keynesian Experience and After.

19. September 2022 at 02:18

“This paper has suggested a simple model that can account for the key anomalies of the traditional monetary approach. It disaggregates the quantity of credit into a ‘real’ and a financial circulation. In time periods, when the ratio of credit in the financial circulation to credit in the real circulation rises, the simple quantity theory must be expected to disappoint, as it is a special case of the more general quantity theorem of disaggregated credit. In such time periods, a financial boom is likely, as asset prices are driven up by speculative borrowing on the back of collateralised assets. This explains why the traditional monetary quantity theory was not popular in the 1920s and 1930s, and again in the late 1980s and early 1990s. Then the traditionally defined velocity of money declines and excess credit creation can ‘spill over’ as foreign investment. However, during time periods such as the 1950s, when in many countries credit was mainly channeled into the real economy, asset prices remained stable and the traditional quantity theory could be expected to hold. The fact that the model can account for the major anomalies observed in many countries over many time periods demonstrates generality and robustness.

The empirical results for the Japanese case have been unambiguously supportive. The Japanese asset bubble of the 1980s was due to excess credit creation by banks for speculative purposes, largely in the real estate market. The apparent velocity decline is shown to be due to a rise in credit money employed for financial transactions, while the correctly defined velocity of the real circulation is found to be very stable“

https://eprints.soton.ac.uk/36569/1/KK_97_Disaggregated_Credit.pdf

19. September 2022 at 04:32

Hey it’s the ‘address the messenger not the message’ show.

At the same time FBI was smearing by hoax ‘investigations’ that “Trump” was colluding with Russia, the FBI were themselves PAYING A RUSSIAN SPY TO LIE ABOUT TRUMP TO THE FBI.

When in Jan 2017 Igor Danchenko told the FBI the dossier was bunk, THE FBI THEN PAID HIM AND PROTECTED HIM BEHIND A ‘SOURCES AND METHODS’ FIREWALL AWAY FROM THE PUBLIC AND FROM CONGRESS.

And during this time, site owner was writing to the public “There is more than enough evidence to impeach Trump for collusion”.

See how the dialectic faith operating system of the radical left IMPLEMENTS A DIVIDED COLLECTION OF BELIEFS OF WHAT IS ‘TRUTH’ IN THE PUBLIC?

19. September 2022 at 06:07

re: “The apparent velocity decline is shown to be due to a rise in credit money employed for financial transactions”

Financial transactions are not random.

19. September 2022 at 06:18

See: William G. Bretz “Juncture recognition in the stock market” Published January 1, 1972

19. September 2022 at 08:37

https://www.theepochtimes.com/trump-says-the-fbi-colluded-with-russia_4738075.html

For those of us who figured this out early in, it has been a lonely & frustrating road. The truth never had anything to do with liking or not liking Trump – but those were the only two positions allowed by the Op Mockingbird logic of the propaganda arm of the D party (MSM) and thus all the minds trusting of it as well.

Many media pundits, many of whom were USED AS SOURCES on this site, were happy to go along with painfully false narratives to the detriment of the people of the country. Today they continue to smear/attack people for standing up for the truth, be it by name calling “Truthista”, excuse me “Trumpista”, or, attacking the messenger in any other way all to give an excuse not to engage the message.

Elements within the FBI have been PROVED to have colluded with Russian National spies to take down a political opponent of the Democrat Party.

Court filings are the SOURCE of these truths, NOT, contrary to the personality cultists so jealous of their personality cult, merely blindly following the statements of “Trump”.

Good guys KNEW about the hoax being PROJECTED onto Trump, and set a trap.

——–

Former President Donald Trump on Saturday reversed a long-held Democrat narrative by saying it was the FBI that colluded with Russia—not him.

For years, Trump has categorically denied the Russian collusion narrative. Several investigations, including one carried out by former special counsel Robert Mueller, found no evidence Trump colluded with Moscow to win the 2016 election, although those notions have persisted in mainstream media outlets.

On Saturday during a rally in Ohio to support GOP candidates, Trump made note of special counsel John Durham’s investigation into the federal government’s Russia investigation. Last week, Durham’s team issued a court filing that said Igor Danchenko, the alleged principal source of the “Steele dossier” that targeted Trump, was later made a paid FBI informant.

Danchenko, a Russia analyst, is facing five charges of lying to the FBI. He has pleaded not guilty to the charges.

“I think that sounds like a slightly Russian name,” Trump said during the event. “The foreign national fabricated some of the most ridiculous smears and lies in the phony Steele dossier. It was all phony.

He added: “How would you like to be me and go home and explain that one to my wife (Melania Trump)? Darling, it wasn’t true. I swear it wasn’t … it was all phony.”

The 45th president then asserted that the allegations that were pushed in the dossier, a series of notes pushed by former UK spy Christopher Steele, were made up by Democrats who were “working with a paid informant of the FBI.” Steele compiled the dossier while being paid by Hillary Clinton’s 2016 presidential campaign and the Democratic National Committee.

“Man, what a country we have,” Trump also told the rally-goers. “We’ve got to fix our country. It’s so sad.”

According to a recent court filing, Danchenko was made a paid FBI confidential informant in March 2017 and remained as such until October 2020. The FBI declined to comment, referring The Epoch Times to the Department of Justice. The department did not respond to a query.

In 2016, Danchenko was paid by Steele to collect information on Trump, who was then a presidential candidate, and Steele was in turn hired by opposition research firm Fusion GPS. Fusion GPS, meanwhile, was being paid by the Democratic National Committee and Clinton, who was then the opponent of Trump.

Prosecutors have said Danchenko lied about key details, including falsely saying he did not get information from Dolan for the dossier.

Danchenko, a Russian-born national who lives in the United States, is scheduled to be tried in October.

Earlier this month, his lawyers filed a motion to dismiss charges (pdf) and argued Durham’s prosecution is “a case of extraordinary government overreach.”

“Danchenko sat through numerous voluntary FBI interviews and provided hours of truthful information to the government,” Danchenko’s attorneys said, adding that he had “no role” in the “drafting of the” Steele dossier and had “no knowledge of their existence.”

“Indeed, Mr. Danchenko did not even know what specific project [Steele] was working on when he began to solicit Mr. Danchenko for information about Trump and his connections to Russia. Mr. Danchenko was also unaware of how many other sources had contributed to the creation of the Reports,” the filing stated.

The Epoch Times has contacted the FBI for comment.

Trump made the remarks Saturday while campaigning for Republican Senate candidate J.D. Vance in Youngstown, Ohio.

Zachary Stieber contributed to this report.

19. September 2022 at 08:50

Within days of Trump reposting a meme of himself with a Q lapel pin and WWG1WGA string of characters, and playing songs titled “I am Q” and “WWG1WGA” at his latest two rallies, all of which msm picked up on and made sure to write ‘concerned’ articles about it, look at what the Pentagon just PUBLICLY announced they’re doing:

https://justthenews.com/government/security/pentagon-audit-psychological-operations-after-social-media-account-takedowns

“Coincidence” I’m sure, lol

19. September 2022 at 09:30

George, Trump is an OG, while right on some issues, he’s unfit for presidency.

Postkey: Explain why Vi falls while Vt increases.

20. September 2022 at 06:59

Stupid is as stupid does. Vi, the income velocity of funds, falls (reflecting money demand) while Vt accelerates, the transaction’s velocity of funds (reflecting an increase in money flows). Vt was used in American Yale Professor Irving Fisher’s truistic “equation of exchange”. N-gDp is a subset of money flows.

It’s exactly as Lawrence K. Roos, Past President, Federal Reserve Bank of St. Louis and past member of the FOMC (the policy arm of the Fed) as cited in the WSJ April 10, 1986:

“…I do not believe that the control of money growth ever became the primary priority of the Fed. I think that there was always and still is, a preoccupation with stabilization of interest rates”.

Not so liberated, Chairman Paul Volcker, in a 1982 WSJ article was quoted as saying that he “believes in principle the Fed should pay interest on reserves held against deposits on rounds of equity” and “as a matter of principle favors payment of interest on all reserve balances”.

” as income velocity that cannot but impress anyone who works extensively with monetary data” (Friedman, 1956, p. 21).

Or (WSJ, Sept. 1, 1983)

Friedman bastardized the equation of exchange that he had printed on his car license plate. The transactions’ velocity of money has sometimes moved in the opposite direction as income velocity, as in 1974-1975 or 1978.

re: “the ‘mystery of the missing money’ (Goldfeld et al., 1976).

The transactions velocity of money was a statistical stepchild. I.e., virtually all the demand drafts that were drawn on DFIs, the CUs, S&Ls, etc., cleared through DDs – except those drawn on MSBs, interbank & the U.S. government. That is all “new payment methods” clear through transactions’ deposits.

20. September 2022 at 07:04

We have Karl Marx’s rentier capitalism. Why do you think murder rates are rising? Social behavior is pre-programmed.

George Bailey’s “Its a Wonderful Life” was derived by putting savings back to work, where velocity was 2/3 and money was 1/3. The banksters seeking to gain a larger portion of the loan pie, drove up Reg. Q ceilings, inducing nonbank disintermediation. The economic engine is now being run in reverse.

“The 30-year Bankrate.com mortgage rate has more than double since last summer, spiking by 3.32%. Far more than the corporate bond index yield (which moved 3.14% higher) or the 10-year treasury yield which is “only” 2.25% more than it was. This is a reasonable comparison, given all three of these have similar duration.”

20. September 2022 at 10:31

Spencer:

“Unfit for Presidency” : Why? What source information leads to that conclusion?

No fake news sources whose mission is to ‘Get Trump’ and protect the Democrat Party, please and thanks!

——————

pro-life rally yesterday in Pennsylvania (5,500 people)

https://i.imgur.com/QXO8NPE.png

pro-abortion rally today in Pennsylvania (50 people)

https://i.imgur.com/45oxPDi.jpg

Remember when a poster here claimed (likely used fake news sources as source) wrote that ‘most people, in the developed world at least, are pro abortion’ ?)

Turns out that a LOT of what we have been victimized by op mockingbird fake news narrative as allegedly being ‘majority opinion’, is in fact from a (loud, lying, did I say loud?) MINORITY.

And we’re meant to feel stupid and isolated if we dare go against the regime’s narrative.

20. September 2022 at 11:33

https://justthenews.com/government/federal-agencies/fauci-knows-he-funded-gain-function-research-misled-congress-former-cdc

https://renz-law.com/wp-content/uploads/Senator-Johnson-Final.pdf

That Covid-19 was developed at the Wuhan Lab is a story that isn’t going away, no matter how many fake news msm articles are published to deflect from this.

5d chess:

https://i.imgur.com/EsBc00D.jpg

20. September 2022 at 14:28

https://www.dailymail.co.uk/news/article-11232409/Democrats-BLOCK-Republican-bid-access-Hunter-Biden-documents.html

Democrat criminals running cover to protect other Democrat criminals.

21. September 2022 at 04:18

Is it not a vicious evil for the primary cause of deflationary and inflationary ‘pain’ to announce to the country that they are going to bring ‘pain’ to the people?

https://twitter.com/guardian/status/1572466354451775488

End the Fed and go to precious metals.

21. September 2022 at 05:00

George, re: “what source”

“Peril is a book by American journalists Bob Woodward and Robert Costa about the last days of Donald Trump’s presidency, as well as the presidential transition and early presidency of Joe Biden. The book was published on September 21, 2021, by Simon & Schuster”

21. September 2022 at 10:38

All monetary savings originate within the payment’s system. Demand deposits are just shifted into time deposits. The banks collectively pay for the deposits that they already own.

Hiking rates induces nonbank disintermediation, where the banks outbid the nonbanks for loan funds. The opposite scenario cannot exist. This destroys the transaction’s velocity of funds. I.e., it reduces R-gDp relative to N-gDp. It is backwards.

A larger proportion of savings have been dissipated in financial investment (mal-investment), e.g., the stock market (the transfer of title to existing goods, properties, or claims thereto).

There should be subsidized mortgage rates for new residential construction.

21. September 2022 at 11:08

The rate-of-change in bank credit has begun to decelerate.

Bank Credit, All Commercial Banks (TOTBKCR) | FRED | St. Louis Fed (stlouisfed.org)

22. September 2022 at 07:06

Increases in DFI loans and investments [earning assets/bank credit], are approximately the same as increases in transaction accounts, TRs, and time deposits, TDs, [savings-investment deposits/bank liabilities/bank credit proxy] excluding IBDDs.

That the net absolute increase in these two figures is so nearly identical is no happenstance, for TRs largely come into being through the credit creating process, and TDs owe their origin almost exclusively to TRs – either directly through transfer from TRs or indirectly via the currency route or through the DFI’s undivided profits accounts.

Bank Credit:

2022-05-25 17025.9423

2022-09-07 17286.2629

22. September 2022 at 09:06

see: Inflation Is Best Explained by This Underrated Economic Theory

Analysis by Tyler Cowen | Bloomberg