Immigration, wages, and the Phillips Curve

As you may know, the actual Phillips Curve is about the relationship between unemployment and wage inflation. That’s the relationship A.W. Phillips actually identified, and it’s still the correct version. Price inflation doesn’t correlate well with unemployment. Painful disinflation is and always has been about getting wage inflation down.

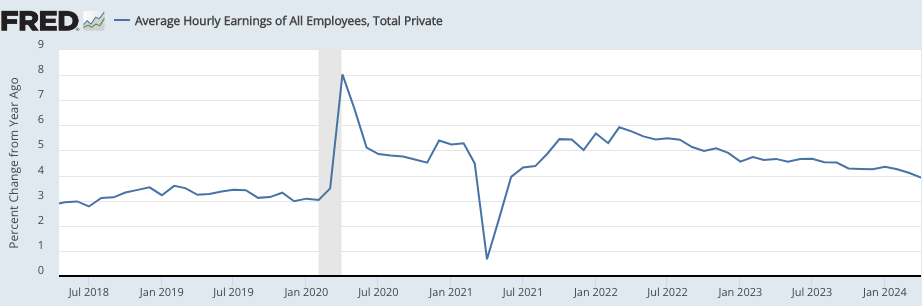

Forget payroll employment, the big news in today’s job report is the decline in 12-month wage inflation, to a rate slightly below 4% (and only 2.8% over the past three months):

It’s ironic that the thing that may well cost Biden the election (a surge in undocumented immigration) is the very thing that might (and I emphasize might) allow the first recession-free disinflation. The first American soft landing.

PS. The ultimate goal should be around 3.0% to 3.4% wage inflation.

PPS. It looks to me like wages are about 8% above pre-Covid trend and NGDP is about 10% above trend. I suppose the gap is unexpectedly high immigration. So Fed policy has been roughly 8% to 10% too expansionary over the past 5 years.

Tags:

3. May 2024 at 15:46

There are forty thousand wet markets in China. If the I f the Wuhan wet market was truly the source of C19… Would one expect or even demand radical reforms of wet market standards? Beijing appears unconcerned about wet markers.

The one wet market in China where C19 emerged—Wuhan— happened to be next to two labs that were conducting gain of function research on C19 bat viruses? And which had experienced leaks before (Including an ill employee who self isolated at home.)

Stretches credulity, no?

3. May 2024 at 17:11

Solon, You said:

“Beijing appears unconcerned about wet markets”

They tried shutting them down after SARS 1, which is known with certainty to have come through a wet market.

“happened to be next to two labs that were conducting gain of function research on C19 bat viruses?”

No, it isn’t. Try avoiding nutty conspiracy sites when you get your information.

4. May 2024 at 06:28

Can you please explain why the ultimate goal should be 3.0 – 3.4% wage inflation, as opposed to 2.0% wage inflation?

4. May 2024 at 08:24

Todd, Because the Fed has a 2% inflation target, and real wages tend to trend upward over time. Look at wages in 2018-19, when inflation was a tad under 2%.

4. May 2024 at 12:15

If wage inflation is still 1% above target, I don’t see how they are projecting rate hikes this year and taking hikes off the table.

The market is rallying every time they confirm this.

4. May 2024 at 21:35

Just over 80% of S&P 500 companies have reported Q1 earnings, with the latest estimate for the concurrent quarter earnings yield at 3.60%, versus YoY NGDP growth of 5.49%. This means an estimated NGDP output gap of nearly 1.90%. So, the economy was running a bit hotter, if anything, than the prior quarter.

That said, markets are still predicting a glide path back near equilibrium, and the 5-year inflation breakeven is just about back down to the Fed’s target, in core PCE terms. Also, Q1 NGDP growth could be revised down.

5. May 2024 at 10:08

Bobster, I don’t wish to defend the Fed, but clearly they won’t cut rates unless wage inflation slows significantly. They are forecasting rate cuts because they expect lower inflation. (I’m a bit more skeptical.)

Michael, You may be right, but clearly this disinflation is taking way too long.

5. May 2024 at 13:21

Scott,

I want to emphasize that even with inflation expectations near the Fed’s target, the economy is running too hot. NGDP growth is simply too high. It’s the net positive real growth shocks that are helping bring inflation down. It would be better to slow growth somewhat more quickly.

That said, at least we’re not in a terrible spot economically. We’re just taking unnecessary risks.

5. May 2024 at 13:31

I should also point out that it’s pretty good news that stock prices have suffered twice in the past year as inflation expectations have approached and surpassed the Fed’s target. This indicates the Fed has regained credibility in adhering to their inflation target. Unfortunately, inflation targeting is often pro-cyclixal.

I’m guessing the Fed will adopt a symmetric FAIT framework next year, which could effectively allow for NGDP targeting, but that won’t be the outcome. I thik it’ll just mean somewhat less excess volatility in NGP growth. That’s obviously progres, but very incremental.

5. May 2024 at 14:57

The US Department of Energy has assessed that the Covid-19 pandemic most likely came from a laboratory leak in China, according to a newly updated classified intelligence report.Feb 27, 2566 BE

5. May 2024 at 16:04

Michael, I agree on the economy, not sure about the symmetric policy claim (doubt it.)

Solon, Not sure what’s funnier. That you think this comment relates to this post, or that you expect anyone to take seriously a claim with no link.

Face it, you lost.

5. May 2024 at 17:10

Why do they expect lower inflation? Lags?

5. May 2024 at 17:48

I think the Fed could target NGDP using a forward indicator of the S&P 500 earnings yield that combines consensus earnings forecasts with S&P 500 futures prices. This would likely be better than the current inflation-targeting approach, though would be inferior to the idea of creating an NGDP futures market for the same purpose. I think it’s an idea worthy of additional study by people who are more sophisticated than me.

One potential political problem would be the possible charge that the Fed is motivated to pump up Wall Street, which is ironic, since such an approach would have prevented much of the extreme run-up in stock prices during the internet boom, and the post-pandemic over-stimulation.

5. May 2024 at 18:05

@MD Sandifer:

The problem, which you allude to, is that the public is way too unsophisticated (almost said dumb) to understand that. It’s not irony, it’s that they just can’t understand the concept.

5. May 2024 at 23:18

Scott,

“..as you may know, the actual Phillips Curve is about the relationship between unemployment and wage inflation…”

Isn’t the relationhip unemployment and “real” wage inflation? As far as I know, there is no empirical relationship between nominal wage growth and unemployment.

Question: If immigration is expected to run above trend, should this not affect the expected growht of money demand? If yes, doesn’t this meand that the NGDP target should be increased?

6. May 2024 at 07:16

Scott, you said, “It looks to me like wages are about 8% above pre-Covid trend and NGDP is about 10% above trend. I suppose the gap is unexpectedly high immigration.”

Are you saying that the gap between the 8% increase in wages vs the 10% increase in NGDP can be explained by high immigration?

If so, are you implying that immigration depressed wages relative to prices? I know that you are pro-immigration, but the anti-immigration crowd has been saying immigration depresses wages for years and is a reason to have less of it.

6. May 2024 at 08:02

Bobster, Yes, lags. And the recent downward trend in wage inflation. Also falling “spot rents”.

Viennacapitalist, No, Phillips look at the relationship between unemployment and nominal wage inflation.

You can make an argument for doing the NGDP targeting in per capita terms, but I don’t expect a significant increase in the population growth rate going forward. I think this is a blip.

Travis:

“Are you saying that the gap between the 8% increase in wages vs the 10% increase in NGDP can be explained by high immigration?”

Yes.

“If so, are you implying that immigration depressed wages relative to prices?”

No. It may be, but that’s not what I’m saying. I’m saying it depressed wages relative to NGDP.

6. May 2024 at 08:06

msgkings,

I think it’d be easier to explain my approach than the Fed’s current approach. As market monetarists have long argued, it’s probably easier to explain that NGDP targeting seeks to keep nominal spending on track than to explain what inflation is, and how inflation is targeting using interest rates as a signalling mechanism.

As far as using a foward-looking earnings yield is concerned, it could be explained that neoclassical theory says that the economic growth rate and the rate of return on capital have an equilibrium relationship, with deviations primarily due to monetary policy mistakes. Hence, targeting the S&P 500 earnings yield, via OMOs or reserve adjustments, could make NGDP growth more consistent, and hence near equilibrium.

Of course, most people pay little attention to monetary policy and far fewer than those who pay attention understand it, but I think this is a more straightforward approach than inflation targeting.

I think this approach is vulnerable though to attacks from the far left and far right who both hate Wall Street. The far left is economically ideologically opposed to Wall Street, due primarily to ingnorance on economic matters, and the far right hates Wall Street due to social and cultural ideology. Wall Street represents coastal elites with cosmopolitan liberal social values that try to force ESG values on society, as far as the far right is concerned.

6. May 2024 at 23:07

Scott,

correct, however, as John Hussman argues the empirical period under study by Philips (stable general price level), results in a perfect correlation between nominal and real wages, i.e. the phillips curve describes real wage growth as a function of labor market conditions.

It says nothing about the general price level and indeed there is no relationship between unemployment and the general price level.

Wonder what you think of it.

https://www.advisorperspectives.com/commentaries/2023/04/24/fabricated-fairy-tales-and-section-2a

7. May 2024 at 06:52

Scott, your point about wages vs NGDP in contrast to wages vs prices is very interesting. Perhaps it’s worth a blog post?

Since NGDP = NGDI, does your position imply that the percentage of income going to capital increased when immigration increased?

7. May 2024 at 07:32

VC, You said:

“results in a perfect correlation between nominal and real wages,”

That’s absurd. During the Depression nominal wages fell sharply and real wages rose sharply.

Travis, No, total wages and NGDP rise at roughly the same rate, it’s hourly wages that lag.

7. May 2024 at 22:32

scott,

good point, however phillips looked at uk data, maybe different (or less probounced?)

8. May 2024 at 08:28

VC, Not that different during the period he examined.

8. May 2024 at 15:45

Interestingly, in a world of toilet and exclusive city-states,

the inclusive open-immigration cities would probably be the toilet cities.

9. May 2024 at 14:24

Scott,

Off-topic, but on a topic you’ve addressed at times in the past:

You’ve noted the correlation between spot oil prices and inflation breakevens, as have I. This correlation hasn’t concerned me, mostly because the correlation between YoY NGDP growth and inflation breakevens is a good bit higher, and the correlation between YoY NGDP growth and YoY change in spot oil prices is a bit higher also.

I conclude that it’s primarily NGDP growth driving changes in both inflation breakevens and spot oil prices.