Extended UI benefits may cause tighter money

In the previous post I provided evidence that extended UI benefits tend to reduce aggregate supply and increase unemployment. (BTW, the most recent three posts are best read in reverse order, this one last.) Now I will argue that extended benefits probably trigger a more contractionary monetary policy.

Let’s assume a sort of “Bernanke put” on the price level. More specifically, assume that if inflation threatens to fall below the 0% to 1/2% range, the Fed will pull out all the stops with some sort of unconventional easing, say QE or lower interest rates on excess reserves. I’ll call this a “zero lower inflation bound” assumption.

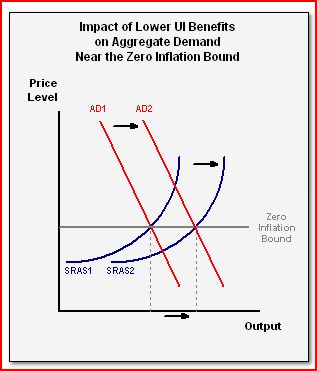

The standard Keynesian argument against cutting extended UI benefits is that it would reduce inflation expectations, and hence AD would fall. Any job-creating effects from lower wages would be swamped by the deflationary impact of falling prices. But if the economy is at the zero lower inflation bound, then cutting UI benefits does not reduce inflation. To better understand this counter-intuitive result, imagine an AS/AD diagram (some day I need to learn how to make graphs on a computer.) Lower UI benefits will tend to shift the SRAS curve to the right. Normally this would lower inflation. But if we are already at the zero inflation bound, then the Fed will react to this policy shift by moving the AD curve to the right, in order to prevent prices from falling. In that case we are in a classical world, where less UI and lower minimum wage rates will lower both nominal and real wage rates, and also boost employment.

You may have noticed an amusing irony in this argument. Keynesians like Paul Krugman argue that all the laws of classical economics go out the window when nominal interest rates are at the zero lower bound. Cutting UI doesn’t create jobs. There is a paradox of thrift. But if we assume that inflation is at the zero lower bound (due to the Fed’s reaction function) then much of (old) Keynesian economics goes out the window. In one sense there is nothing new here. The new Keynesians have long recognized that the old Keynesian model is invalid when the central bank has a symmetrical policy of inflation targeting. Fiscal policy can’t affect inflation, and, ipso facto, it can’t affect AD.

Here I am proposing something more modest–an asymmetrical lower bound on inflation, but a central bank that is still willing to tolerate slightly higher inflation rates. In that case fiscal stimulus can still boost NGDP, but fiscal austerity no longer contracts NGDP. This is roughly analogous to the zero interest rate bound, where conventional monetary policy can lower NGDP, but is powerless to increase NGDP.

I still believe the symmetrical inflation target is the better policy assumption, but I think this one is also fairly plausible for small changes. It also loosely relates to a point that Andy Harless recently made in the comment section to one of my posts. Harless argued that the Fed may be reluctant to engage in unconventional easing out of fear that they might overshoot into high inflation. If I’m not mistaken, implicit in that view is the idea that there is some inflation rate (perhaps 0%?) where the Fed hits the panic button and engages in more QE or lower interest on reserves. Maybe even an explicit inflation target. If I have interpreted Harless correctly, this would allow for a bit of the sort of asymmetry that I have assumed in this post.

PS. I am frequently amused by how often Paul Krugman suggests that any discussion of fiscal stimulus is completely out of bounds if it doesn’t implicitly acknowledge that monetary policy is ineffective at zero nominal rates:

If you believe stimulus is a bad idea, fine; but surely the least one could have expected is that opponents would listen, even a bit, to what proponents were saying. In particular, the case for stimulus has always been highly conditional. Fiscal stimulus is what you do only if two conditions are satisfied: high unemployment, so that the proximate risk is deflation, not inflation; and monetary policy constrained by the zero lower bound.

Notice how Krugman sort of rolls his eyes in disgust at us fools who refuse to “listen” when Keynesians claim that central banks are unable to debase fiat currencies. OK, I will try to listen more in the future. But I don’t think Krugman is being fair when he implies that people who believe the following are ignorant of the basic tenets of macroeconomics:

But even given the Fed’s own projections, it’s not doing its job, it’s missing its targets. Yet it apparently sees no need to act.

The preceding quotation was made just a few days ago by a distinguished economist. I don’t think it is very polite to suggest that this economist doesn’t “listen” and somehow never learned that the Fed is “constrained” once rates hit zero. And then consider this quotation from a few days earlier:

But how, exactly, does it serve the Fed’s credibility when it fails to confront high unemployment, while consistently missing its own inflation targets? How credible is the Bank of Japan after presiding over 15 years of deflation?

Whatever is going on, the Fed needs to rethink its priorities, fast. Mr. Bernanke’s “it” isn’t a hypothetical possibility, it’s on the verge of happening. And the Fed should be doing all it can to stop it.

There is nothing objectionable about these two quotations. At worst, you could accuse the economist who made them of being a tad inconsistent.

Seriously, I do understand how Krugman reconciles all this in his own mind. The Fed could do a lot more, but it’s risky and they probably won’t. Ergo, we need fiscal stimulus. (Of course Congress won’t either, as some of us warned last year.) But not all of us buy into his assumptions about how the Fed operates, and hence not all of us believe the rules of classical economics fly out the window once rates hit zero. That was the point of this post—to show that you could make an equally plausible claim that the laws of Keynesian economics fly out the window when inflation falls to its lower bound.

Update, 7/20/10: Rob Fightmaster was kind enough to send me the following graph:

Tags: Unemployment Insurance

20. July 2010 at 11:30

Scott,

This strikes me as right on the money (sorry). The key thing to remember is the argument going on inside the Fed. So long as core inflation remains above a certain level (0.5%-1%) the hawks will keep the upper hand. But if it falls towards 0% or below, this will provide Bernanke with the ammo he needs. Then monetary policy would become more Monetarist/New-Keynesian (Friedmanesque? Svensonesque? Sumneresque?) and the response of the economy would become more classical – as you point out.

The only thing that bothers me is that current growth expectations seem to imply a reasonable probability of hitting 0% inflation. So why don’t markets see this and respond to the implications of the policy response at zero inflation bound? Is it because markets have not fully priced in the zero inflation bound?

Of course if they did, the zero inflation bound would never be breached in the first place and there would be no need for the policy response. So the Fed could be more stimulative simply by announcing the existence of the zero inflation bound. Imagine how stimulative they would be if they announced a 1% lower inflation bound – or a forecast for the central tendency of inflation of 2% by the end of next year.

20. July 2010 at 11:37

Don’t unemployment benefits increase AD because recipients spend them? Financing the benefits doesn’t have an offsetting effect given current interest rates, etc. I don’t believe you need to bring inflation expectations into the mix.

20. July 2010 at 12:04

In PK’s ’98 paper on Japan’s liquidity trap* he seemed to recommend monpol because, “there is a government fiscal constraint”. Note that at that point the IMF’s measure of Japanese net debt to GDP was 46.2%. I must be missing something; why is the prescription different for Japan than the US?

*http://web.mit.edu/krugman/www/japtrap.html

20. July 2010 at 13:24

Scott:

“…implicit in that view is the idea that there is some inflation rate (perhaps 0%?) where the Fed hits the panic button and engages in more QE or lower interest on reserves”

I certainly don’t think it implies a discontinuous response, as your description seems to suggest. It is partly a matter of time, as the Fed waits to see what the effects of its earlier QE will be. There is a plausible case that the impact on output and inflation will be slower than the impact of monetary policy has been in the past (and the Fed must surely believe this is an important possibility; otherwise it becomes very hard to explain their current passivity).

I’ll have to think about the implications, but I don’t think my story implies a lower bound on inflation. For one thing, I think the Fed is right to be uncertain about the impact of its policies. (I agree that NGDP or price level targeting would make the effect more reliable, but even then there would be uncertainty.) Whatever the Fed does when the inflation rate goes down, who knows whether it will succeed in keeping the inflation rate above some presumed “panic” level? Certainly the Fed will get more aggressive the lower the inflation rate goes, but exactly how much more aggressive, and what the impact will be, is hard to determine.

It’s almost certainly true that UI extensions lead, on average, to relatively tighter monetary policy even at the zero short-term interest rate bound. (If Krugman denies that, he just hasn’t thought this through — or else he really thinks the Fed is psychotic.) I can’t confidently say more than that without writing down a model. My guess is that I could write down a plausible model in which UI extensions — even with a substantial supply side effect — raise aggregate demand despite a Fed reaction function that takes into account the asymmetry I suggested. And my guess is that that would be the correct conclusion in real life. My guess is also that I will be too lazy to actually try writing down such a model.

Gregor:

“The only thing that bothers me is that current growth expectations seem to imply a reasonable probability of hitting 0% inflation. So why don’t markets see this and respond to the implications of the policy response at zero inflation bound? Is it because markets have not fully priced in the zero inflation bound?”

What exactly would the policy response would be, and what would be the implications for current market valuations? Looking at the bond market, it does seem as if it might be pricing in a substantial probability of more QE. (That might be hard to distinguish from pricing in the possibility of deflation.) Implications for other markets aren’t clear to me. If we hit the zero inflation bound and the Fed successfully defends it but goes no further, what does that imply for real assets like stocks? Not clear to me.

20. July 2010 at 13:26

‘Don’t unemployment benefits increase AD because recipients spend them? Financing the benefits doesn’t have an offsetting effect given current interest rates, etc. I don’t believe you need to bring inflation expectations into the mix.’

Increases in government borrowing however, take away from private investment, so the investment part of AD gets switched for consumption. Also, government benefits aren’t exactly efficient, and a lot of the money going to beneficiaries gets lost along the way due to overhead.

20. July 2010 at 13:36

>>Increases in government borrowing however, take away from private investment,>>

In general, there’s a real danger of that happening, but not under current circumstances, certainly not enough to nullify the benefits. That’s why I referenced current interest rates – no evidence of crowding out.

UI is rather efficient. If memory serves, overhead is very low. In any case, most of the overhead would seem to be keeping gov’t workers employed.

20. July 2010 at 13:49

“Notice how Krugman sort of rolls his eyes in disgust at us fools who refuse to “listen” when Keynesians claim that central banks are unable to debase fiat currencies.”

I think the Krugman’s point with the zero bound here might have been the opposite of what you said. In the case of Germany, it wasn’t that Krugman would be afraid the central bank would be unable to loosen, but that they would want to tighten monetary policy in order to stop inflation, which would counteract fiscal policy. In a recession that’s bad enough where interest rates are at the zero lower bound and where deflation is a threat, the central bank general wouldn’t dare to tighten policy. This is why Germany was a bad example of fiscal stimulus since it didn’t meet those requirements and the central bank did end up tightening.

20. July 2010 at 13:52

I meant to say “the central bank generally*”

20. July 2010 at 14:05

I suppose I agree with Sumner on this one, but I don’t think unemployment benefits, at this point, matter much. We are talking about $30 billion.

The big stuff is QE, and we need it bad.

I know this is an anecdote, but still: I have used or owned industrial-warehouse space in Los Angeles since the early 1990s, and looked at same since the early 1980s. There are industrial-warehouse buildings now empty that have never been empty. Many of them.

On retail, in Beverly Hills no less, there are vacant and nearly abandoned properties on the north side of Olympic–in Beverly Hills! One corner restaurant has been closed for at least two years. Broken windows etc.

Dudes, this is getting ugly. According to Trepp, one in 10 commercial real estate loans is sour, through the rate of going bad is decreasing. Still, more every month.

We can dick around with unemployment, or try to rebuild Afghanistan, and I can think of many wastes of money.

The big stuff is what is the Fed going to do? We have to relfate property. We are facing deflation, and the CPI is already down for three months in a row. Unit labor csts are going down. Real estate is as soft as fresh poop.

20. July 2010 at 15:55

If you really believe this, then you should probably support raising taxes to balance the budget in order to get the Fed to act. I am far more skeptical. The Fed may take the lead from Congress as to whether to be more accommodating or not and be willing to let the economy sink if it thinks that is what they are content with.

20. July 2010 at 16:13

“Notice how Krugman sort of rolls his eyes in disgust at us fools who refuse to “listen” when Keynesians claim that central banks are unable to debase fiat currencies. OK, I will try to listen more in the future.”

Well, let’s see. If they permanently raise the value of their balance sheet by about 10% by buying about $235 Billion of 2-year bonds at whatever yield that addition of demand would fetch in the market (0%?), then I’m pretty sure it would at least slightly debase the currency.

Maybe they don’t want to be seen as “monetizing the debt” (though it would only be about 2 months worth of deficit, at the current rate). Ok, then they could do the equivalent and use that printed cash to buy a basket of yen, pounds, and euros on the spot and forex futures markets (or their bonds).

Maybe that would set off a small “beggar thy neighbor” competitive devaluation war of the sort the old Bretton-Woods IMF was supposed to prevent. But then again, maybe a small war like that would be good for the all advanced economies. It would return inflation to trend 2%, and the war would provide cover for the central bankers to finally do what is necessary to restore normal expectations.

20. July 2010 at 20:15

If the fed drives up inflation and NGNP, doesn’t this favor one class of people at the expense of another class of people?

Homeowners and banks are helped since their assets are worth more.

The average working person living in rental property is hurt because their rental rates and other costs go up while their wages are unlikely to go up much with such high unemployment.

I have two children who are renters. I would like to see house prices continue to fall to a level where they can actually afford to buy a house, not go back up in price and lock them out of the market!

21. July 2010 at 04:13

Gregor, I think the markets are factoring in a policy response. The TIPS spreads show about 1% inflation over the next few years. That tells me that markets don’t think the Fed will allow deflation.

foosion, UI benefits do not increase AD when a central bank is inflation targeting. I think that is a pretty standard new Keynesian result. If they did boost AD, they would also boost inflation–which contradicts the assumption of inflation targeting.

MW, Yes, I’ve done a lot of posts discussing that 1998 paper. Krugman has definitely moved to the left.

Andy, I generally agree with your reply to Gregor. Regarding the zero bound and policy lags, I focus on expectations. There are two things to be said about inflation expectations:

1. The fed is more worried about movements in inflation expectations (either deflation or high inflation) than they are about actual (transitory) movements in inflation. We had a bit of headline CPI deflation in the 2008-09 period, but it didn’t affect core inflation. The Fed is really concerned about deflation expectations setting in–a la Japan.

2. If you buy the previous point then the Fed is watching the TIPS spreads. David Beckworth has a recent post showing the big drop in 5-years TIPS spreads this year. I am certain the Fed is aware of this, and I think it factors into the chatter about possible easing. I emphasize TIPS spreads because there is no policy lag there. Last year I speculated that the Fed would not allow 5 year TIPS spreads to fall below 1%. (Actually they briefly did in late 2008, but that could be attributed to short term liquidity issues.) I still think the Fed has a floor on expectations, even if they don’t admit it. And as there is no policy lag between monetary policy and TIPS markets, I think it makes sense to talk about them targeting that variable (in an asymmetric way.)

John, Yes, I understand Krugman’s point, but I don’t agree that the situation then was different from today. The central bank can tighten today to prevent fiscal stimulus from working—indeed you could argue that the Fed, ECB and BOJ have done exactly that.

Benjamin, And just to be clear, I am not opposed to giving the unemployed a bit more money—it’s just that I’d rather see it in a lump sum. But monetary policy is the key.

Lord, Raising income taxes has a really bad supply side effect. But a carbon tax would be a good idea. And I do favor shrinking the deficit on the spending side. I’d like to see Obama and Pelosi sit down with Bernanke and try to work out a deal. Supposedly Clinton and Greenspan did this in the early 1990s, and it worked.

Indy, That’s why inflation of NGDP targets are key. It is not clear how much QE is needed to hit any given target. First the Fed needs to set a target, or a target range.

22. July 2010 at 17:39

Bob, The goal is to have predictability–steady growth in NGDP or prices. That would not favor either lenders or borrowers.