Countries of the past, and future

Remember the Sports Illustrated jinx? Athletes that appeared on the cover of Sports Illustrated often saw their performance drop off sharply. I wonder if the same applies to Paul Krugman? Here’s a Krugman post from 2013, trashing the Irish economic model:

The one sense in which Ireland has made some progress is that it has somewhat reassured bond investors that its population will continue to sullenly acquiesce in austerity; as a result, Irish 10-year rates, while still at a large premium, are now 60-80 basis points below those of Italy and Spain.

But the repeated invocation of Ireland as a role model has gotten to be a sick joke.

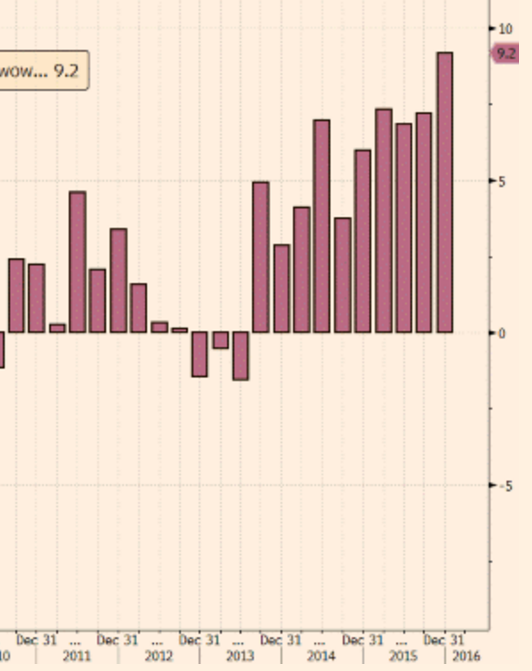

I’m not sure the Irish feel “sullen” about the 9.2% RGDP growth announced last week:

Notice that Ireland’s dramatic turnaround began almost immediately after Krugman’s August 2013 post. The post was entitled:

Notice that Ireland’s dramatic turnaround began almost immediately after Krugman’s August 2013 post. The post was entitled:

Ireland Is The Success Story Of The Future, And Always Will Be

So what type of economic model does Krugman like?

Just to be clear, I think Brazil is going pretty well, and has had good leadership. But why exactly is Brazil an impressive “BRIC” while Argentina is always disparaged? Actually, we know why — but it doesn’t speak well for the state of economics reporting.

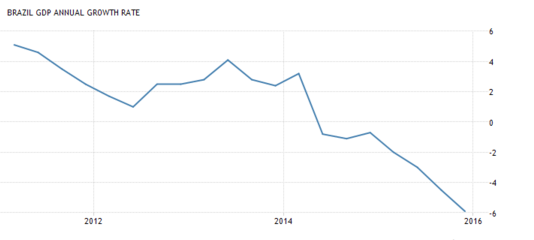

I first wrote this post on the day when Lula was indicted for corruption, and his successor is now threatened with impeachment for the same. In fairness, I would not expect Krugman to be aware of the political intricacies of Brazil. I’m more interested in his views of economic policy. So how has Brazil’s economy done since the May 2012 post, under that “good leadership”?

Yikes, that’s almost the mirror image of Ireland. While Ireland is already richer than Germany (In GDP/person, perhaps not GNP), and growing at a much faster rate, Brazil is now poorer than China, and declining as fast as China is growing.

Yikes, that’s almost the mirror image of Ireland. While Ireland is already richer than Germany (In GDP/person, perhaps not GNP), and growing at a much faster rate, Brazil is now poorer than China, and declining as fast as China is growing.

Argentina also slowed sharply after Krugman’s post, indeed the slowdown was already underway in 2013, but he relied on the 2012 data, when growth was still strong. Fortunately they have a new government, which is beginning to institute some reforms.

PS. Another irony; didn’t the “country of the future” joke that Krugman applied to Ireland, originally apply to Brazil?

Tags:

17. March 2016 at 15:05

That’s why Trump is so strong. Krugman disowned him, too. Krugman got the opposite of a golden hand.

Just to be clear, I think Brazil is going pretty well, and has had good leadership.

Lol.

But why exactly is Brazil an impressive “BRIC” while Argentina is always disparaged?

A really tough question. Krugman really seems to love the Kirchners, Maduros and Castros of the world. They are only in power for decades. No reason to rush a negative judgement. But a candidate who said a few bad things and uses bad language? To the cross with him! And then burn him alive on a stake. Just to be sure.

17. March 2016 at 15:23

While I do not agree with the reasons for why you conclude Krugman was (again, for the millionth time) wrong, your posts that refute Keynesianism are always a pleasure to read.

17. March 2016 at 16:31

Completely off-topic, but could you do a post explaining how trade deficits AREN’T the same as debt? Noah Smith is once again going off on twitter about it…

17. March 2016 at 16:34

” I’m more interested in his views of economic policy.”

I’m pretty sure the huge corruption revelations that kept happening year after year in Brazil are one of the central reasons for their currency crisis and struggling economy.

As for Ireland, that boom was apparently from a surge in FDI, kinda hard to predict those kinds of animal spirits. When Krugman actually wrote that article, Irish GDP growth was negative again, so it was fair to say that, at that particular moment, Ireland was hardly the hallmark of success.

Anyway I don’t think there isn’t a leading thinker out there who doesn’t have a number of bad predictions or two under their belt. I’m pretty sure I remember some recent predictions from you regarding China that ended up looking a bit foolish on the eve of one of the biggest stock market collapses they’ve ever faced.

17. March 2016 at 16:41

Also by your own model Ireland should have struggled too, remember that Ireland is dependent on the ECB for monetary policy, which in your view was overly tight during this period.

If you say “while it’s true that the ECB policy was harmful to Ireland, other factors offset this which allowed it to boom”, then it’s equally fair for Krugman to say “while it’s true austerity policy was harmful to Ireland, other factors offset this which allowed it to boom”.

17. March 2016 at 17:09

Ireland’s per capita GDP is nearly equal that of the United States, at $51,000 vs $54,000 for the U.S., 2014 stats.

And Ireland is able to obtain a 9.2% real increase in their GDP?

I have often wondered if US economists are far too timid and gloomy in their projections of what is feasible growth.

How is it that Ireland can obtain a nearly double-digit rate of real growth? And remember they are not an undeveloped backwater, their GDP per capita is nearly the same as the US.

I guess the answer is, drink more beer, booze it up, print money and shoot for Full Tilt Boogie Boom Times in Fat City.

Unzone property too.

Sheesh, I would be happy with a few years of 5% real growth

17. March 2016 at 18:38

“I’m pretty sure the huge corruption revelations that kept happening year after year in Brazil are one of the central reasons for their currency crisis and struggling economy.”

That’s actually a excuse from politicians who made a very bad economic policy. If you look at the fundamentals you’ll see that.

To the government in charge any economic problem will be solved by stimulating demand, that kind of thinking was followed by a great fiscal irresponsibility (I think that’s why Krugman likes them so much) with a passive monetary policy even when inflation was raising (the target for inflation is 4,5 %, the actual is 10%). Just another populists party in Latin America.

PS. America could take some brazilian economists to raise inflation. They’ll take care of it very fast.

17. March 2016 at 18:45

Ah, the economic policy that produce such a disaster began in 2010.

17. March 2016 at 19:01

Goose, Simple, Australia buys 1000 laptops from China. In return, Australian workers build a condo and sell it to Chinese buyers. That’s a trade deficit for Australia, but not debt.

Smith is smart, but knows much less than he thinks he knows.

Britonomist, You said:

“Anyway I don’t think there isn’t a leading thinker out there who doesn’t have a number of bad predictions or two under their belt. I’m pretty sure I remember some recent predictions from you regarding China that ended up looking a bit foolish on the eve of one of the biggest stock market collapses they’ve ever faced.”

Krugman’s made a lot of bad predictions in recent years—remember 2013 and 2014?

I don’t think I’ve made any bad predictions about China, can you be more specific? I don’t predict stock prices. I did predict 6% GDP growth for China in 2016, and I’m sticking with it.

You said:

“Also by your own model Ireland should have struggled too, remember that Ireland is dependent on the ECB for monetary policy, which in your view was overly tight during this period.”

Krugman has an AD model, I have a AS/AD model. Ireland has much better supply side policies than Greece or Brazil.

17. March 2016 at 20:45

What Britonomist said, and Sumner’s response is weak, as he supposes his model is better than Krugman’s, when in fact if you assume money neutrality and no money illusion, both models fail. Truth is, economics is nonlinear, and next year Brazil could be the winner while Ireland stagnates. Ireland btw is a creature of US tax law (allowing companies to offshore their profits). What the tax man giveth, he taketh away.

17. March 2016 at 22:08

Scott: the aphorism you are probably thinking of is:

Brazil is a country with a great future ahead of it, and always will be.

The companion aphorism is:

Argentina is a country with a great future behind it.

“Krugman has an AD model, I have a AS/AD model.”

So, you are saying Krugman has become French?

http://www.deirdremccloskey.org/docs/pdf/PikettyReviewEssay.pdf

“In a way, it is not his fault. He was educated in France, and French-style teaching of economics, against which the insensitively-named Post-Autistic Economics (PAE) movement by economics students in France was directed, is abstract and Cartesian, and never teaches the ordinary price theory that one might use to understand the oil market, 1973 to the present. Because of supply responses, never considered in books by non-economists such as Paul Ehrlich’s The Population Bomb (1968) or by economists who do not understand elementary economics, the real price of oil, for example, since 1980 has fallen.”

18. March 2016 at 01:09

Doesn’t Ireland benefit from the joy of low expectations? Unemployment is still close to 10%, and GDP is still below its pre-recession peak.

18. March 2016 at 01:29

“Athletes that appeared on the cover of Sports Illustrated often saw their performance drop off sharply.”

I think this is actually somewhat logical and result of “regression toward the mean” phenomenon. Imagine that performance of athlete and/or country is combination of innate ability and luck. We should not expect that anybody who got extremely lucky/unlucky last round will have the same result this round of competition.

18. March 2016 at 02:39

Irish GDP numbers are largely meaningless, NGDP growth in 3Q15 was 10.5%. Such volatile numbers devalue the concept.

Financial entrepot’s are have GDP, R or N, too difficult too count.

See the excellent Bean Review, Section 3.93 p113 for details:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/507081/2904936_Bean_Review_Web_Accessible.pdf

Or just read this:

https://thefaintofheart.wordpress.com/2016/03/14/output-gap-targeting-is-voodoo-economics-too/

18. March 2016 at 02:45

Ok, I’m gonna be a Krugman apologist here. His critique of Ireland has always been pointed at Euro area politicians and ECB. Do you Scott think that they have done good job during the past 8 years. Me neither.

Ireland still has unemployment of 9% and many people have huge debts from the housing bubble far exceeding the value of property. Those who were lucky to stay employed have had to take paycuts as large as 15%. Krugman says that internal devaluation will bring growth back at some point but it’s much more painful than other means.

18. March 2016 at 04:06

Be careful about Irish data. It has 4.5m or so people and is a quasi tax haven within Europe. This means many corporates (e.g. Google) route as much revenue as they can through it and so GDP can look artifically high.

You need to adjust for this to say meaningful things about the economy.

18. March 2016 at 04:12

Krugman is a political operative. Everything he says should be viewed with that in mind.

18. March 2016 at 04:16

Krugman really seems to love the Kirchners, Maduros and Castros of the world.

It’s a reasonable inference that Robin Wells writes his columns and she fancies these characters.

18. March 2016 at 04:16

In other news

https://www.reddit.com/r/The_Donald/comments/4a2bu9/what_really_happened_at_the_chicago_rally_my/

I think it’s fair to judge a man by his enemies. Trump is certainly pissing off the right people.

18. March 2016 at 04:32

The SI “jinx” is probably because of regression to the mean. Do you think this applies to the Krugman jinx as well? Or is it that his policy views are wrong?

I would like to see more than two data points before I conclude anything, but these look like cases of regression to the mean.

18. March 2016 at 04:38

Also, as others have pointed out above, Ireland still has 10% unemployment compared with 5% pre-crisis, and 15% during the crisis. Not so great.

Of course, it’s hard to conclude much from one rapidly developing small country closely attached to a much larger (and more developed) economic area that experienced a huge banking crisis followed by terrible macroeconomic management and a sovereign debt crisis.

18. March 2016 at 04:46

Wait, I just read the Krugman piece on “Brazil”, and you completely mischaracterized it.

Krugman is actually talking about Argentina, and comparing reporting on Argentina with Ireland. His point is that Argentina did well after devaluation, whereas Ireland did poorly after austerity. The Brazil line is just a throwaway to say that he’s not criticizing Brazil (since he used it as a benchmark for Argentina).

In context, he’s talking about monetary policy — he’s saying that Ireland has done poorly because they haven’t used expansionary monetary policy, whereas Argentina has done well because they have. I think he’s entirely correct. Don’t you?

18. March 2016 at 04:52

Seize the means of production! No Gods, No Masters, No Landlords!

18. March 2016 at 05:03

Krugman would argue that solid GDP growth in Ireland started once austerity ended. See, e.g.

https://sdw.ecb.europa.eu/quickview.do;jsessionid=21852EBCE4DC8864E308967A92C52FF4?SERIES_KEY=325.GFS.Q.N.I8.W0.S13.S1._Z.B.B9P._Z._Z._Z.XDC_R_B1GQ_CY._Z.S.V.CY._T

18. March 2016 at 05:06

Be careful with Irish GDP. Tech companies tend to hold their IP in Irish subsidiaries for tax reasons, which, as I understand it, causes a lot of earnings to wind up being recognized in Ireland even if no actual Irish people were involved (or paid) in the process. So I think total nominal labor compensation would be a better aggregate to track for Ireland, divided by the GDP deflator if you believe in that kind of thing.

The world is a weird place.

-Ken

18. March 2016 at 05:07

Wrong link. Here’s the primary balance in Ireland:

https://sdw.ecb.europa.eu/quickview.do?SERIES_KEY=325.GFS.Q.N.IE.W0.S13.S1._Z.B.B9P._Z._Z._Z.XDC._Z.S.V.N._T

It’s essentially flat since 2014 (i.e. no more austerity).

18. March 2016 at 05:13

Britonomist: “As for Ireland, that boom was apparently from a surge in FDI, kinda hard to predict those kinds of animal spirits. When Krugman actually wrote that article, Irish GDP growth was negative again, so it was fair to say that, at that particular moment, Ireland was hardly the hallmark of success.”

That is exactly why a thoughtful observer should not make snarky, ham-handed predictions. In Krugman’s post, he referenced an article titled “Annals of Austerity FAIL, Eurozone Redux”. Since Krugman’s post, Ireland’s deficit has continued to shrink as a % of GDP while government spending has been relatively flat.

Krugman was wrong in his prediction because his model is wrong.

18. March 2016 at 05:21

@Daniel:

“I think it’s fair to judge a man by his enemies.”

No, that’s pretty much an incredibly stupid way to judge someone, even dumber than judging someone by claimed supporters (as opposed to welcoming support. If you make such a statement, then you’re definitely saying it’s fair to judge Donald Trump by the enthusiastic support of David Duke.) It is inevitably the case that the worst extremists in any situation (on any multidimensional analysis of “position”) get opposed the hardest by the worst extremists of other position. It’s tough to understand what logic would differ. Yet the very clashes between extremes make people feel that they need to pick an extreme side; just as clashes with Communists helped Hitler, so too did the idiots in Chicago help Trump, which is why he provoked them and canceled when he didn’t have to.

Donald Trump is indeed hated by extremists whom I abhor, but he’s also hated by everyone on my side I find decent, thoughtful, and interesting, even those whose political opinions I strongly disagree with but accept as part of a coalition. OTOH, he is favored by every idiot, suck up, grifter, imbecile, and useful idiot that has been a necessary part of a party coalition.

18. March 2016 at 05:40

Does anyone else find it interesting that the first comment for this post immediately references Trump?

18. March 2016 at 05:43

To Scott—Follow up question on your response to Goose.

I have always understood a trade deficit is offset by a capital surplus. But what happens when that surplus is used to support our Government’s excess spending? If we were to assume Government spending is largely redistribution (i.e., entitlements), are we redistributing Chinese wealth to US citizens who can now consume more medical care or save (e.g., social security can be saved)? But we still have to pay back the debt (unless the Fed buys it of course and holds to maturity), don’t we?

So why isn’t a trade deficit net borrowing?

18. March 2016 at 06:44

Suppose I’m slamming my head against the wall but then I stop. Would you imagine that I feel immediately better? Just as the U.K saw a boost in growth after letting up on austerity i.e stopped banging their head against the wall Ireland is experiencing the same.

18. March 2016 at 06:48

When I see someone referring to Trump as an “extremist”, I know he’s a member of the priestly class who worries that a Trump victory would mean a loss of privilege.

18. March 2016 at 07:59

What you fail to understand is that it is liberals like yourself who are hated by all decent people and defenders of civilization.

Ouch.

What actually is disconcerting is that if I think of something disgusting, appalling, dishonorable, or grossly imprudent in matters of policy, I can usually reasonably infer that the majority of the arts and sciences faculty wouldn’t have it any other way; ditto the teacher training faculty, the dean of students, the provost, the university president, &c. And the chairman of the board of trustees would cover for them unless some injury to the athletic program were involved.

18. March 2016 at 08:38

http://liveblog.irishtimes.com/bdfb23bf73/LIVE-Budget-2015/

“In two and half hours, Minister Noonan will end the Government’s long-standing austerity drive by announcing the State’s first expansionary budget in more than six years.”

Irish growth can’t be attributed to “ending austerity” if austerity only “ended” (and meagerly so) this past October.

18. March 2016 at 10:19

[…] great post from Scott, when he goes after my favorite Keynesian. Here’s the zinger from […]

18. March 2016 at 12:26

My understanding was that Ireland has a favorable tax situation that the EU was not happy about. Ireland was hurt by the housing crash. But the tax situtation was good for them. I hope it stays that way.

18. March 2016 at 12:27

Everyone, I am aware that Ireland is a small country with heavy foreign investment, that’s why I put the qualifier about GNP into the post. I wish someone would dig up the relevant data for Ireland. What Krugman doesn’t understand is that AS is as important as AD. The difference between Brazil and Ireland is not AD, it’s AS oolicies.

Jonathan, You said;

“Wait, I just read the Krugman piece on “Brazil”, and you completely mischaracterized it.”

Nope, I did not mischaracterize it at all. I gave an exact quote and the quote is not taken out of context. He says the leaders did a good job in Brazil, whereas in fact the leadership of Brazil produced an economic disaster.

Ken, I agree that total labor comp. data would be better. Does anyone have any?

Dustin, Good point.

Mike, You said:

“So why isn’t a trade deficit net borrowing?”

It’s certainly possible that both might occur at the same time but (as Australia shows) you can also have huge trade deficits year after year while running balanced budgets.

James, See Dustin’s comment. Also Goose.

18. March 2016 at 14:14

Scott,

I think the unit labor cost chart (if it’s accurate) at

http://www.economonitor.com/blog/2014/02/eurozone-competitiveness-indicators-and-the-failure-of-internal-devaluation/

backs up your assertion about supply side factors. Ireland did a great job dramatically bringing down its unit labor costs after 2009. I’ve long suspected that Krugman’s effort to play up the austerity issue in the Eurozone while downplaying unit labor costs and currency flows had more to do with helping the anti-austerity rhetoric coming from the Democrats rather than giving an honest intellectual diagnosis.

18. March 2016 at 14:33

Excellent post!

18. March 2016 at 15:08

With all due respect Mr. Sumner I think this quote by you know who was intended for you. Especially the levels and rates bit. “Every economic uptick in an economy that practiced austerity in the past is trumpeted as proof that Keynesians were wrong and the austerians were right; never mind distinctions between levels and rates of change, or the fact that even the most Keynesian economists never asserted that fiscal policy is the *only* determinant of growth.

Nov 2015

18. March 2016 at 15:42

@goose- you said “Irish growth can’t be attributed to “ending austerity” if austerity only “ended” (and meagerly so) this past October.”

The 5th sentence of your link says that Ireland front loaded their $600 billion cuts in 2010. I could dbe wrong here but I imagine the harshness of cuts diminished over the years. It’s about the “ended austerity” that helped with growth but the reduction of it

18. March 2016 at 15:43

^opps I meant It’s not* about the “ended austerity….

18. March 2016 at 16:04

@Dustin you said “Since Krugman’s post, Ireland’s deficit has continued to shrink as a % of GDP while government spending has been relatively flat.”

So government spending has been flat after his post (or 2013) according to you. We know they cut spending in 2010 harshly. The deficit shrunk has a % of gdp as you pointed out. Well Im no math expert but when the denominator increases the outcome gets smaller. Maybe the denominator in deficit/gdp increased because, among other things,they reduced cuts i.e stopped banging their head on the wall

19. March 2016 at 01:48

“Austerity” was always bad framing. A country must be solvent, irrespective of how much it decides to tax or spend.

Speaking of “countries of the past” I stumbled across a fascinating piece of monetary history in Gibbons’ book on Rome, the writing itself as interesting (considering when it was written) as its subject. It involves Aurelian trying to clean up the currency and sparking a civil war in the process, it’s a bit lengthy but I could share if you’re interested.

19. March 2016 at 02:05

Scott

Link to Irish real (constant prices) and nominal (current market prices) GDP, income from rest of world (a big negative), and GNP

http://www.cso.ie/en/releasesandpublications/er/na/quarterlynationalaccountsquarter42015/

Tables 2 and 3

19. March 2016 at 08:16

Goldman says Wednesday’s Fed decision was one of the most dovish Fed decisions of the 21st century

http://www.bloomberg.com/news/articles/2016-03-18/goldman-sachs-this-was-one-of-the-most-dovish-fed-decisions-of-the-21st-century

19. March 2016 at 10:23

The Irish are good at suffering. They can take the wage cuts and job losses that tight money brings, and bounce back because they don’t fall back on bad, demand-side fiscal policies. Their higher levels of drinking must be key, as Benjamin points out.

19. March 2016 at 10:27

I agree with the commenter above that this is not an accurate characterization of the Krugman post.

Firstly, it is talking about the past. At the time Krugman wrote the post, Ireland was being held up as a model, when it hadn’t performed well at all. After a very long time (from 2008 to late 2013), Ireland began to do well. That hardly invalidates Krugman’s point.

Your own mechanism of AS/AD is not clear. From the chart given above by Gordon, lots of countries went through “internal devaluation” and relative improvement in competitiveness, including Spain, Portugal and Greece. Needless to say, the results have not been uniformly good.

19. March 2016 at 10:37

One of the reasons Ireland is doing well is that this article is satire – in the land of ‘let’s raise the minimum wage now!’, not sure how much of a joke this would be…

http://waterfordwhispersnews.com/2016/03/18/everyone-to-strike-for-better-wages-now-the-good-times-are-back/

19. March 2016 at 10:43

As the managing director of an oil field services consultancy specializing in the deepwater segment, I was the first in the industry to criticize Petrobras governance, back in 2010, when the company was still the darling of investors and the hope of the global oil supply.

This criticism had nothing to do with Petrobras as an operating company. At the time, it was still quite competent at its core function.

However, the pre-salt discoveries ignited a frenzy of rent-seeking and corruption. The core of my critique centered around local content requirements, which grew as high as 70% over time.

The deepwater segment is highly specialized and capital intensive. Certain things, like subsea production trees, are only manufactured in certain places like Houston; Aberdeen, Scotland; and Stavanger, Norway. If you wanted a drillship, pretty much Korea was the place to buy it.

The Lula government decided to use Brazil’s pre-salt finds to bulk up Petrobras and use it as a tool for wider industrialization. The former policy compelled Petrobras to undertake the lion’s share of deepwater development in Brazil, far more than it could reasonably handle.

Industrialization was to be accomplished using local content regulations, in essence, compelling the elaborate, vast and capital intensive supply chain to open shop in Brazil. This sounds great on paper. In practice, it meant designating ‘made in Brazil’ as the chief criteria in equipment selection, superior to price, quality or suitability.

So, let’s take the case of a Korean shipbuilder Daewoo, who partnered with Odebrecht, a Brazilian construction company, to build deepwater vessels in Brazil. Now imagine that the partners have put some big money into building the shipyard in Brazil, and the company needs orders.

Of course, the supply chain in Brazil was woefully under-developed in Brazil versus the one in Korea, with which literally no other country could compete. Thus, a drillship which might cost $700 million from Korea could cost, say, $1.2 bn in Brazil.

With local content laws, all comparability was lost. Petrobras couldn’t just say, well, the Korean vessel is cheaper, let’s buy it. Rather, only Brazilian vendors could tender, and the price was much higher (but how much?) owing to local content regs.

So we now have Marcelo Odebrecht negotiating with Dilma Rousseff regarding the purchase of vessels for PBR. Put another way, a government official was making a purchasing decision for a publicly-listed national oil company to buy billions of dollars of assets with no international comparability. What could go wrong?

And there’s more. Suppose Daewoo has invested $500 million in a shipyard and hired a thousand workers, pretty much the government has to order from them. Can the government reasonably refuse Daewoo business? Can it say, sorry you invested all that money and hired all those people, but we’re not buying from you. Of course not. So all of sudden, procurement starts looking a lot like patronage. The government would instruct PBR to buy vessels from Odebrecht, even if they preferred to work with, say, Samsung.

In other words, local content regs forces operational decisions. It compels Petrobras to use certain suppliers and prohibits it from using others. And that means delays and cost-overruns, which again inhibit any kind of comparability in offers. And when Petrobras is spending $25 bn a year in capex, it’s not hard to see where massive corruption comes from. Nor is it hard to see how Marcelo Odebrecht was convicted for 19 years for corruption, or why Lula was hired as Dilma’s chief of staff recently, and why thousands of people are protesting in the street.

Once a foreign vendor has invested in Brazil, it is captive to that system, as it has incurred up-front fixed costs to be

prepared to compete as a vendor. This means, among others, Brazilian employees familiar and comfortable with the local system. In other words, the company will be co-opted. It is for this reason that the scandals were so wide-spread. I would guess 80% of the foreign companies selling to Petrobras were involved in corruption. Maybe more. Indeed, I have often wondered why the Obama administration did not crack down on Houston–where these suppliers are located in the US–with greater conviction. The administration could have swept up a big chunk of the sector.

Now, the scandals in Brazil may seem a great mystery, but if you paid attention in your first few econ courses, you could see them coming a very long way off.

19. March 2016 at 12:07

@Steven Kopits

Great Comment, I a have worked as an investment banker and asset manager in Brazil in the last 15 years, and subscribe to everything you wrote. I could not have written it better.

I would add that Brazil is a Keynesian dream economy: heavily regulated , hihg taxes, high transfer taxes (all the “stimulate” investment and demand), loose monetary policy to stimulate demand …. But it clearly does not work. Corruption is a nasty detail on top of the really damaging Keynesian model .

Keynesians like PK when confronted with this just take the “exit to the left” arguing that they only defend the keynesian model when the economy is in the liquidity trap, but hey, you market monetarists have showed that this is not necessary either, so, why botter with keynesians? I am with John Cochrane here, we tried their recipe in the seventies, and it failed leading the US to the “great inflation”. They (keynesians) should just be ignored. I haven’t read a full PK post in almost 10 years now (I end up dropping it after a few lines, because he is either trashing someone or posting a “conservatives are devils” sort of thing), and I don’t think I am missing anything …

19. March 2016 at 20:07

“Your own mechanism of AS/AD is not clear. From the chart given above by Gordon, lots of countries went through “internal devaluation” and relative improvement in competitiveness, including Spain, Portugal and Greece.”

-ORly?

https://research.stlouisfed.org/fred2/series/GRCGDPDEFQISMEI

https://research.stlouisfed.org/fred2/series/PRTGDPDEFQISMEI

https://research.stlouisfed.org/fred2/series/ESPGDPDEFQISMEI

19. March 2016 at 20:22

Or compare this:

https://research.stlouisfed.org/fred2/graph/?g=3Qco

to this:

https://research.stlouisfed.org/fred2/graph/?g=3Qcn

What internal devaluation are you talking about?

19. March 2016 at 20:24

Jose

You don’t think you’re missing anything reading pk? If you had read his stuff you would have known since the beg of the financial crises that an expansion of the monetary base wouldn’t by inflationary that interest rates would stay low that cutting spending in a recession is disastrous while at the zero bound and qe efforts didn’t amount to the debasement of our currency. You missed a lot.

19. March 2016 at 20:26

I think a lot of people in your industry made the exact opposite predictions.

19. March 2016 at 23:28

James E

And he’d have learned in 2012 that the US fiscal cliff in 2013 would have thrown the US back into a recession.

19. March 2016 at 23:50

Flat wages per hour but increasing hours worked. Not happiness yet, they are in the Euro after all. But it’s a better situation than not having the extra hours to work.

http://www.cso.ie/en/releasesandpublications/er/elcq/earningsandlabourcostsq32015finalq42015preliminaryestimates/

19. March 2016 at 23:56

Charts 3 and 5 in the above link seem to show no recovery in hours worked in Ireland until the 5% cut in nominal wages per hour

20. March 2016 at 00:43

E.Harding,

I was talking about the link Gordon gave. See the third chart from the top. This is the chart, in particular, I was talking about: http://www.economonitor.com/wp-content/uploads/2014/02/wood1.png

20. March 2016 at 00:47

(Oh, for a comment edit function)

“Third chart from the top” should be “first chart from the top”

20. March 2016 at 02:51

“qe efforts didn’t amount to the debasement of our currency”

yep, we were fortunate that almost all other countries debased theirs simultaneous to us. kept the ratios stable.

20. March 2016 at 08:57

Derivs

You’re completely wrong. Paul Ryan chastised been Bernanke in 2011 for debasing our currency through monetary policy. A few months later the ecb raised interest rates. Those on the right just can’t admit when they’re wrong

20. March 2016 at 11:54

Daniel. You said:

“I think it’s fair to judge a man by his enemies.”

What do you make of the fact that Hitler’s enemies were the communists?

James, You said:

“Just as the U.K saw a boost in growth after letting up on austerity i.e stopped banging their head against the wall Ireland is experiencing the same.”

Oh really, then why did prominent Keynesians fail to predict the pickup in growth when the austerity (supposedly) let up. And why did Keynesians wrongly predict a slowdown in growth in the US in 2013, when the deficit fell from $1.06 trillion to $560 billion, and yet growth actually sped up?

James, You said:

“With all due respect Mr. Sumner I think this quote by you know who was intended for you. Especially the levels and rates bit.”

I hope not, because it doesn’t apply to me. My analysis is no more anecdotal than Krugman’s.

Anand, You said:

“I agree with the commenter above that this is not an accurate characterization of the Krugman post.”

Please tell me which of my sentences is misleading. Be specific.

And there is much more to AS than “internal devaluation.”

Steven and Jose, Thanks for that info.

James, You said:

“If you had read his stuff you would have known since the beg of the financial crises that an expansion of the monetary base wouldn’t by inflationary that interest rates would stay low that cutting spending in a recession is disastrous while at the zero bound and qe efforts didn’t amount to the debasement of our currency.”

Don’t you think my predictions have been far more accurate than Krugman’s?

20. March 2016 at 11:58

“You’re completely wrong”

OK, so Europe didn’t print lots of money at the same time? See, If you print lots of money and the other guy doesn’t, and currency value stays the same, I suggest you keep printing money and go shopping until you own all their stuff.

“A few months later the ecb raised interest rates”

Huh? you’re almost sailing on the QE3 by now…. and why should I care about interest rates in 2011? The fun part was way over by then…

20. March 2016 at 14:10

What do you make of the fact that Hitler’s enemies were the communists?

Oh, if only things were as black and white in reality as they are in the stories people like to tell themselves.

Personally, I’m very amused by all these liberal types who claim to value democracy as an end unto itself, only to discover that the proles are quite fond of fascism.

Their solution ? Abolish the proles, of course.

How about not pissing off the proles in the first place ?

20. March 2016 at 16:52

Scott, you’re such a tease.

*What* caused the Irish spike (and Brazillian slide)?

20. March 2016 at 17:28

Daniel, If you don’t answer my questions then I won’t respond to you in the future. Now I’ll ask you again,

“What do you make of the fact that Hitler’s enemies were the communists?”

A yes or no would suffice.

Awacs, Ireland has better supply-side policies than Brazil. That’s not the only difference, but it’s one of them.

20. March 2016 at 17:48

Mr Sumner you said

“Oh really, then why did prominent Keynesians fail to predict the pickup in growth when the austerity (supposedly) let up”

Actually they did. Their theory clearly says that growth can ensue after austerity via internal devaluation but that this process is extremely painful. In fact this is what happened in Ireland. Spending cuts lead to unemployment which led to a decrease in wages which lead to an increase in competitiveness which led to exports. These exports replace the demand lost from austerity which leads to growth. This is textbook Keynesianism. But since prices are sticky hence wages are sticky this process takes too long.

you said “And why did Keynesians wrongly predict a slowdown in growth in the US in 2013, when the deficit fell from $1.06 trillion to $560 billion, and yet growth actually sped up?”

They were probably too busy combating unfounded theories like expansionary austerity put froth by Alberto Alensia or a fiscal cliff if the debt-to-gdp ratio passes 90% put forth by Ken Rogoff. Or when Jean-Claude Trichet said “confidence-inspiring policies (aka austerity) will foster and not hamper economic recovery.

But wait. We’ve seen U.S gdp look solid just to go back in reverse for many years now. Krugman and the like we’re prob saying “ya decent numbers but lets not make the same mistake we made when recovery was under way during the great depression”

You said “Don’t you think my predictions have been far more accurate than Krugman’s?”

I’m late to game with your blog but will try to keep up now.

21. March 2016 at 00:59

Yes or no to what ?

What I make of that is that Hitler was obviously better than the Reds. Which is backed up by the historical record.

I will also tell you this – as someone born behind the Iron Curtain (before it fell), Westerners greatly underestimate the seriousness of the Red threat.

And seeing as how most modern historians are outright communists (they like to call themselves “progressives”, to confuse outsiders), I’d say the real story of what happened in the 1930s is still waiting to be told.

21. March 2016 at 04:57

Scott,

You linked to two blog posts. They were both making different points.

The Ireland post was simply making the point that Ireland’s performance up until that point was nothing to crow about. For the period of 2008-2013 (when Krugman’s post was written), this is undeniably true. Five years is not a short period.

The second unrelated post is looking at the performance of Argentina and Brazil. And a graph where Argentina’s growth was respectable for a very long period (2002-2012). He was saying that Argentina is depicted in negative terms, which is correct (isn’t it?). Again, 10 years is not a short period. There is no indication that Krugman prefers Brazil to Ireland.

Of course there are problems with all governments, Argentina, Brazil, Ireland, US whatever.

There is plenty of misleading stuff here, but I suppose the main one is connecting the two posts which have no connection, and neglecting to mention the point of the two posts. So, I suppose the main objection is to the sentence: “So what type of economic model does Krugman like?”

21. March 2016 at 05:36

@James Elizondo

I did not need to read PK to reach that conclusion back in 2008 (that monetary policy was tight). I wrote an article in the most prestigious financial newspaper in Brazil(Valor) at the time about that. Unfortunately, the link is not up anymore, and it is in portuguese, otherwise I would post it here.

PK has not produced anything new or meaningful for more than a decade now. It is plain keynesianism , you can read it directly from Keynes, you don’t need PK to translate it for you.

21. March 2016 at 05:41

“The second unrelated post is looking at the performance of Argentina and Brazil. And a graph where Argentina’s growth was respectable for a very long period (2002-2012).”

Argentina/Brazil… These are poorly managed balance sheet countries, they benefited from being completely exposed to commodity pricing. Congratulating them on their success from ’02-’12 is little different than congratulating the leaf for making it downstream believing the leaf has some navigational skills as opposed to recognizing the effect of the current.

So did Argentina benefit from the fact they had their currency demolished in 2001, or because the price of goods they produced went globally hyperbolic starting in 2002. I know which one I pick.

21. March 2016 at 06:18

James, You said:

“Actually they did.”

Actually they did not. They were widely criticized in the blogosphere for failing to predict the pickup in British growth. Here’s one of my favorites, from Britmouse:

“I find it astonishing that Krugman and Wren-Lewis, having done post after post in 2012 describing how the UK does have real fiscal austerity in 2012, are suddenly happy to now argue that a relaxation of fiscal austerity in 2012 is the “reason” for GDP recovery in… erm, 2013.”

The Keynesians also failed to explain why the slow UK recovery consisted of slow productivity growth and fast jobs growth. In the Keynesian model austerity affects jobs, not productivity.

Or how British fiscal policy could have been considered “austerity” at a time when the UK had one of the 2 or 3 largest budget deficits in the world.

As far as “internal devaluation”, Krugman says wage cuts are contractionary, not expansionary. Remember his “paradox of toil” paper with Eggertsson?

You said:

“I’m late to game with your blog but will try to keep up now.”

Let me fill you in. I made all the correct predictions that Krugman made, and lots of correct one’s where he was wrong. In early 2013 Krugman predicted a slowdown in the US due to austerity, and said that 2013 would be a “test” of market monetarists like me, who predicted the austerity would be offset by monetary stimulus. We were right. In 2014 he predicted no increase in job growth due to ending extended unemployment benefits, whereas I said there’d be a modest increase in jobs (there was). He suggested that Japan might not be able to depreciated the yen if they wanted to. I said they could, and the Abe government showed I was right.

Daniel, Since you are a little slow, let me help you out. You cannot judge a person by the quality of their enemies. If you could, then Hitler would have been a great man, because the German communists were awful. Not only were you unable to answer my question, but you thought my analogy was somehow defending the communists.

Anand, You don’t seem to understand how blogging works. When I link to some posts that does not imply I am commenting on those posts. Is that clear? I was not commenting on the two posts I linked to. I was commenting on the specific assertions that I quoted. I linked to show people that the quotes are not taken out of context. And they were not. Krugman really does think the socialists provided good leadership to Brazil. He really did laugh at the notion that Ireland was the country of the future.

Of course I agree that ECB policy was bad, I’ve said that many more times than Krugman has. But unlike Krugman, I also think supply side policies are really important, and largely explain why Ireland did better than Greece.

21. March 2016 at 06:41

Mr. Sumner- I see. Thank you for your response.

@Jose Romeu Robazzi

“I would add that Brazil is a Keynesian dream economy: heavily regulated , hihg taxes, high transfer taxes (all the “stimulate” investment and demand), loose monetary policy to stimulate demand …. But it clearly does not work. Corruption is a nasty detail on top of the really damaging Keynesian model.”

I don’t have a Phd in econ but this a is terrible representation of Keynesianism. Models/theories are used to answer specific questions. Keynes can provide us with a means of thinking about how economies operate when running at less than full employment. What are the implications of fiscal policy at the zero bound? As Mr. Sumner points out it doesnt have all the answers. But show some respect by at least representing the theory correctly.

21. March 2016 at 06:57

Prof Sumner, you are letting your Trump Derangement Syndrome get the better of you.

The way I see it, the Left has gone completely bonkers and clearly needs to be brought down a notch or two.

And the fact that so many SJWs froth at the mouth tells me that he might just be able to do that.

A little bit of repression does a society good.

21. March 2016 at 08:47

@James Elizondo

Keynes said, in chapter 24 of the General Theory:

“In some other respects the foregoing theory is moderately conservative in its implications. For whilst it indicates the vital importance of establishing certain central controls in matters which are now left in the main to individual initiative, there are wide fields of activity which are unaffected. The State will have to exercise a guiding influence on the propensity to consume partly through its scheme of taxation, partly by fixing the rate of interest, and partly, perhaps, in other ways. Furthermore, it seems unlikely that the influence of banking policy on the rate of interest will be sufficient by itself to determine an optimum rate of investment. I conceive, therefore, that a somewhat comprehensive socialisation of investment will prove the only means of securing an approximation to full employment; though this need not exclude all manner of compromises and of devices by which public authority will co-operate with private initiative. But beyond this no obvious case is made out for a system of State Socialism which would embrace most of the economic life of the community. It is not the ownership of the instruments of production which it is important for the State to assume. If the State is able to determine the aggregate amount of resources devoted to augmenting the instruments and the basic rate of reward to those who own them, it will have accomplished all that is necessary. Moreover, the necessary measures of socialisation can be introduced gradually and without a break in the general traditions of society.”

21. March 2016 at 08:52

The ADL said they are returning Trump’s donations.

Just one more Valu-Rite-soaked hobo tossed into the flaming dumpster of this campaign. Can’t wait to watch it go over the cliff this fall!

21. March 2016 at 13:23

Keynes was just a man. May be hard to believe but Keynesian theory can be separate from what the actual person that the theory stemmed from.

22. March 2016 at 18:38

Talldave, I see that (in polls) Trump trials that socialist Cuba fan Bernie Sanders by 11% in that ultra-blue state called “Utah”. Well done, GOP primary voters!!

23. March 2016 at 07:13

Scott:

I retract my statement that you “mischaracterized” the Krugman piece, which implies bad faith on your part.

I’ll just say that I read it differently than you did, and leave it at that.

24. March 2016 at 13:16

Thanks Jonathan, We’ll have to just agree to disagree.

25. March 2016 at 09:38

Scott

Not sure it’s meaningful to talk about Ireland at all. It would rank about 26th if were in the GDP league table of US states – the position of Alabama. It ranks 8th in the Eurozone and is just 2% of Eurozone GDP.

26. March 2016 at 07:43

James, Ireland trails only Luxembourg in per capita GDP, within the EU. That’s impressive for a country that was relatively poor when I was young.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita