Peak fiscal indiscipline

For quite some time, I’ve been beating the drum on the reckless nature of fiscal policy, and now the media is getting on board. Craig Torres and Liz Capo McCormick have an excellent piece in Bloomberg:

“Austerity is going to be on nobody’s platform for the foreseeable future,” said Lou Crandall, chief economist at Wrightson ICAP. Democrats and Republicans will push the U.S. toward “peak fiscal indiscipline” over the next couple of years, he said.

What both parties have learned is that, for now, the debt-carrying capacity of the economy appears to be high. One reason is the U.S. continues to be the world’s biggest provider of safe assets.

“We are the prettiest pig in the pig pen and we will be so for some time,” said David Beckworth, a senior research fellow at the Mercatus Center at George Mason University. “We have greater debt capacity than we thought we had.”

David’s right. Unfortunately it’s as if you told an alcoholic that they had more money in their bank account than they thought. But now there’s a new concern; Congress is discovering that they passed a law back in 1978 that requires the Fed to engage in monetary offset:

Democrats soon to be in command of the House of Representatives are pushing for infrastructure spending and a wider distribution of gains to workers from a hot job market. Republicans want economic growth to accelerate from their tax cuts, deregulation and defense spending. Steadily rising interest rates can appear contrary to both goals. . . .

“On the House front, there will definitely be more criticism [of the Fed]. They will say clearly we have good outcomes, so what’s the hurry?” said Edward Al-Hussainy, a senior analyst for interest rates and currencies with Columbia Threadneedle Investments. “On the Republican side, the question will be, ‘If we roll out more stimulus, are you going to offset it? That doesn’t work for us.”

Offset!?!? There’s that horrible word again.

I’m having a lot of trouble selling people on the idea of having the Fed self-evaluate past monetary policy decisions, and report the results to Congress. People look on this as an ordinary public policy issue, where there are different points of view, different special interest groups, a CYA attitude among policymakers, etc. But monetary policy is nothing like ordinary public policy issues. With a normal public policy issue, there might be a debate about whether higher interest rates are a good or bad idea, but at least both sides would agree as to what sort of policy produces higher interest rates. In this case, Congress even lacks that basic knowledge. Congress doesn’t have a clue as to how to evaluate monetary policy, and really does need help from the Fed. I don’t doubt there are people in Congress who favor capping inflation at 2%, and who also want the Fed to engage in a pro-growth policy.

The Dems seem to think that easy money will raise real wage rates, as prices are more flexible than wages. If anything, it would lower real wage rates in the short run. Indeed real wage growth has slowed since Trump took office, partly because monetary policy has gotten easier. The GOP seems to think that military spending will boost growth, which against seems very unlikely. Although it’s especially difficult to figure out what the GOP believes, because their views seem to change radically from one year to the next.

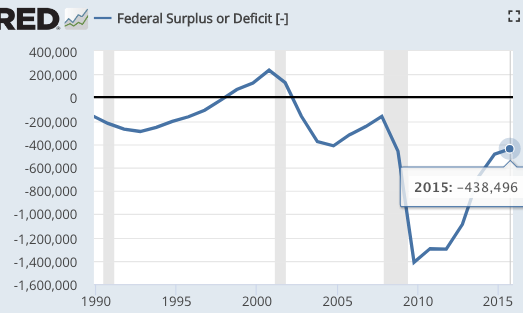

During my first 7 years of blogging, I frequently pointed out that the GOP didn’t really favor small government, as when they finally took all three branches of government in 2001 they went on a deficit spending spree. A number of commenters assured me that the Bush GOP was gone, and the party was now controlled by small government Tea Party types. They were right in one respect, this is not the Bush GOP. Deficit spending today is far higher than anything imagined by Bush, with the deficit expected to exceed $1 trillion next year, even as unemployment falls to 3.7%. The Tea Party? They love it, as long as Trump keeps trolling the liberals.

The Dems are deeply misguided on many economic issues, but at least the party still has tiny traces of idealism. The idealists in the GOP are either dead (McCain), retiring (Ryan, Flake, Corker), or “changed” (Graham.) No matter how cynical I get, I can’t keep up.

To be sure, there will be no immediate crisis. The US has an enormous ability to borrow money, especially at these low rates:

Following the passage of the Republican’s Tax Cut and Jobs Act of 2017 — which rocketed projections for debt held by the public to 96.2 percent of gross domestic product by 2028 from 76.5 percent in 2017 — 10-year Treasury yields are hovering around 3.19 percent compared with 2.4 percent at the end of last year.

But keep two things in mind. First, this trend is unsustainable. Second, even this unsustainable path is the “rosy scenario”, assuming no recession in the next decade. I’m actually more optimistic than the average economist on that score, but even I believe it’s unwise to base fiscal policy on that sort of optimistic assumption.

Politically, however, my argument is a loser. The cost of a reckless fiscal policy, a reckless monetary policy, a reckless bank regulatory policy, a reckless global warming policy, and a reckless foreign policy, are not likely to occur until after the 2020 elections. And to a politician, nothing after 2020 matters.

So how large a debt should we have? I don’t know, but that’s not really the point. Even if I’m wrong, and more US debt would be helpful in meeting the global need for “safe assets”, that is not a reason to run massive, irresponsible budget deficits. Rather you’d want to create a sovereign wealth fund, and use the fund in later decades to meet the fiscal needs of retiring boomers. Of course we don’t have the foresight of a Norway or Singapore, and are becoming more banana republic-like by the day.

There’s a long historical record of populist economic policies, and in almost every case it hasn’t ended well. Let’s hope Powell can withstand the pressure.