Before you call me a moron . . .

You might wish to consider whether you and I hold the same views. Here’s a brand new commenter named kipd:

stats are made to be manipulated and then lied with you moron. try some time out here in the real world. EVERY business I can see needs people. I’m building a house. EVERY sub is begging for people. this crisis did not exist 3 years ago. you exemplify the “elitist” leftists of the phantasy utopia of big cities and college campuses.

Of course I agree that there’s a tremendous shortage of workers. I’ve discussed that problem in dozens of posts, well before most other pundits. So why does kipd assume that I disagree with him or her? (Based on the tone, I’m guessing “him” is the preferred pronoun.)

I presume it’s due to my recent post about the myth of the “missing workers”, the idea that workers left the labor force during Covid and never returned.

There are no missing workers; employment is at an all time high. The very real labor shortage is due to the huge surge in aggregate demand triggered by a recklessly expansionary Fed monetary policy. Full stop.

We have more than enough workers to produce an equilibrium level of output. But due to the high level of demand, firms are trying to produce a level of output far beyond equilibrium. We have a worker shortage, despite not having any missing workers. So tell me kipd, who’s the moron?

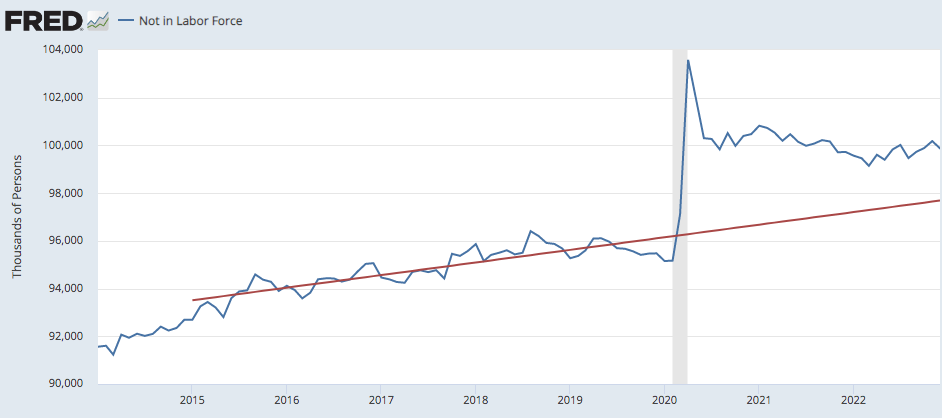

Another commenter linked to this graph:

I hate it when people draw trend lines over cyclical data; they seduce us into seeing patterns that are not there. It’s like drawing a line from the 2009 trough to the 2019 peak for “trend RGDP”. This is done all the time, and probably deserves a new post. But I’m too lazy.

The problem here is that the trend growth in “not in labor force” is gradually accelerating over this entire period, due to the increasing retirement of boomers. During economic booms such as the late 2010s, the rate of growth slows briefly. But the underlying trend is rising, and is steeper than the line shown on this graph. Draw a slowly rising trend line through the very first and the very last point, and you’ll have a more accurate read of the actual trend. The late 2010s are below the actual trend line due to the cyclically strong economy. (Just as RGDP growth was above trend.)

Tags:

11. April 2023 at 14:55

I suspect that a couple generations of ‘labour shortages’ would decrease polarization in America.

But I cannot prove that.

11. April 2023 at 15:21

Clearly kipd has a hard time differentiating between a shortage of something and something missing, the poor thing.

11. April 2023 at 21:49

Solon, It would also lead to hyperinflation.

11. April 2023 at 23:38

“Solon, It would also lead to hyperinflation.”–SS

Well, not sure.

Japan has had a lot more job-openings than jobseekers since 2016 or so. In 2019, about 160 opening for 100 job-hunters (pre-C19).

Now, back to 130-ish to 100.

The Japanese rate of inflation rose after C19 and the ratio lessened towards more “balance.” Of course, as usual, many complicating factors.

The BoJ says the nation’s inflations rate, now around 3%, is temporarily high, even as job-openings again outstrip job-hunters.

Japan just doesn’t seem set up to sustain wage inflation. The BoJ and government leaders are pressuring the private sector to raise wages. It doesn’t happen.

In theory, it should. In reality, it does not.

Maybe in the US tight labor markets would lead to more inflation. Hyperinflation? Or 4% inflation?

12. April 2023 at 03:31

I just started your new e-book. Maybe I will finally understand what monetary policy is. Or what it might be. Although I doubt it.

If we have worker shortage due to high aggregate demand—-if the demand is nominal why should there be a worker shortage? In the end we make things and create services. If it’s high real demand——-is that bad? I guess it depends if we are spending savings. Is inflation bad?——only if we think it will be X but ends up being Y.

I am pretty sure you know these answers. I don’t however.

12. April 2023 at 05:55

Solon, Scott’s point is the only way to have unemployment below the natural rate is to have unexpected inflation, and therefore, the only way to sustain unemployment below the natural rate is to keep surprising everyone again and again with higher-than-expected inflation, and that (obviously, I hope) leads to hyperinflation.

Markets are stubborn things.

12. April 2023 at 06:14

Scott, could you unpack your comment about how expansionary monetary policy increased aggregate demand which led to the labor shortage? Essentially, I am not sure if you are referring to ZIRP or COVID stimulus (because that would be fiscal), or something else entirely. In my mind, ZIRP could have a lot to do with our current situation if businesses used ZIRP to invest in expansion, which then required more workers to realize returns on those investments, only to eventually run into the brick wall of reality, i.e. the shortage of available workers. This could especially be troublesome if many businesses are doing this at the same time and fighting over the same shrinking pool of workers, causing wages to increase and affecting prices.

12. April 2023 at 06:32

Ken Duda:

Theoretically, what you say is true.

Then one can ponder what is the “natural rate” of unemployment:

“The natural unemployment rate is the minimum unemployment rate resulting from real or voluntary economic forces. It represents the number of people unemployed due to the structure of the labor force, such as those replaced by technology or those who lack the skills to get hired.”—Investopedia.

Well, geez, this does not seem illuminating. A tautology?

Japan was sinking into deflation when it had 160 job openings for every 100 job-seekers (2016-2019).

You know, culture or social standards may be stronger than macroeconomists think.

For example: Suppose I offered you a sum of money, with assurance of never being caught, to commit a foul act.

You would likely decline. Why? You could make $100k for kicking an old lady down a flight of stairs. An hour’s work. You wouldn’t do it.

Why are wages in Japan so flat, despite very low unemployment, and repeated efforts by government to jawbone industry into raising wages?

Could it be that some social norms trump theories?

Theories are nice. They are theories.

12. April 2023 at 07:30

Solon, Japan doesn’t have inflation because they don’t have NGDP growth. The Japanese labor market has adjusted to that reality, but it’s certainly not wildly overheated.

I think you might have misunderstood my claim. I’m not saying the US cannot have a strong labor market and stable prices, that’s been done before (as in 2019, when unemployment was 3.5%). But if you want a labor shortage like we have today, you will have high inflation.

Tyler, Just look at the NGDP growth rate (and level), which is the best indicator of the stance of monetary policy. But if you insist on Fed “concrete steps”, they did have zero rates and lots of QE, despite a booming economy.

12. April 2023 at 09:36

Anecdotally, a very large number of boomers at my employer who were likely to retire in the next 5 years instead chose to retire promptly at the onset of pandemic. Going to work simply stopped being fun for a while there so they chose to call it quits. Looking at that graph of people outside of the workforce, the narrative of early retirements followed by a reduced number of retirements for several years appears to line up with the numbers.

But to be clear, that’s a short-term loss of employees as they were all going to retire anyway. I strongly suspect that our employee shortage will run its course over roughly five years starting March, 2020.

12. April 2023 at 13:51

Randomize, Good point.

12. April 2023 at 16:12

Scott Sumner:

Well, I have given up having opinions about most things. Maybe you are right.

Another one is Indonesia. The central bank there directly bought government bonds to get the nation through the pandemic.

The Indo rupiah is still appreciating in forex markets. The national government is not indebted to foreign bondholders, there is no risk of default. It seems to have worked.

But that is heresy, no? The Indo government should have borrowed in global bond markets? Instead of just printing the money?

“If you are not confused…then maybe you do not understand the situation.”–Uncle Jerry

12. April 2023 at 23:27

A little bit of cherry-picking going on in this post by Scott Grannis, but…mostly true I think.

…

“My take: There are only two things you need to know about inflation today: 1) without the Owners’ Equivalent Rent component (which makes up about one-third of the CPI), the CPI would have declined at a -1.6% annualized rate in March, and 2) OER inflation has peaked and will almost surely decline significantly in coming months. In short, our national inflation nightmare is over.”

—30—

Lots of charts, everything shows softening inflation.

Inflation cooling also in mainland China, India, Japan and India.

I think we are going back to possible deflation?

The Bank of Japan thinks so, for Japan.

https://scottgrannis.blogspot.com/

13. April 2023 at 05:28

Solon, I lived through the 1970s. I recall all of the “If not for X inflation would be low” articles. Don’t be seduced.

13. April 2023 at 07:28

Do you remember when Sumner told us everyone should wear a mask because they help prevent Covid.

Well, today we received yet another study that proves his commenters were correct — you know the ones he booted from his site — and that Sumner was wrong.

A report published by the UK Health Security Agency (UKHSA) found that “no evidence could be presented” to prove medical-grade face masks protected vulnerable people from COVID.

The study investigated whether so-called high quality masks such as N95, KN95 and FFP2 coverings helped protect vulnerable people in the community from catching the virus.

The result: no evidence.

But isn’t that what every smart person has said over the last three years, including Fauci, before he succumbed to the propaganda machine? Isn’t it just common sense to those with an inkling of intelligence that microns are just too damn small, and that big holes in a cloth mask or even an N95 mask are not going to work….

Perhaps you ought to apologize to Peter McCullough now, for calling him “anti-science” and a “moron” which you did twice.

Or maybe…just maybe…you ought to look in the mirror and ask who the moron really is. Is it Peter, or is it you?

Incidentally, there is also another published study that shows ugly people prefer to wear masks. Maybe this is one reason why Scott spent three years yelling at Alabama republicans for having maskless BBQ’s and enjoying their life. He hopes beyond hope that masks stay on forever…

But I guess I can’t blame him. If I had a mug like that I’d probably prefer a mask too. Even Freddy cougar looks better.

13. April 2023 at 08:19

Edward, Yes, doctors almost everywhere have worn masks for 100 years because they just don’t like the look of their own faces.

The well designed studies show that masks do work. The crappy studies have mixed results.

13. April 2023 at 08:32

Edward, LOL, are you talking about this study?

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1139633/The-effectiveness-of-N95-masks-as-wearer-protection-against-COVID-19-in-community-settings-in-people-at-higher-risk-from-becoming-seriously-ill-from-COVID-19-A-rapid-review.pdf

Do you know how to read? The new study wasn’t looking at spread control. Here’s what they found if you do:

“Note that this review focussed on a specific type of face mask and population; in a previous review (2), we concluded the evidence predominantly suggested that face coverings (of any

type) can reduce the spread of COVID-19 in the community, through both source control and wearer protection, as well as universal masking.”

13. April 2023 at 13:59

Speaking of morons, I foolishly read an article on CNN where they described how Jeremy Grantham has superpowers that allow him to predict asset bubbles. They quoted him as saying “something is going fall apart, it’s just a matter of time…” (I paraphrase, but that’s the gist)

Amazing. Really amazing.

13. April 2023 at 20:22

Someone else already linked to this in the comments to your prior post, but I didn’t see a response from you. But basically the employment trend for men isn’t great. A lot of social problems are associated with male joblessness.

https://fred.stlouisfed.org/series/LREM25MAUSA156S

14. April 2023 at 01:45

SS—I wore bellbottoms through the 1970s. Diddled with fortran cards.

Something tells me this inflation-scare passes sooner rather than later.

Well, let us wait and see.

14. April 2023 at 06:49

FYI, Yes, that’s true. But it’s a separate issue from the cyclical movement in jobs. It relates to long run trends like increasing disability.

Solon, Sure, inflation is likely to decline, but the specific article you provided is not a good reason for believing that.

14. April 2023 at 14:34

Scott,

Are you saying that its impossible for Wages to go up and inflation to stay the same? Is it possible for wages to rise 5% and inflation to go up by only 2%?

14. April 2023 at 14:40

Dr. Richard, That’s theoretically possible, but as a practical matter you need about 3% wage growth to hit the 2% inflation target. That’s what the Fed should aim for.

15. April 2023 at 01:50

Why do you say “Full Stop.”

I know you hear this term on t.v., which is used by the young and quite frankly rather dumb journalists, but don’t you ever analyze these terms before you copy the lingo?

Science is never ‘full stop’

No opinion, in any industry, is ever ‘Full stop’

It’s a nonsensical term, and the fact that you use it says something about your intellectual ability.

15. April 2023 at 07:17

Ron, How about “Get a life”? Is that intellectual enough for you?

15. April 2023 at 23:46

“Solon, I lived through the 1970s”

And the ‘difference’ today?

No ‘BAU’?

‘Most’ ‘economic thinking’ is ‘short run’ and ‘redundant’? ‘It’ ignores the ‘supply side’? ‘Growth’ {and ‘civilisation’} depends upon ‘cheap’ F.F. – those so called ‘halcyon days’ are ‘over’. ?

“The crisis now unfolding, however, is entirely different to the 1970s in one crucial respect… The 1970s crisis was largely artificial. When all is said and done, the oil shock was nothing more than the emerging OPEC cartel asserting its newfound leverage following the peak of continental US oil production. There was no shortage of oil any more than the three-day-week had been caused by coal shortages. What they did, perhaps, give us a glimpse of was what might happen in the event that our economies depleted our fossil fuel reserves before we had found a more versatile and energy-dense alternative. . . . That system has been on the life-support of quantitative easing and near zero interest rates ever since. Indeed, so perilous a state has the system been in since 2008, it was essential that the people who claim to be our leaders avoid doing anything so foolish as to lockdown the economy or launch an undeclared economic war on one of the world’s biggest commodity exporters . . . And this is why the crisis we are beginning to experience will make the 1970s look like a golden age of peace and tranquility. . . . The sad reality though, is that our leaders – at least within the western empire – have bought into a vision of the future which cannot work without some new and yet-to-be-discovered high-density energy source (which rules out all of the so-called green technologies whose main purpose is to concentrate relatively weak and diffuse energy sources). . . . Even as we struggle to reimagine the 1970s in an attempt to understand the current situation, the only people on Earth today who can even begin to imagine the economic and social horrors that await western populations are the survivors of the 1980s famine in Ethiopia, the hyperinflation in 1990s Zimbabwe, or, ironically, the Russians who survived the collapse of the Soviet Union.” ?

https://consciousnessofsheep.co.uk/2022/07/01/bigger-than-you-can-imagine/

“It is this belief in a new digital revolution which gave rise to the much-derided article by Danish politician, Ida Auken – originally titled “Welcome to 2030: I own nothing, I have no privacy, and life has never been better.” More popularly known as “you’ll own nothing and you’ll be happy.” It is a world of digital currencies and digital IDs, vaccine passports and 15-minute cities, electrification and driverless cars. All of it based around the “energy too cheap to meter” from wind turbines and solar panels, and all of it operated by autonomous artificial intelligence within the “singularity” of the “internet of things.” It is a mirage, of course… one only visible to so-called “virtuals” – people whose lives and careers are now so detached from the material world that, were there not so many of them, could otherwise be diagnosed as certifiably in$ane. The real world, meanwhile, looks more akin to the second global collapse – the first being the collapse of the integrated economies of the Bronze Age Eastern Mediterranean empires sometime around 1186 BCE. The majority of ordinary people have seen their living standards decline over the past two decades – a process compounded and accelerated by two years of lockdowns followed by a year of self-destructive sanctions on key resources.”?

16. April 2023 at 07:12

Sumner’s right: “The very real labor shortage is due to the huge surge in aggregate demand triggered by a recklessly expansionary Fed monetary policy. Full stop.”

DeSantis recently railed at the FED’s egregious blunders in the WSJ. Biden’s and the FED’s errors are front and center.

The Keynesian economists have achieved their objective, that there is no difference between money and liquid assets.

The commercial banks are credit creators. The non-banks are credit transmitters. Lending/investing by the DFIs expands both the volume and the velocity of new money. Lending by the NBFIs increases the turnover of existing deposits (a transfer of ownership), within the commercial banking system. The NBFIs are the DFI’s customers.

See https://fedguy.com/

Primer: A Deposit’s Life

16. April 2023 at 08:20

Greenspan at the July 1997 FOMC: “As you may recall, we fought off that apparently inevitable day as long as we could. We ran into the situation, as you may remember, when the money supply, nonborrowed reserves, and various other non-interest -rate measures on which the Committee had focused had in turn fallen by the wayside.

We were left with interest rates because we had no alternative. I think it is still in a sense our official policy that if we can find a way back to where we are able to target the money supply or net borrowed reserves or some other non-interest measure instead of the federal funds rate, we would like to do that.

I am not sure we will be able to return to such a regime…but the reason is not that we enthusiastically embrace targeting the federal funds rate. We did it as an unfortunate fallback when we had no other options…”

N-gDp targeting is the answer.

16. April 2023 at 09:07

Atlanta gDpnow’s latest estimate for R-gDp in the 1st qtr.: 2.5 percent — April 14, 2023. That combined with the inflation rate puts N-gDp too high.

16. April 2023 at 16:03

Not that it will change anyone’s mind, but there is a brand-new study that supports ssumner’s analysis regarding the trends for labor force participation. The TLDR is the labor force participation rate, and by extension, the Not In Labor Force, are right about at the levels they would have been had the pandemic never happened.

Here’s the paper:

https://www.brookings.edu/wp-content/uploads/2023/03/BPEA_Spring2023_Abraham-Rendell_unembargoed.pdf

Here’s Reuters’ summary of the findings:

https://www.reuters.com/world/us/us-labor-force-gap-mostly-due-pre-pandemic-trends-study-finds-2023-03-30/

20. April 2023 at 07:31

Scott, your quote is about previous studies. The current mask study took these into account along with other high quality studies and concluded “Despite screening 4,371 primary studies, as well as all studies included in our previous review of the effectiveness of face coverings (2), no studies were found that examined the effectiveness of N95 and equivalent face masks as wearer protection against COVID-19 when used in the community by people at higher risk of becoming seriously ill from COVID-19.”

Masks are effective against a number of infections, just not ones like COVID. Even studies done before covid were getting poor results on masks. It’s been a contentious topic for a while. Took along time to get doctors to wash their hands too.

20. April 2023 at 12:26

TMC, The point is not “wearer protection”, it’s protecting society from the wearer. That’s where masks are most effective.

1. June 2023 at 06:40

One counter-argument is that the total employment measured by FRED measures the total number of jobs not the total number of people with jobs. Hence total employment is higher because more people are working multiple jobs. But I do agree the bigger issue is too excessive demand for labor above equilibrium.