A long strange trip

For readers who don’t already know this, my new blog is over at Substack:

scottsumner.substack.com

This will be my final Money Illusion post. The blog began on February 2, 2009. But the events that led to the blog took place in late 2008. Indeed my life can be divided into two segments, before and after September 16, 2008. It was that specific Fed meeting that radicalized me, and which led me to create this blog.

Originally, I planned to go back and review my first few posts, to see how they compare to my current views. I’ve decided to do that on September 16th, over at my new blog. That’s the 16th anniversary of a Fed meeting that Ben Bernanke later described (in his memoir) as a mistake:

At the end of the discussion we modified our planned statement to note market developments but also agreed, unanimously, to leave the federal funds rate unchanged at 2 percent.

In retrospect, that decision was certainly a mistake. Part of the reason for our choice was lack of time—lack of time in the meeting itself, and insufficient time to judge the effects of Lehman’s collapse.

I’m not going to thank all the people that helped me along the way, as I’m so forgetful I’d leave out lots of names. The general categories include the other market monetarists, other bloggers, my commenters, my colleagues at Bentley, and my wife and daughter (who had to sacrifice when I devoted too much time to blogging.)

Special thanks to Joe Weisenthal, Derek Thompson, Matt Yglesias and of course Tyler Cowen, who made September 13, 2012 the high point of my life, at least from a career perspective. And yes, the praise was excessive. (Today, that era seems a bit unreal, like another life.)

And thank God we market monetarists were able to come out ahead in our debate with the Keynesians, who predicted that (due to fiscal austerity) spending would slow sharply in 2013. It accelerated.

I also have regrets; most notably that the blog’s tone has often been too critical of people with whom I disagree, including other bloggers and policymakers like Ben Bernanke.

This blog has obviously deteriorated over time. That’s partly because the world situation has become fairly bleak. My whole adult life, I’ve strongly opposed the twin evils of socialism and nationalism. Unfortunately, the world has seen a modest resurgence in socialism and a big increase in nationalism over the past 15 years. This may have contributed to my more pessimistic tone. Burn out. Note that in some of my early posts, I pointed to the fact that previous NGDP collapses such as 1929-33 had also had this effect.

In my new blog, I hope to make the tone more upbeat and I will try hard to improve the quality. I hope to see you all there.

Tags:

1. September 2024 at 09:55

Will miss you over here, looking forward to seeing how you settle into your new home!

1. September 2024 at 13:20

Thank you for preventing macro from falling completely back into the dark ages (this claim is hard to deny IMO) and heres to many more years of blogging to come!

1. September 2024 at 17:04

To save anyone the hunt, the RSS feed URL is:

https://scottsumner.substack.com/feed

And thanks, Scott, for the years of this blog; agree or disagree, it’s always been a joy to read.

1. September 2024 at 18:06

Dear Professor Sumner,

As a former student and long-time reader of your blog, I wanted to express my gratitude for the years of insightful analysis, thought-provoking ideas, and tireless advocacy for better economic policy that you’ve shared with us all.

Your unique perspective on monetary policy, markets, and the broader economic landscape has been incredibly influential, not just for me personally, but clearly for countless readers and policymakers worldwide. Your ability to challenge conventional wisdom and present complex ideas in accessible ways has been a hallmark of your work.

I still remember the clarity and enthusiasm you brought to your lectures and office hours conversations, and it’s been a privilege to continue learning from you through this blog over the years. Your writings have shaped my understanding of not only economics but culture and politics as well.

Thank you for your dedication, your intellectual honesty, and your unwavering commitment to improving our understanding of economics. While your posts on this blog will be missed, I’m certain your influence will continue to be felt in the field for years to come.

Wishing you all the best in your future endeavors, and looking forward to seeing where you go with your new blog.

Sincerely,

Garrett MacDonald

1. September 2024 at 20:43

Thank you for the ride, Dr. Sumner. Your blog has not only served up enjoyment but has also made me a much better economist.

1. September 2024 at 23:33

Tyler Cowen has linked to your blog on Feb 25 2009, and it was a big relief and joy – I finally found a source that takes supply and demand seriously when explaining the crisis. I started reading the blog every day since then, and will continue doing that in the new place. Who knows, maybe I will start commenting again more frequently over there?

2. September 2024 at 05:18

End of an era!

Good luck with the sub stack!

2. September 2024 at 07:36

This blog taught me everything that I know about macroeconomics and monetary policy. And not just me: your efforts changed the world!

2. September 2024 at 08:06

Good luck Scott.

2. September 2024 at 10:31

Farewell OG TMI. This is where macroeconomics really came together for me. Look forward to continuing the journey at the new site.

2. September 2024 at 11:23

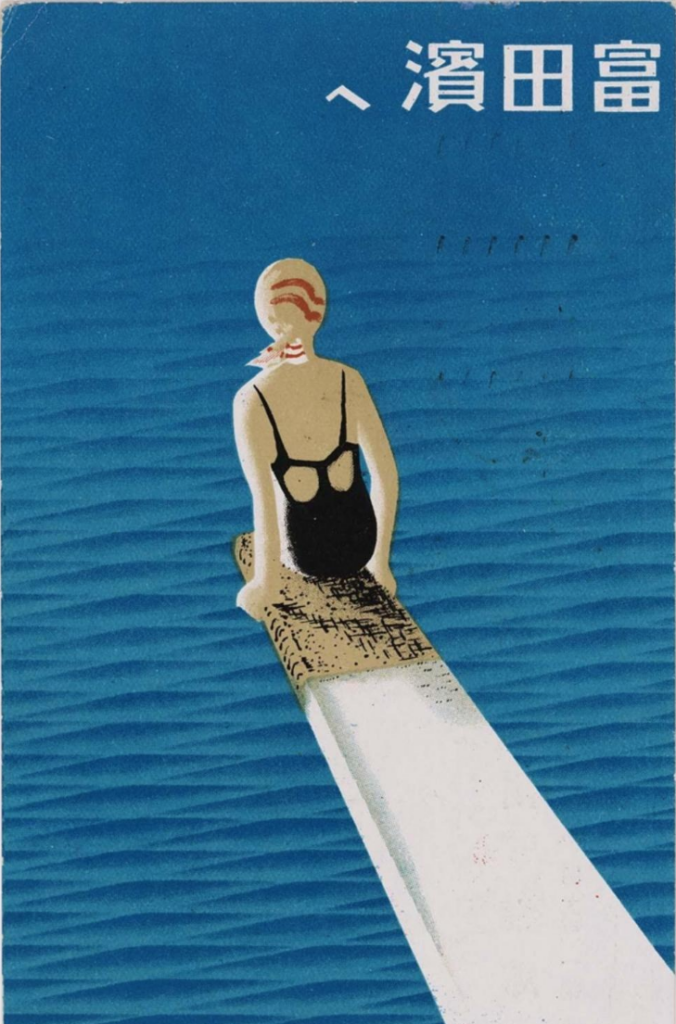

Anybody happen to know what that image is from? I believe it’s a Chinese book cover but I could be completely wrong.

Been a good run Scott, I think I’ve been following you the entire time as well. See you on substack and wish you well in your endeavors regardless.

2. September 2024 at 11:53

Thanks for all the memories, Scott! However the substack evolves, I can only hope that you continue your film reviews that I’ve enjoyed so much over the years.

2. September 2024 at 12:34

https://collections.mfa.org/objects/394661

2. September 2024 at 14:12

Everyone, Thanks for all the comments. I look forward to seeing you over at Substack.

Garrett, Good to hear from you again—hope you are doing well.

Everyone, Yes, the film reviews will continue.

Peter, The image is from a Taisho era Japanese postcard, which I’ve always liked for some reason. Maybe I just like the idea that a postcard can be a better work of art than 90% of what’s in art museums.

Paul, Yes, I first saw it at the Boston museum show.

2. September 2024 at 18:03

The Money Illusion has been an absolute pleasure to read and comment on – both insightful and entertaining! I look forward to the new blog and shall see you over there.

2. September 2024 at 19:56

This blog fundamentally changed the way I view the world. I will miss it. Thank you for all your work and good luck with the new Substack.

3. September 2024 at 14:26

Thanks, I enjoyed your comments.

3. September 2024 at 15:33

Thank you Scott, I’ll miss this website.

3. September 2024 at 16:39

One of the best economics blogs ever, even for those of us who took econ in college, but no further. I have subscribed to your substack.

3. September 2024 at 20:26

End of an era!

I have learned so much about economics from this blog and I am going to miss it enormously.

I have signed up for the substack but still feel things will never be the quite the same ever again.

3. September 2024 at 21:04

“I have signed up for the substack but still feel things will never be the quite the same ever again.”

That’s right, they’ll be far better!

3. September 2024 at 22:08

Thank you. Sumner-sensei’s blog has really helped me think more clearly about the economy.

The place shown in the image is Tonda Beach in Shirahama. cf.https://www.nankishirahama.jp/spot/536/

Shirahama is also a great place to visit when sightseeing in Japan.

4. September 2024 at 07:43

I stopped reading MoneyIllusion (and virtually everything else) about 4-5 years ago. Major sad family issues. My life has completely changed. But I am arising gradually out of the ashes—-I am ridiculously fortunate to have a wonderful family and so many friends.

Having said that, I really enjoyed Money Illusion when I discovered it. I learned a great deal and was even inspired to meet with the Fed and had several conversations with them. I cannot list all the interesting things I learned reading your material—-which inspired me to do my own research.

However, my favorite topic was our occasional Bob Dylan comments —for example/—

“Rip down all hate,” I screamed. Lies that life is black and white

Spoke from my skull, I dreamed

Romantic facts of musketeers

Foundationed deep, somehow

[Refrain]

But I was so much older then I am younger than that now

.

4. September 2024 at 13:37

Thanks everyone.

Michael, I’m planning to do a post on Dylan over at Substack, but not right away.

4. September 2024 at 17:20

‘That’s right, they’ll be far better!’

I hope you are right – certainly if it improves the quality of the comments that will be a positive.

The main drawback from my perspective is that most substackers charge for some of their posts and it would be too expensive for me to follow all of my favorites. I’ll probably pay to subscribe to your substack – but I still feel its another (probably the last) nail in the coffin for the thriving and free econ blog-o-sphere of the last 15 years (admittedly pretty dormant apart from you and Econlog and a few others for a while now)

4. September 2024 at 21:13

Thanks for the ride Scott,

I learned so much. And, subscribed to the pursuit of happiness as a matter of course, both capitalized and lowercase, realized and unrealized 😉 .

See you there!

5. September 2024 at 06:31

Will probably read your sub stack anyway—- but will look particularly for the Dylan essay

5. September 2024 at 09:07

Market, Econlog will still be free.

Thanks mbka, I’ve enjoyed your thoughtful comments.

Michael, Probably in a few months.

6. September 2024 at 05:10

Scott,

I have recently been of mixed minds about some of the attention to housing as a political issue. It’s good to see it being addressed, but the solutions are somewhat confused. I felt helpless. Then last week the Washington Post emailed me and asked me to write an op-ed to tell Vice President Harris what I think she should do. All of a sudden, I had a voice that might just reach the ears of power.

That opportunity could never have happened if this blog had not existed. It would never have happened without your generosity of intellectual spirit and your willingness to consider content over credentials.

In a way, i have had a second career that came from September 16, 2008, and which I owe to a large extent to you.

Thanks for everything.

6. September 2024 at 08:45

Thanks Kevin, I’ve been extremely happy to see your continued success. I’ve noticed that you are attracting more and more attention from some of the best people in the media and blogosphere. Keep up the good work.

6. September 2024 at 20:47

I will of course keep reading your great posts at Econlib and now Substack, but I still want to thank you for the wonderful journey here for 15 years!

I ended up reading the blog on a daily basis for nearly the entirely of its existence, and I have learned (and enjoyed) so much that I actually kinda owe you a paid Substack subscription. =)

7. September 2024 at 04:45

My favourite all-time website. Hundreds of bookmarked posts. It’s always open as a tab on my mobile browser, along with econlib. This blog has had a bigger effect on my worldview than anything else out there.

I started reading daily in 2011, but i don’t comment often. I’ve probably read all the significant posts from before then as well. And I’ve gone back and re-read them again and again. Very often I go back and search through old posts when I think “Wait what did Scott Sumner say about XYZ again?” I wish I had the knowledge, intellect and skill to so crisply convey these things like Scott does.

I’ve fallen behind on my reading this past month, so I’m a bit late to comment. Just my luck.

9. September 2024 at 03:08

There are advantages to starting over, but you cannot run away from yourself.

Referring to yourself as “elite,” and responding to commenters with ignorant, ad-hominem attacks, is the sign of a narcissistic sociopath.

Furthermore, to achieve some modicum of happiness one needs to have a social life. To have a social life, you need to learn how to be friendly.

You’ve been unpopular and disliked your whole life: from high school to 70, and because of that failure you have a deep resentment towards humanity.

Not good.

9. September 2024 at 08:32

Thanks HL and tpeach.

Eddie, I’ll miss you too.

12. September 2024 at 10:11

The link to your substack shows an error page with the content: error. I can provide screenshots if it would help you fix the site as I appreciate your content.

12. September 2024 at 11:26

Tim, The link seems to work for me. Could it have been a temporary problem?

12. September 2024 at 12:46

It was probably temporary. It is working now.

13. September 2024 at 11:36

Wishing you the best in your new endeavour, Scott.

7. October 2024 at 20:13

Scott,

Quick note of thanks. I’ve hugely enjoyed your blog and the intellectual stimulation I gotten from it. Also it was pleasure getting to know you and your wife.

Hope we can catch up again sometime soon.

Best,

dtoh

6. November 2024 at 15:27

Couldn’t find the substack and if it’s moderated just as well…

Voted for Trump and he won. Sorry liberal Scott Sumner who believes in money non-neutrality, which is akin to believing the state can steer the economy. Nothing could be further from the truth* (cite below). Keynes, Freeman and Rothbard believed, as does Sumner and most of mainstream economists, that money is not neutral; essentially they were all statists. Oh the irony. As a wag once said such beliefs are due to economists begging for attention, as if their opinion matters. It matters as much as pre-election polls do, that is, not that much.

Bye. I can’t say I’ll miss your blog.

*MONEY, REAL INTEREST RATES, AND OUTPUT: A REINTERPRETATION OF POSTWAR U.S. DATA, Robert B. Litterman, Laurence Weiss Working Paper No. 1077, NATIONAL BUREAU OF ECONOMIC RESEARCH, February 1983, “Taken literally, our results imply that monetary policy has not discernably affected the real rate, although it has causally influenced nominal interest rates”

14. November 2024 at 10:05

See you on the other side.