A crude attempt to translate Rowe/Krugman/DeLong into monetarism

As readers know I’m not very good at mathematical economics. Actually that’s not quite right, I’m pretty good at that part of math called “geometry,” but not so good at that part of math called “algebra.” Unfortunately most economists don’t consider geometry to be math. So most people will want to skip this post, where I try to translate Paul Krugman’s geometric critique of Steve Williamson into monetarist language. There’s about an 85% chance I am wrong, but I’m hopeful that my smarter commenters can tell me why.

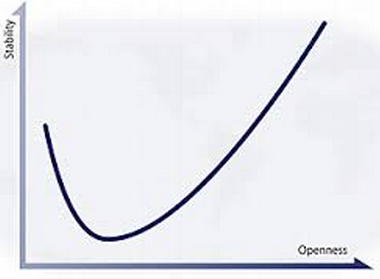

Even worse, I cannot draw graphs, so I will verbally describe changes on a graph. Anyone still reading? I did find a graph on the internet that looks roughly like what I have in mind, however the horizontal axis in my graph is next year’s NGDP (or price level) and the vertical axis is next year’s monetary base.

Why the U-shape? Recall that countries with no NGDP growth have low interest rates and hence a high demand for base money. In Japan the base is more than 20% of GDP. In Australia, a country that averages 6% NGDP growth, it’s only 4% of GDP. In Zimbabwe it is (was) still lower. However the growth rate of NGDP in Zimbabwe is so fast (or was a few years ago) that the total base is still much higher than it would have been with 6% NGDP growth, despite being even a lower percentage of GDP. On the other hand the difference between 0% NGDP growth and 6% NGDP growth is trivial compared to the difference between the base being 20% of GDP and 4% of GDP.

Let me illustrate this with a specific example. We start at the Australian position, near the bottom of the U-shaped graph. Now the central bank contemplates three possible policies: status quo, the Japanese option, and the Zimbabwe option. (No idea why they’d want to move.) Assume policy is 100% credible. My claim is that a move toward the Japanese option would actually require a larger monetary base, as the slowdown in NGDP growth would be trivial compared to the jump in demand for base money as a share of GDP, from 4% to 20%. Moving that way would force the central bank to print lots more base money, despite the slower NGDP growth and inflation. Sound far-fetched? Check out the US since 2008. We’ve seen the slowest NGDP growth since Herbert Hoover, and a big surge in the base.

The other direction is easier to explain. It’s common sense that moving toward Zimbabwe hyperinflation would require a bigger base, despite being a smaller share of GDP. After all, they had individual currency notes of $100 trillion.

Now draw a horizontal line that cuts the graph in two places. The intersection on the left is likely to be at the zero interest bound, or very close. The right is the more “normal” equilibrium. I believe the dual equilibrium is related to the indeterminacy problem in ratex fiat money models, but am not sure. (Here I mean “indeterminacy” in the “multiple equilibria” sense of Bennett McCallum.)

Now we finally get to the Krugman thought experiment. The liquidity premium for government bonds increases. That reduces the yield on government bonds relative to other assets. That then reduces the hot potato effect, as the gap between the yield on government bonds and base money declines. Less HPE is just another way of saying the demand for base money increases at any given level of NGDP. This means the U-shaped graph shifts vertically upward. At the equilibrium on the right side (the “normal” case) the equilibrium point shifts to the left. Next year’s NGDP declines, just as you’d expect. But the equilibrium on the left side moves to the right, suggesting that more demand for base money is expansionary. That’s the case where Krugman criticized Williamson, translated into monetarism.

Or perhaps I’m in way over my head.

PS. This post is motivated by posts by Nick Rowe, Paul Krugman, and Brad DeLong.

Tags:

30. November 2013 at 20:02

Scott,

I think to make any sense out of this discussion, you have look at MB – ER. If the Fed simply swaps money for financial assets (e.g. Treasuries) with the private banking sector, it’s very clear that this will have no effect on anything unless the market expects a future decrease in ER other than through an unwinding the swap with the Fed.

If you subtract out the ER, your graph becomes much more linear and there is really nothing to explain. (At least up to the point where the non-banking sector begins to hold increased quantities of money as a store of value, e.g. substitute financial asset).

1. December 2013 at 00:13

Scott,

I suggest you’re making general assumptions about the relationship between base and nominal growth based on just two or three atypical countries. For example the Japanese are famous for being keen savers, so they aren’t typical. And it’s Japan that gives rise to your U-shape. As to Zimbabwe, that country is very atypical.

As to the US since 2008, that again is an economy that has not been typical: it has been badly skewed by the fact that Congress has refused to allow adequate fiscal stimulus, so the Fed has tried to counter that with an asset purchase scheme (i.e. monetary base creation scheme) of record proportions. But that hasn’t worked too well because (in the words of J.K.Galbraith) “firms borrow when they can make money and not because interest rates are low”.

I’m quite happy with the simple relationship that MMT advocates, which would be a continuously upward sloping line. Or perhaps an initially horizontal line which then slopes upwards, reflecting the fact that as the base rises (all else equal), employment rises with inflation remaining about constant. While excessive base increases lead to excess inflation.

1. December 2013 at 04:11

Isn’t the answer to which equilibrium a given amount of base money will lead to based on expectations about the future path of the monetary base.

The velocity shock is a shock to the amount of money people and institutions want to hold not a shock to the growth rate in the amount of money they want to hold.

If people expected the monetary base to raise a lot as interest rates fall and then grow only slowly from then on we get the equilibrium on the left and if they expect the monetary base to continue to grow at very fast rates then we get the equilibrium at the right.

Isn’t this all really just about expectations of the future path of the monetary base, and not at all about the zero lower bound or whatever else voodoo the New Keynesians insist on sticking in their models.

1. December 2013 at 06:31

dtoh, I’m not at all sure that the graph is linear without ERs, but it’s more likely to be so. But in any case I want to leave ERs in, as most QE goes right into ERs, so that’s what we are trying to explain.

Ralph, You said:

“I suggest you’re making general assumptions about the relationship between base and nominal growth based on just two or three atypical countries. For example the Japanese are famous for being keen savers, so they aren’t typical. And it’s Japan that gives rise to your U-shape. As to Zimbabwe, that country is very atypical.”

I can’t imagine why you say this, these cases are completely typical. As far as I know every hyperinflation case looks roughly like Zimbabwe, and although liquidity traps are rarer, Japan is also typical.

I’m surprised to hear the that MMTers advocate a simple upward sloping relationship, I thought just the opposite.

Trevor, You asked:

“Isn’t the answer to which equilibrium a given amount of base money will lead to based on expectations about the future path of the monetary base.”

Yes, that’s what I meant when I suggested the policies were credible. You’d need a specific future path of the base to make the expectations change in the appropriate direction.

1. December 2013 at 07:10

Scott, you said;

” But in any case I want to leave ERs in, as most QE goes right into ERs, so that’s what we are trying to explain.”

There’s nothing to explain. Unless there is an expectation that the ER are going to be exchanged in the future with the non-banking sector for other assets, QE and the resulting increase in ER have no impact on anything. Zero.

It’s like discussing the economic impact of what temperature Bernanke sets the thermostat in his office. It’s totally irrelevant.

1. December 2013 at 09:21

Actually, Zimbabwe stopped their inflation, the old fashioned way; they stopped printing Z-dollars and now use Euros, Pounds, USD and the Rand. As this Economist piece shows;

http://www.economist.com/news/finance-and-economics/21576665-grubby-greenbacks-dear-credit-full-shops-and-empty-factories-dollars-they

‘A problem for all retailers is a shortage of small change. One-dollar bills are filthy from frequent handling. The South African rand is the main currency in Bulawayo, Zimbabwe’s second city, and one-rand coins are used in place of dimes all over the country. If coins are short, a credit note or sweets may be offered instead. Items that are frequent purchases have rounded prices. A loaf of bread usually sells for $1.

‘Given their own experience with money-printing, locals are queasy about “quantitative easing” as practised by the Fed and other rich-world central banks. Yet for all the printing of electronic dollars by the Fed, the greenback is a hard currency in Zimbabwe. Few are clamouring for its replacement by a local brand.’

1. December 2013 at 09:39

“Less HPE is just another way of saying the demand for base money increases at any given level of NGDP.”

The demand for base money is always the supply of base money, for the simple reason that every base dollar that exists, is valued enough to be held and owned by someone.

The quantity of base money cannot increase via market actor activity. Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money.

If the ratio between base money to NGDP changes, this is not market actors communicating their preferences for more or less base money. Only if there exists a market in base money production can such preferences be communicated in the quantity of base money.

In a free market, this would be done by the relative rates of profit between base money production, and all other production. If market actors want more base money, then what they are really wanting is a higher purchasing power of existing base money. They don’t actually want more base money qua base money. You can know this by postulating a scenario where the rate of new base money production is exactly matched by an equivalent rate of increase in prices. If this kept occurring, then the demand for more base money would never be satisfied. People are wanting more purchasing power but they are not able to get it because the value of each base dollar is decreasing at the same rate.

Thus, market actors who want more base money, actually want more purchasing power. The natural market method of achieving this, would be for individual market actors to do what is in their individual self-interest to do, namely, they will hold their existing balances of base money for a longer period of time. Doing so will have the result of making prices lower than they otherwise would have been. That will raise the purchasing power of base money, and do what market actors wanted all along. This is what would occur in a free market of money, alongside the production of money, which is much easier to anticipate in a free market than in a central banking world subject to the whims of a small group of people with political power backing their desires.

1. December 2013 at 10:12

Ralph Musgrave,

“For example the Japanese are famous for being keen savers, so they aren’t typical.”

You can’t be referring to household savings rates because the Japanese household savings was only 0.8% as a percent of gross disposable income last year according to the OECD. yes, it was much higher in the 1970s, and it peaked at 21.3% in 1976.

Thus I’m assuming you’re talking about the Japanese gross national savings rate, which is a little above average by advanced country standards (21.6% of GDP in 2012 compared to 19.5%) but a little below average by world standards (24.8%) according to the IMF. But even that isn’t all that remarkable, and in fact the Japanese gross national savings rate is below that of all the Germanic and Nordic countries in Europe (it’s also below that of Australia).

More curiously, why would a high household savings rate or a high gross national savings rate make a country more predisposed to being in a liquidity trap?

Yes Switzerland’s monetary base is 77.5% of GDP as of 2013Q3 (Japan’s is 36.2%), and Switzerland has both a relatively high household savings rate and a relatively high gross national savings rate, but the US’s monetary base is 20.1% of GDP and the UK’s monetary base is 22.1% of GDP in 2013Q3 and both the US and the UK are below average in terms of household savings rates and gross national savings rates (only Cyprus and Iceland had a lower gross national savings rate among advanced countries than the UK in 2012).

Moreover we have easily available historical data on the US for all of this going back to 1929:

http://research.stlouisfed.org/fred2/graph/?graph_id=148665&category_id=0

The R-squared between the monetary base as a percent of GDP and the personal savings rate is 3% and falls to 1% when you exclude 1942-45 (WW II). The personal savings rate was at its lowest (-0.8%) in the depths of the Great Depression (1933) and exluding WW II (when high personal savings was more or less required) it was at its highest (13.3%) in 1971 at the beginning of the stagflationary 1970s.

The R-squared between the monetary base and the gross national savings rate as a percent of GDP is 7% which nevertheless is statistically significant (at the 5% level) but the correlation is negative. In fact gross national savings was at its lowest in 1932 (6.7%) and, excluding WW II, it was at its highest (24.6%) in 1965, at the very beginning of the Great Inflation.

And referring back to Japan, recall that its household savings rate peaked in 1976. Well, its gross national savings rate peaked at 39.0% of GDP in 1970 according to AMECO. And recall that Japan’s CPI inflation rate peaked at well over 20% in 1974.

So it seems to me if anything the correlation between savings rates and liquidity traps is the complete opposite of what you are implicitly theorizing. And actually this is totally in keeping with Keynes’ Paradox of Thrift.

1. December 2013 at 10:33

If your U-shaped curve is derived from comparisons between countries, that doesn’t necessarily tell us anything about what would happen within any particular country.

Also, why do you draw a U-shape rather than a C-shape, or even an O-shape?

1. December 2013 at 10:57

Mark,

“And actually this is totally in keeping with Keynes’ Paradox of Thrift”

How so?

1. December 2013 at 11:02

Geoff,

“Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money.”

If I had a desire for more base money I could go to my bank and withdraw my deposits as cash. The fact that I don’t create base money doesn’t mean I can’t manifest my desire for more of it.

1. December 2013 at 11:56

Philippe,

The Paradox of Thrift states that if desired savings increase because of depressed aggregate demand then, all other things being equal, aggregate demand will fall even further and will in turn lower aggregate savings even more because of the decrease in effective demand. The Great Depression is a classic example of both a liquidity trap and of the Paradox of Thrift.

1. December 2013 at 13:25

Philippe:

“If I had a desire for more base money I could go to my bank and withdraw my deposits as cash. The fact that I don’t create base money doesn’t mean I can’t manifest my desire for more of it.”

If you withdraw base money from your bank, then that requires your bank to have a reduced demand for base money holding.

You can’t convince others to give their base money, unless they agree to hold less of it, meaning if their demand goes down. In these circumstances, there is no general, economy-wide rise in the demand for base money. There is merely off-setting demand increases and decreases.

Moreover, when you withdraw base money from your bank, you are actually seeking for more purchasing power. For example, you will have higher purchasing power with $50 cash in your hand at a cash only Chinese take-out restaurant, than you would with a debit card or a check.

Suppose that every time you wanted to hold and use base money, you find that every seller stops accepting cash, and that every time you deposited base money back into your bank, those sellers started accepting cash again. Assume this is true only for you, and nobody else. Would you ever withdraw cash, to sit on, or eat? Likely not. You would not want just the base money. You want what the base money can buy. You want the purchasing power. If you knew nobody accepted cash every time you held cash, then you would likely not hold cash, ever. Unless of course you really do want to eat it or sit on it. But then this wouldn’t be a part of the money supply any longer anyway, so we can safely ignore it.

Given this is the case, now assume that everyone wants to hold more base money in their hands, or on their person. Assume that everyone seeks to hold more base money. The same thing is still the case. People don’t want more base money to eat or sit on, they want more base money for purchasing power purposes. The only way that a given supply of base money can increase in purchasing power, given that everyone wants to hold more base money, would be if prices fell. Only then can a supply of base money increase in purchasing power for everyone.

The above analysis should make it clear to you why it is wrong to believe that a desire from everyone to hold more base money, or at least for some people to hold more base money than other base money owners are willing to give, can be satisfied by printing arbitrary quantities of base money from a central bank. For with more base money having been printed, the desired increase in purchasing power cannot be had. Each base dollar would be worth less, and would buy less. People would be no better off than before. Their desire to hold more purchasing power would be constantly frustrated if there is a central bank printing more base money by some arbitrary amount, for example whatever would result in aggregate spending rising by some arbitrary rate, in the name of “giving what people want”.

Only the market can tell you want every individual wants, using prices, demand, supply and other economic statistics. NGDP going down, for example, certainly does not tell you that there is a need for more base money.

1. December 2013 at 13:28

Mark Sadowski:

The Paradox of Thrift is a myth.

Aggregate demand falling should occur, if market actors find that their existing spending patterns are resulting in real activity that cannot be sustained, due to errors in assumptions of capital availability.

Yes, it is true that a fall in aggregate demand will, ceteris paribus, reduce aggregate profitability, and that a reduction in profitability will, ceteris paribus, put downward pressure on employment and output.

But this is not necessarily a bad thing. It is wrong to believe that every reduction in aggregate employment is an evil, and that every reduction in aggregate output is an evil.

The liquidity trap is also a myth, BTW.

1. December 2013 at 14:00

“If you withdraw base money from your bank, then that requires your bank to have a reduced demand for base money holding.”

No it doesn’t. My bank can get more base money from the central bank in exchange for bonds. My bank can’t create base money but it can manifest its desire for more of it by going to the cb.

“Moreover, when you withdraw base money from your bank, you are actually seeking for more purchasing power”

If I withdraw money from my bank I’m not doing it because I want there to be deflation. Even if I did want deflation that wouldn’t be relevant.

1. December 2013 at 14:43

Aggregate demand falling should occur, if market actors find that their existing spending patterns are resulting in real activity that cannot be sustained, due to errors in assumptions of capital availability.

A rough translation would be “anything I don’t like is an unsustainable bubble”.

1. December 2013 at 14:57

Out of curiosity, if I smacked an austro-sadist in the head with a baseball bat and it resulted in a cracked skull – would I get to say “the fact that your skull cracked proves it was poorly built” ?

If not, why is it ok to say that a reduction in output and employment brought about by a monetary contraction proves an “unsustainable real activity” ?

1. December 2013 at 14:58

I’m not endorsing inflicting bodily harm upon anyone, austro-nut or not.

1. December 2013 at 15:04

Philippe:

“No it doesn’t. My bank can get more base money from the central bank in exchange for bonds. My bank can’t create base money but it can manifest its desire for more of it by going to the cb.”

That still requires them to hold base money prior to you owning it. That means that when you acquire base money from your bank, your bank MUST own the base money first. In order to own base money, and to trade base money, that requires a demand for holding base money and a subsequent decrease in the demand to hold base money. You’re actually just describing a situation that is perfectly consistent with what I said above. You’re not contradicting it.

“Moreover, when you withdraw base money from your bank, you are actually seeking for more purchasing power”

“If I withdraw money from my bank I’m not doing it because I want there to be deflation. Even if I did want deflation that wouldn’t be relevant.”

I didn’t say you wanted price deflation per se. I said you wanted more purchasing power. If that comes about through falling prices, then you have achieved your desire. You are not in control of all prices Philippe. When you hold your money earnings, for any length of time, say a couple of weeks, then you are, during that period, putting downward pressure on prices, because by virtue of you holding that money, there is a smaller nominal demand prevailing in the economy.

Prices for electronics are falling, despite any psychological predilection on your part for those prices not to fall, or for the sellers to prefer increasing prices.

If in a free market everyone wanting to hold money for longer has the consequence of falling prices, then that is indeed what people want. It would be like saying you want to stay asleep all day long, but you don’t want to lose your job! And anyone who claims you do indeed want to lose your job, even if you did not intend for it, are not wrong. They are correct. You can’t hold a job and sleep at the same time. Same thing with everyone wanting higher purchasing power by holding cash for longer. You can’t have your cake and eat it too.

1. December 2013 at 15:14

Daniel:

“A rough translation would be “anything I don’t like is an unsustainable bubble”.”

You have only revealed your own conception of bubbles with that comment, namely, “If I don’t want to accept it is an unsustainable bubble, then I don’t have to.”

“Out of curiosity, if I smacked an austro-sadist in the head with a baseball bat and it resulted in a cracked skull – would I get to say “the fact that your skull cracked proves it was poorly built”?”

That comment accurately encapsulates your approach to complex social problems. Smack it with a hammer of the state, and it should “respond” the way you want it to respond.

“If not, why is it ok to say that a reduction in output and employment brought about by a monetary contraction proves an “unsustainable real activity”?”

What a ridiculously ignorant line of questioning. Individuals holding onto their money for a period of time longer than you or others anticipate, is not in any way morally, economically, or even logically akin to hitting someone over their head with a baseball bat against their will.

The former is choosing to exercise one’s property rights in choosing NOT to engage in trading. The latter is a violation of property rights.

Are you seriously that mentally defective that you cannot grasp the ethical difference between choosing not to enter into a contract with someone, which leads to them earning less income than they otherwise would have received, and choosing to initiate violence against someone with a baseball bat?

Why don’t you ask yourself why so many people would suddenly find it beneficial to hold their money earnings for longer than they used to prior? Rather than make the ignorant blanket statement that ALL reductions in employment are evil and ALL reductions in output are evil, why not instead ask whether all full employment and full output scenarios are desirable. You seem to have a very crude mentality when it comes to the economy.

1. December 2013 at 15:20

Is it me or is your argument based upon an assumption of scarcity of money ?

Because if so, you truly are too stupid for words.

1. December 2013 at 15:20

Daniel:

“I’m not endorsing inflicting bodily harm upon anyone, austro-nut or not.”

Interesting how you feel compelled to explicitly convince others of what should be the default position concerning someone on an economics blog. Or maybe you’re trying to convince yourself more? Perhaps you would feel more welcome on a blog that talks about war and death? You’d probably feel more at home.

In actual fact, and I hate to break this to you, but you are in fact an advocate of bodily harm against innocent people. For how else would you impose your central banking ideology on everyone else? You NEED to have that threat of bodily harm, backed by a willingness to actually do so, in order for ANY variation of central bank “policy” to work. For if such threats and making good on the threats were removed, then individuals would quite naturally start to use their own preferred means of exchange, and no central bank, indeed no state, would be possible to even arise. That is the implication of no threats of bodily harm.

Now you can have thoughts of hitting others over the head when you can’t get what you want, but ask yourself if that’s the kind of person you want to be.

1. December 2013 at 15:26

Daniel:

“Is it me or is your argument based upon an assumption of scarcity of money?”

That isn’t an assumption, that is a requirement for anything to serve as a money. If the thing is not scarce, like sunlight, or breathable air, then it could not serve as money.

“Because if so, you truly are too stupid for words.”

I know it’s difficult to engage in economic science on this blog, considering how it is really a blog on the art of political control and coercion, but do try to one day read economic texts. You just might be able to avoid making yourself look less than favorable.

I know you “hammer for every problem” folks like to think that you have abolished scarcity with coercion based unlimited fiat money printing. I know scarcity scares you. But more fiat money doesn’t solve the problems that too much fiat money has caused. I hope that even someone as misguided as you would understand that if A causes problem B, then the solution cannot be more A.

1. December 2013 at 15:31

When human nature contradicts a fanatic’s ideology – it is human nature that needs revising.

1. December 2013 at 15:34

“that requires a demand for holding base money and a subsequent decrease in the demand to hold base money”

No it doesn’t. If a customer withdraws some cash that doesn’t mean the bank has a desire to hold less base money. If the bank wants to replenish their base money they can get some from elsewhere. For example they can go to the cb and buy some.

1. December 2013 at 15:34

Daniel:

“When human nature contradicts a fanatic’s ideology – it is human nature that needs revising.”

When a fanatic appeals to human nature to justify their fanaticism, you know you’ve won the argument.

1. December 2013 at 15:40

Daniel:

“No it doesn’t. If a customer withdraws some cash that doesn’t mean the bank has a desire to hold less base money. If the bank wants to replenish their base money they can get some from elsewhere. For example they can go to the cb and buy some.”

I see you’re still having trouble with this. What you are describing is after the fact. In the exchange of base money from bank to client, the bank must choose to hold less base money at that time. It is arbitrary to focus on the subsequent moment in time when the bank COULD choose to send more bonds to the Fed for base money. For if we considered that as the relevant time period in question, then the Fed must choose to send that base money to the bank, instead of keeping it for itself. There would still be an offsetting demand for base money in that scenario.

All demands are revealed in exchanges. If the bank gives you base money, it has to reduce its base money by that amount, at that time. This time has always been the relevant time when talking about supply and demand in exchanges.

And the bank cannot keep sending bonds to the Fed anyway. The bank has a limited supply. If enough of its customers want base money, then the bank might not have enough bonds to send to the Fed. Scarcity is ubiquitous in economics. Economics deals with scarcity.

1. December 2013 at 15:42

Communists were convinced that abolishing private property would cure people of selfishness.

Austro-sadists are convinced that throwing millions of people out of work proves the benefits of a monetary contraction.

Winning the argument indeed.

http://danceswithfat.files.wordpress.com/2011/08/victory.jpg

1. December 2013 at 15:51

Daniel:

“Communists were convinced that abolishing private property would cure people of selfishness.”

“Austro-sadists are convinced that throwing millions of people out of work proves the benefits of a monetary contraction.”

If those millions of people are helping produce goods that are not capable of being completed due to capital misallocation, then it would be most humane to choose unemployment over delaying the correction at the cost of putting even more people out of work in the future.

When Greenspan stopped the corrections in 2001, and stopped unemployment from rising, he created an even greater bubble, which had even an worse outcome later on than what would otherwise have been the case had the corrections been allowed to take place in 2001.

Your position is untenable.

1. December 2013 at 15:54

Daniel:

You’re trying to win an economics argument by appealing to emotions. By guilt tripping people into feeling bad about unemployment, you hope to persuade them to ignore the underlying economic science.

1. December 2013 at 15:55

“In the exchange of base money from bank to client, the bank must choose to hold less base money at that time”

Banks promise to let depositors withdraw money (under certain conditions). If a customer comes in and withdraws cash, that has nothing to do with the bank wanting to hold less cash. The bank is just fulfilling its obligation. If as a result it then finds itself short of base money it can go to the cb and buy some more, or it can get some more from elsewhere. As you say it is of course possible for banks to go bust nonetheless.

1. December 2013 at 16:03

guilt tripping people into feeling bad about unemployment

So you’re lacking in cognitive empathy too, not just basic intelligence.

1. December 2013 at 16:04

Philippe:

“Banks promise to let depositors withdraw money (under certain conditions). If a customer comes in and withdraws cash, that has nothing to do with the bank wanting to hold less cash.”

Yes, it does. If the bank is to GIVE cash to a client, then it MUST, MUST, MUST choose to hold LESS cash at that time.

If I give money to you in exchange for a hamburger, then you MUST want to decrease your holdings of hamburgers, and I MUST want to decrease my holdings in money.

As the owner of the hamburger, you could choose to not give me the hamburger. You would do so if you wanted not to decrease your holdings of hamburgers by one unit.

Same thing with the bank. By giving you base money, they must choose to decrease their holding of base money.

“The bank is just fulfilling its obligation.”

By choosing to fulfill its obligations, it is choosing to reduce its ownership of base money. Remember, the base money is actually the bank’s property, according to the law. It’s not actually “your” money.

“If as a result it then finds itself short of base money it can go to the cb and buy some more, or it can get some more from elsewhere. As you say it is of course possible for banks to go bust nonetheless.”

Try not to get sidetracked away from the essential point, which is that for a given dollar of base money, if it is transferred from A to B, there must be an offsetting demand for holding that base money. It’s a necessary implication of all exchanges.

1. December 2013 at 16:11

Daniel:

“So you’re lacking in cognitive empathy too, not just basic intelligence.”

You’re not empathetic. You want guns to be pointed at innocent people. You are the exact opposite of empathetic. You are vicious and immoral.

Empathetic people do not advocate for guns to be introduced into otherwise peaceful cooperation. You want guns to be used in the name of keeping people in jobs they never should have started in the first place.

Fake empathy, grounded on fake intelligence, such as in your case, is a socially deadly combination.

Many more people suffered from unemployment post 2008 than what otherwise would have been the case because people enacted your vicious ideal.

1. December 2013 at 16:17

You are vicious and immoral.

http://thumbs.dreamstime.com/x/bactrian-camel-19006021.jpg

1. December 2013 at 16:25

…and immature.

1. December 2013 at 16:42

“it MUST, MUST, MUST choose to hold LESS cash at that time.”

The fact that the bank chooses not to default doesn’t mean that has less desire for base money, less demand for base money, or wants to hold less base money.

The implication of your ‘argument’ is that the bank can never want to hold, desire or demand more base money than it happens to have at any given point in time. So by your ‘logic’ if there is a bank run and the bank loses all its vault cash this is because the bank has less demand for cash and wants to hold less cash. Pretty silly really.

In reality if I want more base money I can withdraw it from my bank. My bank can then get more base money from the cb or elsewhere. My bank’s demand for base money does not have to go down because I withdrew some cash. Overall there can be an increase in the demand for base money, which can be accommodated by the cb.

Originally you said:

“Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money.”

Which of course was completely wrong, as should be obvious by now.

1. December 2013 at 16:55

Stephen Williamson has a new post:

http://newmonetarism.blogspot.com/2013/12/teachable-moment.html

Teachable Moment

By Stephen Williamson

“Students are often confused, and we can’t always figure out why. The teachable moment comes when students actually articulate their confusion, and then you can work on trying to help them. Nick Rowe, Brad DeLong, and Paul Krugman are all confused – each in his own way – about my last blog post…”

1. December 2013 at 16:57

And David Andolfatto has a related post:

http://andolfatto.blogspot.com/2013/12/is-qe-lowering-rate-of-inflation.html

And here is Nick Rowe’s reply to David:

http://worthwhile.typepad.com/worthwhile_canadian_initi/2013/12/the-effects-of-nominal-interest-rates-on-inflation.html

1. December 2013 at 17:05

Philippe:

“The fact that the bank chooses not to default doesn’t mean that has less desire for base money, less demand for base money, or wants to hold less base money.”

Yes, it actually does mean that. It is irrelevant what the banks specific reason for wanting to hold less base money happen to be, when it comes to the question of whether they do in fact desire to hold less base money, through such things as making good on their promises to pay deposit holders on demand, or purchasing assets.

“The implication of your ‘argument’ is that the bank can never want to hold, desire or demand more base money than it happens to have at any given point in time.”

No, that is not an implication. The implication you are probably trying to get at is that at any given moment in time, every dollar in the total supply of base money is held by someone, and as such, is demanded to be held by that same someone. If that changes, from the bank demanding to hold base money, to demanding to hold something more valuable, such as a client’s continued patronage, continued operation through avoiding bankruptcy, all these are subsequent to the moment in time of which we know that every dollar of base money is held.

You’re confusing yourself over the difference between cross sections and temporal concepts, and the difference between what people are doing now, versus what they might want to do differently in the future.

It is true that if an individual is holding an asset, it is because they value holding the asset over not holding it. It is also true that if A gives an asset to B, then the implication of this is that A wants to reduce their ownership in that asset (in exchange for what they get in return from B), while B wants to reduce their ownership of whatever it is they gave to A (in exchange for what they get in return from A).

“So by your ‘logic’ if there is a bank run and the bank loses all its vault cash this is because the bank has less demand for cash and wants to hold less cash. Pretty silly really.”

No, that does not follow either.

“In reality if I want more base money I can withdraw it from my bank.”

Only if the bank wants to reduce its base money by that amount at that time!

“My bank can then get more base money from the cb or elsewhere.”

That’s after the fact. You might as well say that when I spend money, I don’t want to actually reduce my cash balance because next year I could always earn more money.

That is conflating the present with the future.

If I buy something, it is because at that time in that place, I prefer to reduce my cash by $X, while the seller prefers to increase their cash balance by $X at that time in that place.

Subsequent to this, if the bank or seller wants to hold more cash or base money than what they have, then that will require others to be willing to give cash or base money. This includes parties who create base money and who create cash. Creators of cash and base money still have to choose to give that cash and/or base money to others instead of holding it for themselves.

“My bank’s demand for base money does not have to go down because I withdrew some cash.”

It does go down. The fact that it may or may not go up again after the fact, is besides the point.

“Overall there can be an increase in the demand for base money, which can be accommodated by the cb.”

Not if the banks want more base money than the exchange value of the assets they have to give to the cb.

“Originally you said:”

“Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money.”

“Which of course was completely wrong, as should be obvious by now.”

It is not wrong, and nothing you have said above shows otherwise.

Even if market actors desire just $1 more base money, they cannot CREATE that base money through private production. The central bank must choose to “print” it.

1. December 2013 at 17:22

“Not if the banks want more base money than the exchange value of the assets they have to give to the cb.”

So you agree that there can be an overall increase in the demand for base money which can be accommodated by the cb.

The cb can know that people want more base money because they ask for it. As such this:

“Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money”.

is clearly wrong.

1. December 2013 at 17:26

Philippe:

“So you agree that there can be an overall increase in the demand for base money which can be accommodated by the cb.”

No, that cannot be accomodated by the cb, because if everyone wants more base money, what they are wanting is more purchasing power. More base money cannot accomplish this.

“The cb can know that people want more base money because they ask for it.”

If that were the metric, then the cb would have to print zillions upon zillions of dollars, because everyone would like to earn more money, ceteris paribus.

“As such this:”

“Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money”.

“is clearly wrong.”

No, that attempt also fails. Maybe try a third time?

1. December 2013 at 17:43

“No, that cannot be accomodated by the cb, because if everyone wants more base money, what they are wanting is more purchasing power.”

And yet they go to the cb and ask for more base money. So reality contradicts your assertion.

People ask for more base money, and your response is “they don’t want more base money”. Funny that, isn’t it.

“If that were the metric, then the cb would have to print zillions upon zillions of dollars”

But the cb doesn’t accommodate all demand for money, does it.

“because everyone would like to earn more money, ceteris paribus.”

And yet you just said that people don’t want more money.

1. December 2013 at 18:09

Philippe:

“And yet they go to the cb and ask for more base money. So reality contradicts your assertion.”

Right, but this is not succeeding in acquiring more purchasing power. More base money in existence devalues the existing base money. Reality is consistent with my position. Seeking more purchasing power through acquiring more base money cannot be a general phenomena. If everyone sought more base money, and it was “accommodated” by an inflator, then this will frustrate those who want more purchasing power but do not receive base money from the Fed. The gains to the initial receivers is offset by the loss of the later receivers. The gain is thus a partial one, not a general one.

“People ask for more base money, and your response is “they don’t want more base money”. Funny that, isn’t it.”

I said they don’t want ONLY more base money. For if every other potential receiver stopped accepting base money in exchange for their goods and services, then the need for base money would collapse. It’s not the base money itself people want, it’s what can be bought that is wanted.

More base money does not bring more goods and services into existence.

“But the cb doesn’t accommodate all demand for money, does it.”

That comment should have clued you in that it is not demand for base money that the cb is “accommodating”, but rather it is securing a partial increase in purchasing power for the initial receivers, at the expense of everyone else, with no general increase in purchasing power for everyone.

“And yet you just said that people don’t want more money.”

Individuals want more purchasing power, which seeking more money would obtain, if not through inflation means.

1. December 2013 at 19:00

Geoff wrote:

“The quantity of base money cannot increase via market actor activity. Market actors cannot manifest their desire for more or less base money since it is non-market actors who control the supply of base money.

If the ratio between base money to NGDP changes, this is not market actors communicating their preferences for more or less base money. Only if there exists a market in base money production can such preferences be communicated in the quantity of base money.”

In an economy with an inflation-targeting central bank, market actor activity can and does have indirect influence on the quantity of base money. If market actors choose to hold more base money, an inflation-targeting central bank – will accomodate that by creation of more base money. Conversely, if the central bank creates more base money than market actors want to hold, prices will rise and an inflation-targeting central bank will eliminate base money in response.

Even under the assumption that the central bank can never successfully hit its inflation target, it would still be expected to create more base money in response to a higher demand for base money and destroy it in response to lower demand for it.

“Right, but this is not succeeding in acquiring more purchasing power. More base money in existence devalues the existing base money.”

In the US, there is more than four times as much base money in existence today as there was 6 years ago. Prices, however, are quite obviously not more than fourfold higher.

If those millions of people are helping produce goods that are not capable of being completed due to capital misallocation, then it would be most humane to choose unemployment over delaying the correction at the cost of putting even more people out of work in the future.

“Seeking more purchasing power through acquiring more base money cannot be a general phenomena. If everyone sought more base money, and it was “accommodated” by an inflator, then this will frustrate those who want more purchasing power but do not receive base money from the Fed.”

Not true.

1. December 2013 at 19:33

Michael:

“In an economy with an inflation-targeting central bank, market actor activity can and does have indirect influence on the quantity of base money. If market actors choose to hold more base money, an inflation-targeting central bank – will accomodate that by creation of more base money. Conversely, if the central bank creates more base money than market actors want to hold, prices will rise and an inflation-targeting central bank will eliminate base money in response.”

This is not the market controlling the quantity of base money. This is a central bank controlling the quantity of base money. It doesn’t matter what the reasons for inflating the central bank happen to utilize.

A free market in base money would result in a growth of base money consistent with trade-offs to producing other things with scarce resources. Coercive central banking destroys this mechanism. It prevents rational allocation of resources to money production versus non-money production.

“Even under the assumption that the central bank can never successfully hit its inflation target, it would still be expected to create more base money in response to a higher demand for base money and destroy it in response to lower demand for it.”

It cannot observe a higher demand for base money. It can only set its own rule for what it believes are signals of a higher demand for base money. The rule is necessarily arbitrary, because the inflator is not itself constrained to market forces. Thus we see arbitrary rules like NGDPLT, and false inferences of the form “If NGDP falls, then that is the market telling the inflator to print more base money”.

“In the US, there is more than four times as much base money in existence today as there was 6 years ago. Prices, however, are quite obviously not more than fourfold higher.”

I don’t believe in the myth that as long as prices don’t rise by much, then a previous large increase in base money is therefore innocuous. That’s reasoning from a price change.

What matters is what that increase in base money did to economic calculation, that is, what it did to relative allocations of resources and labor. Instead of allocating resources and labor here, the increase in base money allocated resources to there instead. This is not a market based outcome. It is the outcome of a non-market institution’s activity. Market actors are hampered in coordinating their resource allocations when a coercive, non-market institution is creating arbitrary quantities of medium of exchange for the benefit of arbitrary parties.

“Seeking more purchasing power through acquiring more base money cannot be a general phenomena. If everyone sought more base money, and it was “accommodated” by an inflator, then this will frustrate those who want more purchasing power but do not receive base money from the Fed.”

“Not true.”

It’s true. If an individual wants more purchasing power by holding onto their money earnings for a longer period than before, which would otherwise bring about a fall in spending, then an inflator who steps in to reverse the consequences of holding onto money for longer would indeed frustrate that individual’s goal. It is even more pronounced when millions of individuals want to hold onto their money earnings for longer, and the central bank reverses the consequences of this on a very large scale. Then many individuals are frustrated.

1. December 2013 at 19:42

Everyone, 45 comments and no one has any views on the validity of my argument?

Mark, Thanks for the links, I’ll do a post.

1. December 2013 at 19:50

“Everyone, 45 comments and no one has any views on the validity of my argument?”

Ahem:

http://www.themoneyillusion.com/?p=25034#comment-298709

I guess I forgot I was “no one.”

1. December 2013 at 20:18

Scott,

As long as you’re looking at MB (and not MB minus ER), there’s nothing to be said. MB randomly fluctuates based on whatever arbitrary level of ER the Fed happens to set.

2. December 2013 at 02:09

I think dual equilibrium is a result of simplifications made in the chart. Two equilibria at the same size of the monetary base represent completely different reaction functions. The chart confuses the temporary increase in base money needed to generate higher constant inflation on the right side of the chart with the higher permanent stock of base money in the low inflation regime on the left side of the chart.

“Now we finally get to the Krugman thought experiment. The liquidity premium for government bonds increases. That reduces the yield on government bonds relative to other assets.”

Never reason from the price change. What is the nature of the shock that reduced the liquidity premium? Is it a demand shock, or a supply shock?

2. December 2013 at 08:55

dtoh, I don’t see how that addresses my claim.

123, You said;

“The chart confuses the temporary increase in base money needed to generate higher constant inflation on the right side of the chart with the higher permanent stock of base money in the low inflation regime on the left side of the chart.”

That wasn’t “confusion,” that was the whole point! Take another look at the Krugman post.

And there is no reasoning from a price change, I was reasoning from a change in the interest rate spread caused by financial turmoil.

2. December 2013 at 08:56

But thanks for at least trying you guys, I probably was not clear enough in my post, as no one seems to have gotten the point.

2. December 2013 at 09:35

The curve that you have reminds me of aviation “power curve”

http://flysafe.raa.asn.au/groundschool/powercurve.gif

If you are to the left of the minimum you are in “the region of reverse command.” In this region, it takes more power to fly slower and maintain altitude than it does to go faster.

It is fundamentally unstable as well and takes constant tinkering to find the right power settings and angle of attack to hold straight and level flight. A stall is always threatening.

2. December 2013 at 12:33

“But thanks for at least trying you guys, I probably was not clear enough in my post, as no one seems to have gotten the point.”

Tyler Cowen has linked to this post with a description “a good post by Scott on the debate.” You used to write for the regular people, and now we got a Cowenesque mystery. 🙂

“And there is no reasoning from a price change, I was reasoning from a change in the interest rate spread caused by financial turmoil.”

Reasoning from a change in the spread is a reasoning from changes in two prices. You should reason from the financial turmoil directly, instead of assuming that the only way the financial turmoil affects the monetary base is via the substitution with government bonds. The problem is that the change in the interest rate spread can be caused by the negative demand shock, and it also can be caused by the positive demand shock.

2. December 2013 at 14:40

Scott,

Do the horizontal and vertical axes represent next year’s NGDP and monetary base (respectfully), or changes in those quantities? If the former, I don’t understand why Japan should be on the left (small NGDP) and Zimbabwe be on the right (large NGDP).

2. December 2013 at 15:54

I love the way you just grabbed a really pixellated graph off the web and didn’t bother to change the labels. That might sound like I’m being sarcastic but I’m not. Classic.