Abenomics after 5 years

Abe won a massive election victory in December 2012 on a promise of higher inflation. He was subsequently re-elected in 2014 and 2017, again by a huge margin. This sort of political success is actually very unusual in Japan, where PMs tend to come and go. It’s also unusual that he made such a big issue of inflation, in a country full of elderly savers. (So much for armchair public choice theory.) So how’s he doing after 5 years, apart from being highly popular?

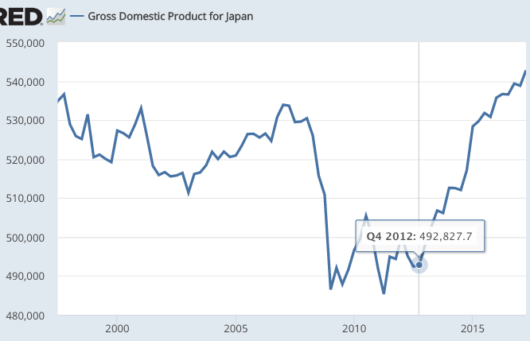

The most important impact of Abenomics was on NGDP, which had been trending downwards prior to his election:

It’s actually better than this Fred graph shows, as Q2 NGDP was revised up to 544.9 trillion yen, and the third quarter came in at a very strong 549.2 yen.

It’s actually better than this Fred graph shows, as Q2 NGDP was revised up to 544.9 trillion yen, and the third quarter came in at a very strong 549.2 yen.

According to market monetarist theory, strong NGDP can be useful in solving 2 problems, excessive debt burdens and high cyclical unemployment. Abenomics has been very successful on both fronts. Unemployment had fallen to 2.7%, the lowest level in 23 years. And the public debt to GDP ratio has leveled off, after soaring higher at a dangerous rate in recent decades.

The debt ratio achievement is especially impressive given the extremely unfavorable demographics facing Japan:

Normally a rapidly falling population makes the debt situation worse, and also makes it more difficult to boost NGDP. Abe overcome this obstacle on both fronts. The boost to NGDP also occurred during a period of fiscal austerity, which of course contradicts the Keynesian model.

Normally a rapidly falling population makes the debt situation worse, and also makes it more difficult to boost NGDP. Abe overcome this obstacle on both fronts. The boost to NGDP also occurred during a period of fiscal austerity, which of course contradicts the Keynesian model.

The BOJ has an inflation target of 2%, and this is one area where they have fallen somewhat short. Prices are up about 5% in five years, which is certainly better than the deflation that preceded Abenomics, but well short of success:

Don’t pay too much attention to the year-to-year changes, as the inflation rate in 2014 was boosted by a sales tax increase, and the inflation rate after 2014 was held down by plunging oil prices. Most forecasters see an inflation rate of just under 1% going forward. Over at Econlog I explain why that’s still too low, even though the Japanese economy can do fine with 1% inflation.

To summarize:

1. NGDP was a big success

2. The debt situation is dramatically improved.

3. The labor market is far stronger

4. Inflation is higher, but well short of the 2% target.

I’d say that Abenomics deserves a B+ on monetary policy. I don’t know enough to comment on the other aspects of his policy, although obviously I don’t agree with his nationalism.

PS. I’d like to thank Ralph Benko for his very generous comments in Forbes. I still feel pretty good about the prediction I made in “An Even Greater Moderation”, which he links to.