Saturos sent me to an interesting debate between Matt Rognlie and Miles Kimball on wage and price stickiness. I’d recommend you read their discussion if you only have time for one post (I tend to agree with Matt), but I’ll put in my 2 cents anyway. Warning: This is blogosphere econ, not academic econ.

I first got interested in this subject when I saw Robert Lucas cite a 1985 JPE paper by Mark Bils, which showed real wages were procyclical. Lucas then suggested that this stylized fact was inconsistent with sticky-wage models, which predicted countercyclical real wages. (The idea is that prices fall sharply in recessions, workers refuse nominal pay cuts, real wages rise, and workers are laid off.)

I was shocked by this claim, as I knew that real wages were highly countercyclical during the interwar years. I also knew that the demand shocks were much larger during the interwar years, and thus these were an almost perfect laboratory test of business cycle models. When I looked at Bils’ paper I saw that he used a 1966-80 data set, and figured his procyclical finding came from the oil shocks. Then Steve Silver and I decided to do a test of the entire period from 1920 to 1985, and we found that wages were strongly procyclical when the economy was hit by supply shocks and somewhat countercyclical when the economy is hit by demand shocks. This finding is completely consistent with sticky-wage models.

In those days I still believed in inflation estimates. Later I began to doubt that economists had developed a clear idea of what inflation is supposed to measure. Let’s start with a fairly clearcut example to see the intuition of sticky-wage models: gold mining. Gold is gold, there are no quality issues. It’s not a newly invented product. It doesn’t get better over time. It’s sold in markets that are almost perfectly competitive, and hence individual mines are essentially price takers. When gold prices rise sharply, I imagine that the ratio of hourly wages to gold prices tends to fall, and employment in gold mining increases. So the sticky wage model would probably work pretty well for gold mining, or indeed any product where it’s easy to measure prices and where the output is sold in competitive industries. (See my PPS for further discussion.)

But most goods are not like that. There are quality changes and there are new products. A huge part of the CPI is made up of “rental equivalent”–a good produced without any labor. And our models are supposed to explain fluctuations in employment! Then there are fake prices. Renters are given 2 months free to move in during recessions, but that doesn’t show up in the CPI. There are all sorts of hidden price cuts, as companies don’t like to raise and lower list prices–bad for PR. So they set the list price for boom conditions, and then give lots of hidden price cuts to move the merchandise during recessions.

But inaccuracies in inflation data aren’t the real problem. Rather in my view NGDP is the “real thing”, not just the sum of inflation and RGDP growth. Over the long run you’d expect nominal wages to track NGDP/person, not inflation. Just look at the soaring wages and low inflation in China. RGDP/person growth drives up wages just as much as inflation. And here’s where things get interesting. Because NGDP fluctuations are erratic, and hourly nominal wages are very sticky, W/NGDP becomes very countercyclical, just as the sticky-wage demand-side theorists initially felt W/P should be.

Bennett McCallum once observed that there are hundreds of ways of modelling how sticky wages and prices impact the business cycle:

My own candidate for the weakest component in a macroeconomic model is the price adjustment (Phillips curve) sector. In McCallum (1999, fn. 14) the argument is stated as follows. “It is not just that the economics profession does not have a well-tested quantitative model of the quarter-to-quarter dynamics, the situation is much worse than that: we do not even have any basic agreement about the qualitative nature of the mechanism. This point can be made by mentioning some of the leading theoretical categories, which include: real business cycle models; monetary misperception models; semi-classical price adjustment models; models with overlapping nominal contracts of the Taylor variety or the Fischer variety or the Calvo-Rotemberg type; models with nominal contracts set as in the recent work of Fuhrer and Moore; NAIRU models; Lucas supply function models; MPS-style markup pricing models; and so on. Not only do we have all of these basic modeling approaches, but to be made operational each of them has to be combined with some measure of capacity output””a step that itself involves competing approaches””and with several critical assumptions regarding the nature of different types of unobservable shocks and the time series processes generating them. Thus there are dozens or perhaps hundreds of competing specifications regarding the precise nature of the connection between monetary policy actions and their real short-term consequences. And there is little empirical basis for much narrowing of the range of contenders.”

McCallum’s footnote beautifully illustrates why the modern approach to macro is hopeless. We’ve had lots of really smart guys working on this for decades. If we don’t have a solution it’s probably because the actual economy is both incredibly complex (lots of models are partly true) and also time-varying (a model that explains the 1920s doesn’t explain the 2000s.)

So my solution is to return to basics, apply the simplest model that is useful for policy. Start with why we care about all this—unemployment. If we had recessions without a change in the unemployment rate, or even hours worked, economists would have never even invented the AS/AD approach to macro–they’d investigate real shocks. We developed modern macro to explain why employment seems to fluctuate in a suboptimal fashion. So let’s start with the labor market; why doesn’t it clear?

And as soon as we begin to look a the labor market, a solution jumps right out at us. NGDP is highly erratic, and nominal hourly wages are very stable. Hence hours worked moves in the same direction as NGDP, over the cycle. (Of course in the long term nominal shocks have no real effects.)

One counterargument is that perhaps the nominal shocks (NGDP fluctuations) are actually real shocks, combined with a central bank policy of targeting inflation. In that case there might be no causal relationship running from NGDP to employment. Rather it might go from real shocks to real GDP to employment, with NGDP merely going along for the ride—as inflation is stabilized. But that’s why monetary history is so important. We don’t just know that NGDP and employment are highly correlated, we know that NGDP shocks caused by insane monetary policies and employment are highly correlated. That’s the smoking gun. To summarize:

1. We know that monetary policy often causes NGDP shocks.

2. You’d normally expect hourly wages to track NGDP/person pretty closely, and long term it does.

3. But when NGDP is shocked by monetary policy, W/NGDP becomes very countercyclical, almost certainly because nominal wages are sticky.

Occam’s razor says that’s the simplest way to explain cycles, and the approach with the most robust policy implications (stabilize the path of NGDP/person.)

Microfoundations? I think that’s a waste of time. A hundred different models might all be partly true. And the price level might be badly mismeasured. And the importance of specific factors in the transmission mechanism may be time-varying. If so, then the search for single, timeless model of microfoundations is like the hunt for the Holy Grail. Better to admit our ignorance and simply address the proximate cause of cycles—unstable NGDP.

When I did my research on the “causes” of the Great Depression,” I began to delve into the endlessly perplexing philosophical debate on “causation.” Being a pragmatist, I ended up with the following conclusion:

The root cause of the Great Depression was the failure of central banks to adopt policies to prevent the Great Depression.

Why such a weird application of the term “cause”? Because there is no baseline monetary policy, no neutral monetary policy. Any monetary policy is a choice. Some choices will produce no recession in 1930. Others will produce a mild recession in 1930. And others will produce a depression in 1930. Of course it doesn’t have to be monetary policy. Hoover’s high wage policy of 1930 also contributed to the Great Depression, and hence (partly) “caused” it. So did Smoot-Hawley, albeit not for the reasons assumed by supply-siders.

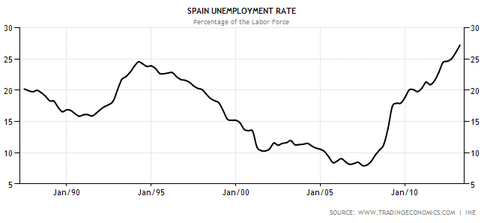

One might argue that claiming NGDP targeting minimizes business cycles doesn’t prove the causation goes through sticky wages, even if the “musical chairs model” is simple and intuitive. It might be sticky prices. But I believe there is other evidence pointing to the importance of sticky wages. When wages are relatively flexible (and I emphasize relatively–they are never completely flexible) then recessions are less persistent for a given NGDP shock. Compare the impact of a given NGDP shock in flexible Hong Kong and inflexible Spain. Or compare the fall in NGDP in the flexible American labor market of 1921, with the inflexible labor market of 1930, or 2009. That goes against the arguments of people like Eggertsson. (BTW, Marcus Nunes directed me to a recent James Hamilton post that criticizes Eggertsson’s views on inflation. Read the Hamilton post with “NGDP” constantly in the back of your mind.)

PS. Note to Tyler; I snuck in “regional” in the final paragraph.

PPS. A competitive firm looks at “market conditions” via the price of its good (such as gold.) But most firms are monopolistically competitive (MC), and the average MC firm looks at changes in NGDP to evaluate market conditions. If, on average, people spend 10% less (i.e. NGDP falls 10%), and wages are sticky, then a typical MC firm will get less revenue and respond by laying off lots of workers under a wide variety of modeling assumptions. Thus the fall in NGDP plays the role in MC firm-dominated economy that P plays in a competitive economy. Note that in the early 1930s US NGDP fell by 50%, whereas broader price indices fell by about 25%. But the WPI, which in those days had lots of goods in flexible price, competitive industries, also fell about 50%. So the competitive firms in the early 1930s saw a 50% fall in the price they could get for wheat, cotton, steel, oil, iron, coal, copper, etc. And the MC firms saw a 50% decline in nominal spending on their goods (toasters, radios, cars, etc.) Both reacted in the same way; laying off lots of workers, as wages fell by far less than 50%.

PPPS. I don’t like the way Tyler discusses the Rognlie/Kimball post:

That is also a good post showing some differences between blogospheric economics and academic economics.

To me, the term ‘blogosphere’ sounds dumber than ‘academic,’ even if you didn’t know the meaning of either term. Say them both out loud. I’d prefer “the ungated, free entry, merit-driven, competitive, methodologically eclectic, wisdom of crowds-based global hive mind,” vs. “ivory tower, methodologically dogmatic, elitest, academic world where you either data mine to publish empirical papers or invent endless permutations of theoretical models.”

PPPPS. And it’s elitest to criticize the way I choose to spell elitest.